HOME >> METRO SHANGHAI

Views from expats on Shanghai's ever-rising rents

Source:Global Times Published: 2016-5-11 19:18:01

According to numbers released by Shanghai Municipal Statistics Bureau in March, Shanghai's property prices jumped almost 21 percent from a year earlier. Although city officials announced measures few months ago to cool down the real estate market, visible changes in rising rents are yet to be seen.

Ever-rising rent is a common complaint in the city, and often they seem to defy market wisdom. And as the rate of foreign resident arrivals has reportedly dropped, it seems more expats are opting out of downtown apartments and choosing to live in the suburbs, where rent is cheaper or the value is higher. Global Times spoke with five longtime China expats to discuss their first-hand observations about the property market.

This year marks my fourth year in Shanghai. Shanghai housing prices vary drastically by area, such as in the city or outskirts of the downtown core. When I first started to rent outside of school, which is located in the Xujiahui area, I paid 3,500 yuan ($537) for a small studio that is roughly 30 sq m. Now, I pay 6,000 yuan for a one-bedroom with one living room (60 sq m) in a walk-up building located in the former French concession (Fuxing and Fenyang roads).

To be honest, I consider myself very lucky with my rental experience, since my landlords are very nice and accommodating. And I was able to avoid using housing agencies. Such rental increases are likely due to the amount of expats living in Shanghai with an "expat package," which includes a large sum for housing. Also, perhaps the supply and demand of the rental market. That's just my two cents. In comparison to my hometown, with my rent price you can also get a decent place.

However, if I was to pay 9,000 RMB for one-bedroom apartment here, I can get a much better place back home in terms of both interior and exterior of the apartment. As for the government, I believe a regulation can be placed such as rent control, which already exists in developed countries such as the US and Canada; only X percentage can be raised from the previous year. This will ensure quality and affordability for renters and equalize the rental market.

I paid 2,100 yuan for a room in a shared flat in Yangpu district, and then I moved downtown. Now I pay 3,300 yuan for a master bedroom in a shared flat with five others in Jing'an district. It is a two-floor penthouse apartment with six bedrooms (two of them are master bedrooms), a total of four bathrooms, two washing machines and one huge living room.

We are very happy with the price-to-service ratio so far, although more and more things need to be repaired, replaced or removed, and we've started to complain about the overall condition.

What annoys me most is that the landlord increased our rent by 300 yuan per room just recently, but was not willing to pay for repairs and renovations of, for example, the air-con or shower. Our flat has been rented out for more than seven years but not once has the landlord felt like investing the apartment to maintain its value.

When I first arrived in Shanghai in 2002, I was living in a serviced apartment paid by the company I was employed with. It was a luxury serviced apartment, with two bedrooms in Puxi, close to Xintiandi, and the monthly cost was around 13,000 yuan. Now I live by myself in the center of the former French concession in a loft inside a lane house, and I pay 12,000 yuan for 70 sq m. It is super well-furnished, with floor and wall heating. I believe that this sort of apartment were costing a third [in 2002] of what it costs today.

Honestly speaking, it's expensive, and I don't see all the value for this sort of price, even though it's very nice, definitely the lane house segment is super-inflated. I do believe that even if the rent is getting more expensive each year, if you act as an investor and buy the property, from the rent you may receive, the interest rate you may get out of it is super low compared to Europe, maybe 3 percent here.

Something is not clear, of course. I do believe that current property prices are a result of speculation, which was caused by the municipality and government managing the market too much. This happens because for years the market was under-regulated. It should be more organic growth, but like everything in China, nothing seems organic and everything is left to the government to set the pace. This in addition to something along the lines of insider trading - same as with the stock market - which opens up speculation.

First time my rental was 3,800 yuan in 2009, and now it is 8,500 yuan. I live with my family, and it's a 130 sq m, three bedrooms, two baths and one living room. One right now, the condition does not fit my expectation from the price, as it is quite old, and needs to be renovated. But mostly, yes, the apartments do fulfill our expectations.

This sudden rise in rents recently are quite disappointing, because the economy has slowed down and expenditures have risen quickly, putting a heavy burden. And also, this sudden rise has no clear reason. My hometown is cheaper than here, obviously, because not too much of a population pressure; it's almost four times less than the rental price here.

