HOME >> BUSINESS

Vanke signs memorandum with Shenzhen Metro

By Chu Daye Source:Global Times Published: 2016-3-13 23:48:01

Pact marks new stage in battle for control of developer, analysts say

Photo: CFP

Graphics: GT

The nation's largest residential real estate developer China Vanke Co said Sunday it has signed a memorandum of understanding (MOU) with Shenzhen Metro Group Co, a subway operator, involving a potential asset deal.

Vanke's shares will remain suspended from trading due to the uncertainty involved in the asset restructuring, the company said in a filing to the Shenzhen Stock Exchange on Sunday.

Vanke said it plans to buy assets from Shenzhen Metro in a deal that could be worth 40 billion yuan ($6.16 billion) to 60 billion yuan. Vanke said it also plans to issue new shares to Shenzhen Metro as payment, but it did not provide further details.

The MOU, which was signed on Saturday, will terminate under a number of conditions: For example, if the two parties can't sign a formal deal before March 15, 2017.

Vanke said it is also negotiating with other potential partners over its asset restructuring.

Song Ding, a Shenzhen-based market analyst at the China Development Institute, said this development shows that Vanke's previous attempts to negotiate with centrally owned State-owned enterprises (SOEs) did not lead anywhere, so the company shifted focus to local SOEs.

The State-asset watchdog on Saturday gave its approval for Shenzhen Metro, a local SOE, to inject its land assets into Vanke and become a shareholder, according to a report by Beijing-based Caijing magazine on Sunday.

In December 2015, Shenzhen-based Baoneng Group replaced China Resources Co as Vanke's largest investor, a move that Vanke's executives opposed, according to media reports.

On December 18, Vanke suspended the trading of its shares on the Hong Kong and Shenzhen stock exchanges, pending an asset restructuring.

As of that date, Vanke's share structure indicated that Baoneng and its affiliates held about 24.26 percent of the company's total shares with China Resources, Vanke's previous largest shareholder, holding a 15.29 percent stake, according to the Caijing report.

Vanke reportedly held talks in December with China National Cereals, Oils and Foodstuffs Corp - known as COFCO - without any results.

"With three months having passed and its shares still suspended, Vanke has to offer something to investors," Song told the Global Times on Sunday.

"The fact that the filing mentioned that the potential cooperation is subject to a number of conditions shows the situation could further shift. This deal could evaporate or more investors could emerge," Song said, adding that the announcement did at least buy Vanke time to make future deals.

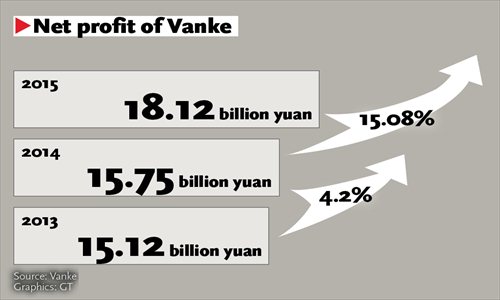

On Sunday, Vanke reported a 15 percent increase in full-year profit for 2015, reflecting the government's move to ease property curbs and prop up housing demand.

Net income rose to 18.12 billion yuan from 15.75 billion yuan a year earlier, Vanke said in a separate exchange filing.

As of the end of 2015, Shenzhen Metro had total assets worth 241.1 billion yuan, with a debt-to-asset ratio of 37.65 percent, according to the company's website.

The company has developed 4.5 million square meters of property projects since 2013 and sold 15 billion yuan of housing.

"If the Shenzhen Metro-Vanke deal works out, then Vanke, one of the world's top property developers, will have achieved a win-win deal," Song said, noting that Vanke projects will also benefit from closer proximity to metro lines.

However, the continued suspension of Vanke shares may not bode well for Baoneng, Wu Chenhui, an independent analyst, told the Global Times on Sunday.

"For Baoneng and its partners, a long delay means many hitches," Wu said, noting that the delay could greatly increase the financial costs of highly leveraged Baoneng.

Posted in: Companies