Xi’s visit boosts China’s critical rare-earth sector

Industry needs upgrade amid trade war with US: analysts

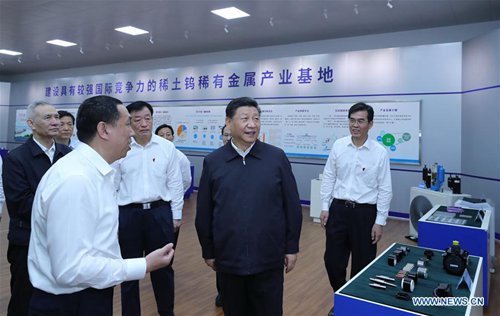

Chinese President Xi Jinping, also general secretary of the Communist Party of China Central Committee and chairman of the Central Military Commission, learns about the production process and operation of the JL MAG Rare-Earth Co. Ltd. as well as the development of the rare earth industry in the city of Ganzhou in east China's Jiangxi Province on May 20, 2019. Xi Jinping visited Jiangxi Province Monday on an inspection tour. (Xinhua/Ju Peng)

Chinese President Xi Jinping, also general secretary of the Communist Party of China Central Committee and chairman of the Central Military Commission, learns about the production process and operation of the JL MAG Rare-Earth Co. Ltd. as well as the development of the rare earth industry in the city of Ganzhou in east China's Jiangxi Province on May 20, 2019. Xi Jinping visited Jiangxi Province Monday on an inspection tour. (Xinhua/Xie Huanchi)

A visit by Chinese President Xi Jinping to a rare-earth company in East China's Jiangxi Province on Monday offered huge support to the critical industry that has been widely viewed as a form of leverage for China in the trade war with the US, but one that also faces issues that need to be addressed.

Xi visited JL MAG Rare-Earth Co, a Ganzhou-based high-technology company specializing in research and development (R&D) into rare-earth permanent magnetic materials, to learn about the company's operations and the development of the rare-earth industry, the Xinhua News Agency reported.

Ganzhou is known for its rare-earths mining and processing industry.

The visit, seen as a sign of backing from the top leadership for the domestic rare-earth industry, immediately lifted the company's shares and those of several other companies. JL MAG 's stock closed up by the 10 percent daily limit on Monday at 25.96 yuan ($3.75).

Xi's trip also drew much attention, coming at a time when China and the US are locked in trade and technology battles. Many have suggested that China should limit rare-earth exports to the US as a countermeasure to the US decision to slap tariffs on Chinese goods and cut supplies of semiconductors for Chinese companies. Rare-earth minerals were among the few items excluded from the latest US tariff list.

"It is normal that the top leader investigates relevant industrial policies," said Foreign Ministry spokesperson Lu Kang during a briefing on Monday, while expressing the hope that the media would not relate the rare-earths visit too closely to the China-US trade war.

"I've said that China-US economic and trade relations must be built on the basis of mutual respect, equality and mutual benefit," said Lu.

China is the world's biggest producer of rare-earth elements, which are necessary for many advanced products from planes to semiconductors, accounting for more than 90 percent of global supply, according to media reports.

Though US and Japanese companies dominate many advanced technologies in the manufacturing sector, China's supply of rare earth is "indispensible," Lin Boqiang, director of the China Center for Energy Economics Research at Xiamen University, told the Global Times on Monday.

However, experts said that in China, the industry remains largely trapped in overcapacity in the upstream exaction of rare-earth elements, and is in dire need of moving up the industry chain to higher-end production. Xi's trip was meant to boost that process.

"China's rare-earth industry structure is very imbalanced and profit margins have been squeezed in the international market," Lin said.

Apart from illegal rare-earth mining and smuggling that dilutes the industry's profitability, much of the profit squeeze is attributable to the low threshold and low added value in the difficult and dangerous process of extracting rare-earth elements from ore. This part of the industry chain imposes high environmental cost but yields limited profits, analysts said.

"Consequently, although China is the biggest exporter of rare-earth elements in the international market, we are not making as much profit as we should," Chen Zhanheng, a vice secretary-general of the Association of China Rare Earth Industry, told the Global Times on Monday.

The trade war between China and the US also highlighted the urgency for China to speed the upgrading process. "To secure and improve our independent R&D ability in the area is meaningful to the development of key industries, and increasingly crucial given the trade friction that is going on between China and the US," Lin said.

In recent years, the Chinese government has been making efforts to reshape the industry and encourage companies to improve their R&D ability in the advanced processing of rare-earth elements.

In a statement released by the Ministry of Industry and Information Technology in 2016, the government pooled the sector's resources by merging numerous rare-earth companies into six large ones to dominate the industry. As of 2016, some specific rare-earth products, including hydrogen storage materials, reached 70 percent of global production.

China has also been the country with the most rare-earth related patent filings in recent years, showing its determination to upgrade its production techniques. According to statistics released by Three Consulting, a US-based rare-earth element advisory company, as of August 2018, China had accumulated 23,000 more rare-earth patent filings than the US.