HOME >> BUSINESS

China, EU should join forces to build Eurasian market

By Jeremy Garlick Source:Global Times Published: 2016-3-17 22:43:01

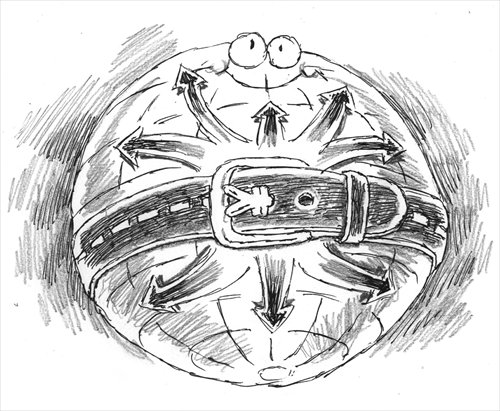

Illustration: Peter C. Espina/GT

It is becoming difficult to keep up with the rate of overseas acquisitions by Chinese companies. In the last year or two there has been an explosion of activity as businesses have begun to look beyond the Chinese mainland for worldwide opportunities to expand their operations and diversify their investments.

The list of new acquisitions by Chinese corporations in Europe is getting longer by the day. The global shipping company Cosco has bought the Greek port of Piraeus. In February ChemChina bid $43 billion for the Swiss biotechnology company Syngenta. In the UK, Chinese firms are investing in luxury yachts, hotels, a famous toy shop (Hamley's) and nuclear power stations. In the Czech Republic, CEFC China Energy, a Shanghai-based group, has acquired stakes in a brewery, an airline, a football club and central Prague real estate. Big Spanish football clubs have also sold stakes to Chinese investors. The list looks likely to grow as acquisition activity continues throughout 2016, with Dalian Wanda in particular preparing an announcement of an expansion in its European operations.

This fresh wave of newcomers has, just as in Africa, South America, Central Asia and the Middle East, the potential to be a game-changer in European business and trade. However, there are a number of issues to be discussed and resolved first.

One of the most notable is the image problem that Chinese products still tend to have in the minds of many Europeans. I frequently read online comments describing Chinese goods as "low quality" or "knock offs," and Chinese factories as "sweat shops" that mistreat their workers.

Of course there are, as is the case with any rapidly developing economy, still some problems in China in areas such as quality control, safety checks and labor regulations. However, the situation is clearly changing, just as it did during the development process in nations such as Japan and South Korea.

Chinese companies thus need to become more effective at projecting the idea to European consumers that they are increasingly capable of competing at the high end of the market, while both treating their workers in a humane fashion and ensuring that goods are safe. Public relations are a side of business that Chinese firms undoubtedly still need to work hard at, just as they do with their own domestic consumers.

Another major problem for China-EU cooperation in general is the question of ensuring that European companies have the same degree of access to Chinese markets that Chinese firms have in Europe. Up to now, some Europeans have complained about the difficulties inherent in entering China due to some restrictions. On the other hand, China has long encouraged foreign direct investment and has allowed a number of European companies to set up factories and outlets in China, so it is unclear whether the situation is really as unbalanced as some commentators suggest.

Thus far, Europe appears to be more receptive to Chinese companies than the US in terms of allowing open access to investment without systematic security checks. In future, however, there is a question whether more oversight may be introduced along the lines of the Committee on Foreign Investment in the United States (CFIUS), which checks the national security implications of proposed foreign investments. For the moment, the absence of such oversight would seem to give Europe a distinct edge in attracting Chinese investors. This advantage is enhanced by the fact that the EU is already China's biggest trading partner. So it is to be expected that there will be a flood of further investment from China this year.

On the back of all this acquisition and investment activity (which also includes the significant presence of certain European firms in China, such as the Swiss multinational power and automation giant ABB and the Czech consumer loans company Home Credit) there is now an outstanding opportunity for the EU and China to join forces in trying to forge a giant Eurasian market, with considerable benefits for both sides.

If the impetus of Chinese projects such as the $100 billion Asian Infrastructure Investment Bank (AIIB) and the "Belt and Road" initiative can be merged with the EU's 315 billion euro ($355.48 billion) Juncker Plan to invest money in jobs and growth, a rare synergy could emerge from the subsequent joint action.

With the AIIB providing finance for business ventures within the 65 countries designated by the Chinese government as falling within the sphere of the Silk Road Economic Belt and the 21st Century Maritime Silk Road, and the Juncker Plan also emphasizing infrastructure and innovation, there would seem to be a window of opportunity in the next few years for win-win cooperation.

Since the "Belt and Road" initiative is intended to connect Western Europe and East Asia across all points in between, the possibilities for capitalizing on growth and investment to the mutual benefit of all parties concerned (including those in South, Southeast and Central Asia, as well as the Middle East and Africa) are also clear.

So if acquisitions and investments by Chinese and European firms in each other's markets can be properly coordinated through clear-sighted action from both sides, working to complement each other as far as possible, there are clear reasons for optimism, allied to good prospects for long-term growth, even amid the current global economic slowdown.

The author is a lecturer in international relations at the Jan Masaryk Centre for International Studies, University of Economics in Prague. bizopinion@globaltimes.com.cn

Posted in: Expert assessment