China’s use of foreign investment up 20.2% in Jan-Aug, refuting ‘capital outflow’ rumors

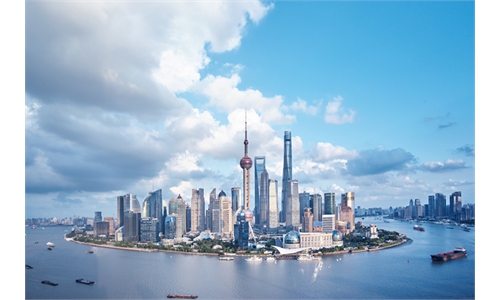

Lujiazui, a financial zone in Shanghai Photo: VCG

China's actual use of foreign capital rose 20.2 percent year-on-year in US dollar terms to $138.41 billion from January to August, with investments from South Korea, Germany, and Japan leading the way, official data showed on Monday, underscoring foreign investors' persistent confidence in the Chinese economy.The growth momentum is also a strong rebuff to the Western media's continuous hype over capital "fleeing" China, and a solid proof of the increasing attractiveness of the world's second-largest economy despite downward pressure, observers said.

In yuan terms, the actual use of foreign direct investment expanded 16.4 percent on a yearly basis to 892.74 billion yuan ($127.25 billion), data from the Ministry of Commerce (MOFCOM) showed on Monday.

China's services sector received 662.13 billion yuan of foreign investment, up 8.7 percent year-on-year, while foreign investment in high-tech industries saw a surge of 33.6 percent.

In terms of the source of investment, capital from South Korea climbed 58.9 percent, Germany 30.3 percent and Japan 26.8 percent, according to the MOFCOM.

Japan, South Korea and Germany all have relatively heavy investment in China's high-tech industries. Many parts of the vehicle component industry chain of South Korea and Germany are located in China, and there are many joint ventures, Chen Jia, an independent research fellow on international strategy, told the Global Times.

Taking into account South Korea's global advantages in semiconductors, those of Germany as a traditional industrial manufacturing power, and those of the UK, the US and others in high-tech R&D, the reasons for the increasing investment of multinational companies in China are the resilience of the Chinese economy, its long-term development potential, and a recognition of the huge market and strong supply chains, Chen said.

This momentum will remain unchanged, and it will not be changed by the foreign policy of any particular US administration, Chen added.

By geography, China's western region reported a 43 percent surge in foreign investment during the January-August period, followed by 27.6 percent in the central region and 14.3 percent in the eastern region.

Facing multiple economic headwinds, China has rolled out myriad policies to stabilize growth, including those aiming to promote foreign investment. The State Council, the cabinet, unveiled 33 measures in May, including efforts to accelerate the delivery of key foreign investment projects and attract foreign investment more proactively.

The revision of the industry catalog for sectors that encourage foreign investment will also be sped up to guide foreign capital into fields including high-end manufacturing and scientific innovation in areas such as the central, western and northeastern regions.

In a further move to attract foreign investment, Meng Wei, spokesperson of the National Development and Reform Commission, said at a press conference on Monday that China will step up efforts to attract investment in the manufacturing industry, and to support the import and export of foreign-invested enterprises in the manufacturing industry.