I came from Beijing, and I'm on my first lease in Shanghai, only nine months in. So the rent hasn't changed yet, it is still 6,800 yuan. It is located in Pudong area. I'm only sharing the apartment with my wife. It is three bedrooms and one living room, which is a bit big for two of us. But my friends told me that two to three years before, the rental prices were about 2,000 to 3,000 yuan less in Shanghai. I think this is a pretty huge increase in only a very short time. I'm also hearing that the house prices went up rapidly.

As a consequence, the rental prices increased. It seems like this is normal on the market, since there's still demand and the houses are occupied quickly. I know that because when we first arrived in Shanghai, we couldn't find a suitable house for some time. At last, we chose to rent a house where one of my friends was forced to vacate, which wasn't our preference. As a result, I think this increase is frightening and a bit artificial and is determined by real estate agencies. One day in the near future, I'm afraid this may result in some economic problems for China, like when the mortgage crisis hit the US nine to 10 years before.

In my hometown, if I consider the income-to-rental ratio, I can say that it is much more sustainable. Of course, the rent in crowded and popular areas are high, but one can find lots of possibilities. The rental prices are stable. The government should consider legislation to control real estate agencies, and there should be some rules to protect renters as well. In China, the market is so open that one cannot forecast the next rental fee that he/she will pay after the contract ends.

The raise in rent should be in line with the economic fluctuation in the country for the existing renter. In addition to that, the landlord can always request renters to vacate the house anytime by just paying back one month of rent. The conditions for the real estate market seem to be determined only in favor of the landlords.

As I said before, I think the increases in rent and housing prices are artificial, and this may cause an economic crisis in the near future. The government as well as the local authorities should consider this seriously and amend the existing real estate legislation and control it very closely. Because this crisis will not only affect the real estate market, but the whole nation, even the whole world.

The article was written by Furkan Erdogan

Newspaper headline: The higher and higher cost of living

Ever-rising rent is a common complaint in the city, and often they seem to defy market wisdom. And as the rate of foreign resident arrivals has reportedly dropped, it seems more expats are opting out of downtown apartments and choosing to live in the suburbs, where rent is cheaper or the value is higher. Global Times spoke with five longtime China expats to discuss their first-hand observations about the property market.

Nini Chen, Fudan University undergraduate student, Canada

This year marks my fourth year in Shanghai. Shanghai housing prices vary drastically by area, such as in the city or outskirts of the downtown core. When I first started to rent outside of school, which is located in the Xujiahui area, I paid 3,500 yuan ($537) for a small studio that is roughly 30 sq m. Now, I pay 6,000 yuan for a one-bedroom with one living room (60 sq m) in a walk-up building located in the former French concession (Fuxing and Fenyang roads).

To be honest, I consider myself very lucky with my rental experience, since my landlords are very nice and accommodating. And I was able to avoid using housing agencies. Such rental increases are likely due to the amount of expats living in Shanghai with an "expat package," which includes a large sum for housing. Also, perhaps the supply and demand of the rental market. That's just my two cents. In comparison to my hometown, with my rent price you can also get a decent place.

However, if I was to pay 9,000 RMB for one-bedroom apartment here, I can get a much better place back home in terms of both interior and exterior of the apartment. As for the government, I believe a regulation can be placed such as rent control, which already exists in developed countries such as the US and Canada; only X percentage can be raised from the previous year. This will ensure quality and affordability for renters and equalize the rental market.

Hanna Eberli, postgraduate student, Switzerland

I paid 2,100 yuan for a room in a shared flat in Yangpu district, and then I moved downtown. Now I pay 3,300 yuan for a master bedroom in a shared flat with five others in Jing'an district. It is a two-floor penthouse apartment with six bedrooms (two of them are master bedrooms), a total of four bathrooms, two washing machines and one huge living room.

We are very happy with the price-to-service ratio so far, although more and more things need to be repaired, replaced or removed, and we've started to complain about the overall condition.

What annoys me most is that the landlord increased our rent by 300 yuan per room just recently, but was not willing to pay for repairs and renovations of, for example, the air-con or shower. Our flat has been rented out for more than seven years but not once has the landlord felt like investing the apartment to maintain its value.

Andrea Speranza, tech startup entrepreneur, Italy

When I first arrived in Shanghai in 2002, I was living in a serviced apartment paid by the company I was employed with. It was a luxury serviced apartment, with two bedrooms in Puxi, close to Xintiandi, and the monthly cost was around 13,000 yuan. Now I live by myself in the center of the former French concession in a loft inside a lane house, and I pay 12,000 yuan for 70 sq m. It is super well-furnished, with floor and wall heating. I believe that this sort of apartment were costing a third [in 2002] of what it costs today.

