Locke denies US reviews target Chinese firms despite rise in probes

The New York Stock Exchange Photo: CFP

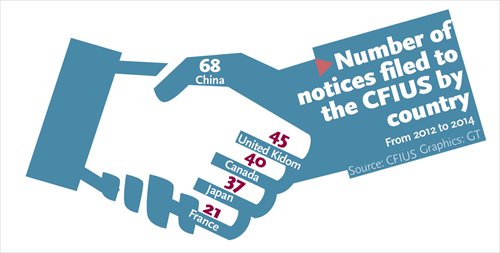

Source: CFIUS Grahpics:GT

Gary Locke, former US ambassador to China, on Saturday denied that the US is specifically targeting Chinese companies in national security reviews conducted by the Committee on Foreign Investment in the United States (CFIUS).

Locke's comment came after the recent release of data by the CFIUS, which showed a rise in the number of transactions reviewed by the agency that involved Chinese investors in recent years.

"The reviews by the US government are to ensure that the transactions don't harm US national security," and this applies "to all transactions, all around the world," said Locke. "In fact, many transactions from European countries have been turned down because of US national security concerns," he noted.

Locke said that for national security reasons, acquisitions that involve companies that work with the US military "whether it's airplane manufacturing or even high-tech" have to be reviewed "very carefully."

In 2014, the CFIUS reviewed 147 deals to purchase US businesses by foreign investors, up 50 percent year-on-year, and the number of deals that involved investors from China totaled 24, more than from any other country, according to the CFIUS 2014 annual report to the US Congress.

In the three-year period between 2012 and 2014, the total number of notices filed with the CFIUS for national security reviews that involved Chinese investors accounted for 19 percent of all notices, up from 17 percent in the 2011 to 2013 period, said the CFIUS report, which was released on February 19.

The CFIUS, made up of representatives from several federal agencies, reviews foreign acquisitions, mergers and takeovers of US businesses to determine the effect of the transactions on US national security.

Difficult process

According to Locke, the national security review in the US could pose a challenge for overseas companies looking to invest in certain sectors in the US. But he said there are virtually no sectors are off limits for Chinese investors.

He said many of the deals with US firms in the high-tech sector have involved Chinese companies in recent years, such as the purchase of IBM's server and PC businesses by Chinese computer maker Lenovo Group. He also mentioned that Chinese companies are "very much involved" in transactions in the US semiconductor industry.

Some of those transactions have been affected by the CFIUS review. The US hard-disk maker Western Digital Corp said on February 23 that Beijing-based electronics company Unisplendour Corp had aborted its planned $3.78 billion investment in the company, after Unisplendour received a notification from the CFIUS that it would investigate the transaction, Reuters reported on February 23.

Currently, State-owned China National Chemical Corp (ChemChina), which plans to buy Swiss seeds and pesticide maker Syngenta AG, will also have to pass a national security review by the US government, Reuters reported on February 4.

ChemChina and Unisplendour could not be reached by the Global Times as of press time.

E.W. Gentry Sayad, Partner and Co-Chair of Asia Practice at Kilpatrick Townsend & Stockton LLP Shanghai Rep. Office (USA) , told the Global Times that just because a company is notified that it will be subject to a CFIUS review is not a reason to quit its business plan.

"The CFIUS review is a normal regulatory process and companies are able to go through it," he told the Global Times on Sunday.

Li Xiaogang, director of the Foreign Investment Research Center at the Shanghai Academy of Social Sciences, told the Global Times on Sunday that the US is actually quite open-minded about China's investment in high-tech areas. "Many countries don't permit it at all," he noted.

He said that the CFIUS review won't reverse the trend that more and more domestic companies will invest in high-tech markets in the US. "Chinese companies are very reliant on technologies from the US," he noted.

Ji Li, director of the research center under Zero2IPO Group, told the Global Times on Sunday that both the Chinese government and domestic companies should actively communicate with the US government to let them understand that investment in the US is just part of normal market operations.

Newspaper headline: Locke says Chinese firms not targeted by US reviews