Chongqing blazes trail with PPP

Southwest China's Chongqing Municipality has become one of the most apt localities in China at attracting private capital through public-private partnerships (PPPs), which the central government has been promoting to ease the financing difficulties of local governments. The municipality, with its rapidly growing economy, has brought in 39 PPP projects since 2014. Under the PPP model, governments and private companies both invest in projects, often infrastructure, and share in the profits. PPP projects also allow local governments to benefit from the foreign investors' expertise and technology.

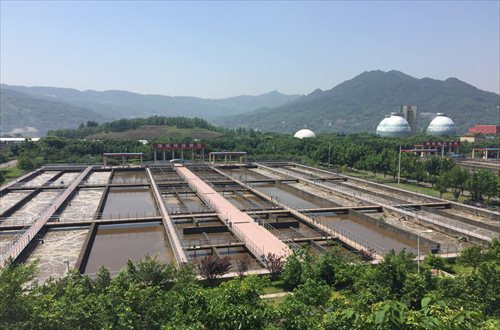

Waste water gets processed at the Tangjiatuo wastewater treatment plant operated by Chongqing Sino French Tangjiatuo Sewage Treatment Co. The company is a public-private partnership (PPP) between Chongqing Water Group and a subsidiary of water company SUEZ. Photo: Chu Daye/GT

In recent years, Southwest China's Chongqing Municipality has not only been the fastest growing locality in China, but also one of the more successful at attracting capital via public-private partnerships (PPPs).

Since 2014, Chongqing has signed on to 39 PPP projects worth 260 billion yuan ($39.83 billion) in total, the Chongqing Daily reported in January, citing data from the Chongqing Development and Reform Commission, the local economic planning agency.

By comparison, East China's Fujian Province signed on to 27 PPP projects worth 40.2 billion yuan as of April 22, according to the Fujian Daily. The projects attracted 31.3 billion yuan in private capital.

Boosted by these deals, Chongqing's investment in infrastructure surged 27.8 percent year-on-year in the first eleven months of 2015, up from 13.6 percent during the same period in the previous year, the Chongqing Daily report said.

Under the PPP model, both governments and private companies invest in projects and share in the profits. The State Council, the National Development and Reform Commission and the Ministry of Finance have been promoting PPP since 2014 as a way to ease the financing difficulties faced by local governments.

Chongqing's PPP projects include expressways, parking towers, bridges and garbage incinerators.

"Chongqing was one of the earliest cities to recognize the importance of bringing in private capital. The city is also growing quickly, generating demand for large numbers of PPP projects," said Jiang Zhen, a research fellow at the National Academy of Economic Strategy at the Chinese Academy of Social Sciences.

In August 2015, a private investment firm - Wanjiayan Investment Co - signed a contract to invest 400 million yuan in and operate one of the city's public hospitals, with the goal of building it into a top-tier medical institution. The company plans to spend the money on procuring new equipment and paying down debt, according to media reports.

In April 28, a PPP deal was signed on the Zengjiayan Bridge in Chongqing, which will cost an estimated 3.27 billion yuan.

Due to the size of its economy and population, as well as its current stage of development, China needs to invest a lot more in infrastructure and public services than developed countries do, Jiang said.

Chongqing's PPP projects have also attracted foreign capital. SUEZ, one of the world's leading environmental companies, was one of the first companies in China to invest in PPP projects. It has had a presence in Chongqing as far back as 2002. Among other things, it operates sewage plants and supply water to the northern part of Chongqing via PPP projects.

One of SUEZ's joint ventures is Chongqing Sino French Tangjiatuo Sewage Treatment Co, situated 10 kilometers downstream of the city center on the Yangtze River.

"The river water that leaves Chongqing is slightly cleaner than the water coming in, which is significant considering that the city is a huge manufacturing hub in western China," Yang Qiaolin, general manager of Tangjiatuo Sewage Treatment, told the Global Times on Monday.

During a visit to Chongqing in November 2015, French President Francois Hollande toured the facility as a model of cooperation between the environmental industries of China and Europe.

The company, which processes 400,000 tons of wastewater a day, is a 50/50 joint venture of Chongqing Water Group and SUEZ's subsidiary Sino French Water. It was established in 2006 under a 30 year contract.

The plant's existence has helped China achieve its goal of keeping its mighty rivers clean. In 2014, as much as 33.8 billion tons of polluted water were discharged into the Yangtze River, media reports said.

"Under the PPP rules, private capital, either foreign or domestic, can make joint ventures more efficient and enhance the quality of public services," Jiang told the Global Times on Sunday.

Obtaining tech

SUEZ has invested more in Chongqing than in any other city in China, said Steve Clark, the company's Asia CEO.

"We finance together with our local partners and we build, then we operate. It is much better than just building the plant and then leaving it to the city government," he told the Global Times on Monday.

The Tangjiatuo plant serves about 1 million residents in Chongqing. It is one of the best equipped and most advanced sewage treatment plants in West China, according to the company.

After the SUEZ subsidiary became a shareholder in the Tangjiatuo plant in 2006, the facility underwent many upgrades, giving it new features reflecting some of the advanced concepts of Europe's environmental industry.

For example, the plant can dry the water content in sludge, a byproduct of wastewater processing, so that the dried sludge can be used as fuel at a nearby cement plant. The process prevents the plant from sending the sludge to a landfill for disposal, where it poses an environmental hazard.

The plant also added a hydropower generator that can supply it with one-fifth of the electricity it consumes. The upgrade saved the plant 4 million yuan in 2014.

Clark said SUEZ is also looking into starting a recycling business for cars and laptops.

Taking the long view

"The core function of PPP is to improve the efficiency of public services," Jiang said. "PPP is more responsive to market demand. It is more flexible and decisions get made faster."

Furthermore, both private investors and the government share the risks in such partnerships.

However, SUEZ is under a lot of pressure from local companies, which sometimes submit bids for contracts that are too low to be sustainable, Clark said.

"We should not be only looking for short-term profits. Infrastructure is a long-term industry. We have to work together with the local government and with local partners [to put] a system in place that will finance all that infrastructure over a long time. If companies come in only for short-term profits, it will not work," he said.

To ensure efficiency in infrastructure, Clark stressed the necessity of allowing a company to charge a reasonable fee for its services.

"We are not asking for high tariff or high return," he said. "This is what we have had in Chongqing. We have been able to make a reasonable return - some profits for us - but most of that money has gone back into investment."

Newspaper headline: Private funds, public goods