Honestly speaking, it's expensive, and I don't see all the value for this sort of price, even though it's very nice, definitely the lane house segment is super-inflated. I do believe that even if the rent is getting more expensive each year, if you act as an investor and buy the property, from the rent you may receive, the interest rate you may get out of it is super low compared to Europe, maybe 3 percent here.

Something is not clear, of course. I do believe that current property prices are a result of speculation, which was caused by the municipality and government managing the market too much. This happens because for years the market was under-regulated. It should be more organic growth, but like everything in China, nothing seems organic and everything is left to the government to set the pace. This in addition to something along the lines of insider trading - same as with the stock market - which opens up speculation.

Habib Jan (left), sales, Pakistan

First time my rental was 3,800 yuan in 2009, and now it is 8,500 yuan. I live with my family, and it's a 130 sq m, three bedrooms, two baths and one living room. One right now, the condition does not fit my expectation from the price, as it is quite old, and needs to be renovated. But mostly, yes, the apartments do fulfill our expectations.

This sudden rise in rents recently are quite disappointing, because the economy has slowed down and expenditures have risen quickly, putting a heavy burden. And also, this sudden rise has no clear reason. My hometown is cheaper than here, obviously, because not too much of a population pressure; it's almost four times less than the rental price here.

Celal Unver, electronics engineer, Turkey

I came from Beijing, and I'm on my first lease in Shanghai, only nine months in. So the rent hasn't changed yet, it is still 6,800 yuan. It is located in Pudong area. I'm only sharing the apartment with my wife. It is three bedrooms and one living room, which is a bit big for two of us. But my friends told me that two to three years before, the rental prices were about 2,000 to 3,000 yuan less in Shanghai. I think this is a pretty huge increase in only a very short time. I'm also hearing that the house prices went up rapidly.

As a consequence, the rental prices increased. It seems like this is normal on the market, since there's still demand and the houses are occupied quickly. I know that because when we first arrived in Shanghai, we couldn't find a suitable house for some time. At last, we chose to rent a house where one of my friends was forced to vacate, which wasn't our preference. As a result, I think this increase is frightening and a bit artificial and is determined by real estate agencies. One day in the near future, I'm afraid this may result in some economic problems for China, like when the mortgage crisis hit the US nine to 10 years before.

In my hometown, if I consider the income-to-rental ratio, I can say that it is much more sustainable. Of course, the rent in crowded and popular areas are high, but one can find lots of possibilities. The rental prices are stable. The government should consider legislation to control real estate agencies, and there should be some rules to protect renters as well. In China, the market is so open that one cannot forecast the next rental fee that he/she will pay after the contract ends.

The raise in rent should be in line with the economic fluctuation in the country for the existing renter. In addition to that, the landlord can always request renters to vacate the house anytime by just paying back one month of rent. The conditions for the real estate market seem to be determined only in favor of the landlords.

As I said before, I think the increases in rent and housing prices are artificial, and this may cause an economic crisis in the near future. The government as well as the local authorities should consider this seriously and amend the existing real estate legislation and control it very closely. Because this crisis will not only affect the real estate market, but the whole nation, even the whole world.

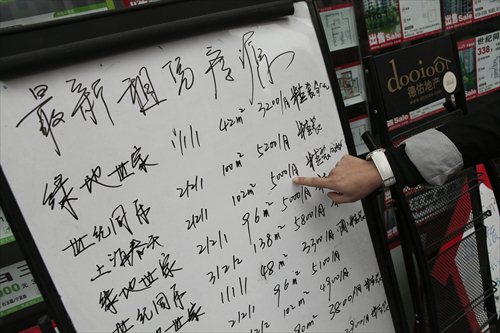

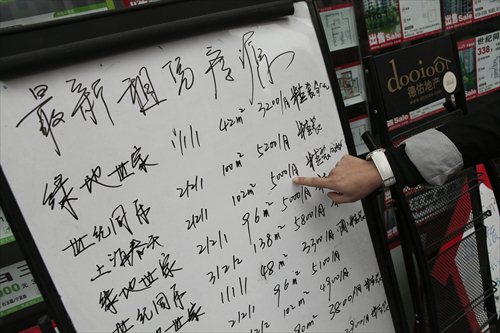

A Shanghai agent shows a client different rental prices in a 2012 photo. Photo: CFP

The article was written by Furkan Erdogan

Newspaper headline: The higher and higher cost of living

Posted in: Metro Shanghai, City Panorama