Chinese investment not a panacea for Greek economy

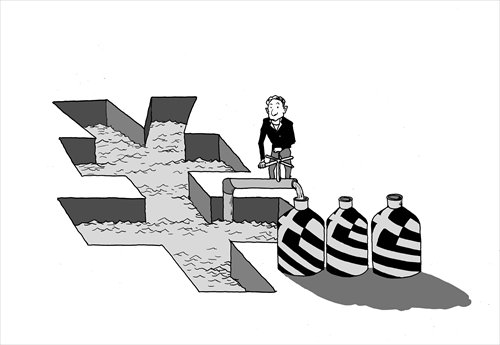

Illustration: Luo Xuan/GT

When Alexis Tsipras, the leader of a country which has experienced the most severe economic recession in peacetime, is visiting China - the world’s second largest economy, expectations about relieving economic agreements are set high.

And rightfully so; for Greece’s magnetism is not merely based upon the attraction of post-recession low asset prices and significant investment returns but also on its geo-economic potential: the country is an anchor of stability in a turbulent area and it is located at a natural gateway of the Maritime Silk Road connecting Asia and Africa with the enormous European Market – China’s most important export destination.

Beijing’s keen strategic foresight has not missed the promising location of Greece. COSCO – China’s largest shipping corporation, has for the past 10 years invested in the Piraeus port; transforming an once backwater peripheral port into one of the Mediterranean Sea’s faster growing logistical hubs.

This has produced a beneficial spillover effect for the local economy and the recovery of Greece and the Greek Prime Minister himself has invited Chinese companies to participate in the Thriasio Logistical Project (one of the largest in Europe).

Most importantly, during his visit at Huawei’s Beijing headquarters, Tsipras called Chinese technological behemoths to complement COSCO’s logistic infrastructure upgrade with the creation of R&D parks in Greece. Greece has the potential to innovate its way out of the crisis supported by Chinese tech behemoths as it has substantial human capital surplus with a plethora of young Greeks educated in some of the World’s top-100 universities.

The investments of China in Greece could also have an even stronger geo-economic pillar in the wider region of the Eastern Mediterranean. The upgraded Suez Canal in Egypt, the investments in the Piraeus port (and potentially at Kasteli airport in Crete), railway projects in the Balkans and EU’s commission plan for an Eastern Mediterranean European corridor which would connect the ports of Greece with the heart of the European market, all attest to the significance of the region for Chinese exports and the ambitious goal of the OBOR to connect China with Europe and accelerate growth in global trade – the lifeblood of the global economy – by boosting global aggregate demand and investing in connectivity and infrastructure – the veins.

In addition, the Eastern Mediterranean is crucial for Security and Stability in both Europe and the Middle East. A stable, richer and economically integrated Eastern Mediterranean would limit the flows of refugees in Europe thus softening the influence of anti-globalization/ anti-EU political forces.

Yet, Chinese investments alone cannot be the panacea for the comprehensive recovery of the Greek economy but only a short-term analgesic to facilitate a political solution about the restructuring of Greek debt in Brussels.

To be sure, Greece has performed the largest fiscal consolidation in the history of OECD and has paid an enormous price in unemployment and brain drain (largest in peacetime history). However the problem of Greece, at this moment is a problem of debt sustainability, deflation and anemic aggregate demand.

Debt sustainability is eminently a political problem within the Eurozone and while China could exercise diplomatic influence through the IMF and through the bilateral EU–Beijing dialogue to support a fair debt restructuring and limit investment uncertainty, it is the EU itself that holds the key. The solution of the “Greek question” does not pass from Beijing but from Brussels and Berlin.

Overall Chinese win-win investments could increase the odds of Greece staying and flourishing within the Eurozone. This will not however suffice to resolve the structural problems of the Eurozone, which demand political consensus within.

Yet the Greeks must also learn by their own mistakes and do not repeat them. COSCO’s investments have not come without problems. Even though the Piraeus project has been the most substantial investment of the last decade in Greece and it constitutes a model of cooperation between a EU member state and China, it had nonetheless become a hotbed of demagogy, harming the image of Greece as a safe destination for investments.

This should be a didactic case for a constructive reform of the Greek mindset towards investments and the de-politicization of projects that increase the competitiveness and geo-economic magnetism of the Greek economy à la Singapore.

Chinese investments, along with a new political culture in Greece and a European “New Deal” for fiscal, monetary and debt policies could become the stepping stones for a stronger Greece in the EU and for an essential boost to Europhilia at a time when the European dream has suffered ominous yet reversible shocks.

With Tsipras comprehensive visiting agenda and bilateral agreements, China has showed its trust to the Greek economy. Now it is time for Europe and Greece to deliver with a fair and sustainable reform forwards.

Shi Zhiqin is a Professor of International Relations at Tsinghua University and a Resident Scholar at Carnegie-Tsinghua Center for Global policy researching in China-EU relations.

Vasilis Trigkas is an Onassis Scholar at Tsinghua University and a Non-Res. Handa Fellow at CSIS-Pacific Forum.