HOME >> BUSINESS

Metals futures soar on outlook for steel sector merger

By Wang Jiamei Source:Global Times Published: 2016/6/27 22:33:00

Baoshan, Wuhan Iron units suspend share trading for restructuring

A steel market in Yichang, Central China's Hubei Province on Monday. Photo: IC

Graphics: GT

Ferrous metals futures soared in China on Monday, fueled by word of the consolidation of two steel industry giants and favorable financial results from related sectors.

The most-active rebar contract for October delivery on the Shanghai Futures Exchange surged 5.98 percent to close at 2,268 yuan ($341.28) per ton on Monday, while hot rolled coils were up 5.97 percent.

On the Dalian Commodity Exchange, the iron ore contract for September delivery ended at 411 yuan per ton on Monday, surging by the 6 percent daily limit, while the September coke contract was up 6.53 percent at 938.5 yuan a ton.

The rally in ferrous metals futures followed moves by Baosteel Group and Wuhan Iron and Steel Group, the nation's No.2 and No.6 steel makers by output, that suggest they plan a joint strategic restructuring.

Shanghai-listed subsidiaries of the two steel groups, Baoshan Iron & Steel Co and Wuhan Iron and Steel Co (WISCO), issued stock exchange filings separately on Sunday, saying that their shares would be suspended from trading as of Monday due to a major asset restructuring plan.

No further details were disclosed, and neither company was available for comment on Monday.

At the market close on Friday, their combined market capitalization was 108.55 billion yuan.

Experts said the restructuring plan is a result of the Chinese government's drive to improve efficiency at State-owned enterprises (SOEs).

Huang Yiping, deputy dean of the National School of Development at Peking University, noted at the Davos World Economic Forum on Monday that China may accelerate SOE reforms in the second half of this year.

WISCO lost 7.52 billion yuan in 2015, the year's biggest shortfall for any A-share company, according to its financial statement. Baoshan Iron & Steel Co reported a net profit of 1.01 billion yuan, but that was down 82.5 percent year-on-year, showed its financial report.

"The merger between Baosteel and Wuhan Steel is in line with the government's drive to cut excess capacity," Xu Xinhua, a professor at the School of Economics and Management of Hainan Normal University, told the Global Times on Monday.

China has cut more than 90 million tons of steel capacity over the past five years and plans to cut an additional 100 million tons to 150 million tons by 2020, according to the Xinhua News Agency.

Xu Shaoshi, chairman of the National Development and Reform Commission, China's top economic planner, said on Sunday during the Summer Davos that this year will see China cut about 280 million tons of coal capacity and 45 million tons of steel capacity, which could lead to a total layoff of 880,000 workers.

While the layoff process may be painful for industries like steel, coal and nonferrous metals, it is inevitable if China wants to achieve a structural transformation, Xu said.

Supply-side reforms must be unswervingly implemented in China's traditional industries burdened with overcapacity.

Monday's robust futures performance may also reflect the performance of the energy and raw material industries in May.

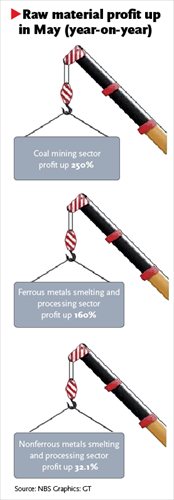

Profits of industries such as coal, steel and nonferrous metals registered a marked resumption of growth in May, He Ping, an official in the Industry Department at the National Bureau of Statistics (NBS), said in a statement posted on the bureau's website on Monday.

During May, profits of the coal mining sector grew 2.5 times year-on-year, profits of the ferrous metals smelting and processing sector increased 1.6 times, and those of the nonferrous metals smelting and processing sector rose 32.1 percent, according to He.

Overall, the profits of China's major industrial companies (defined as those with annual revenue of at least 20 million yuan from their core operations) climbed 3.7 percent year-on-year in May, slowing from a 4.2 percent rise in April, NBS data showed on Monday.

"The continued slowdown in May profit growth further supports our view that growth momentum has remained weak," Nomura economists said in an e-mail sent to the Global Times on Monday.

The economy is still undergoing a structural adjustment, and industrial enterprises may feel the pinch from the ongoing supply-side reforms, which will inevitably affect their profits and the economy's performance as a whole, noted Xu.

Posted in: Companies