Finance reform reins in risks

Essential purpose of financial sector is to support real economy: experts

The building of the People's Bank of China in Beijing Photo: VCG

"An era which recorded my youth has passed," said a Beijing-based journalist, surnamed Jiang, who has focused on reporting on peer-to-peer (P2P) lending businesses since the beginning of her career four years ago.

"I feel upset because of the time and energy I spent as an observer of the industry, but I also understand it needs to be involved in a stricter regulation system, which could provide precious experience for the healthy development of China's financial industries," said Jiang, who called the change a tough but necessary "debridement procedure."

Regulators recently held talks with the last surviving P2P lending platforms in Beijing, according to a report by the financial news site caijing.com.cn on Tuesday, citing sources close to the matter.

In a bid to manage escalating financial risks, China has implemented measures to reign in risky business transactions and illegal speculations.

Though Beijing has not announced it will close all P2P platforms, it is encouraging these platforms to implement reforms.

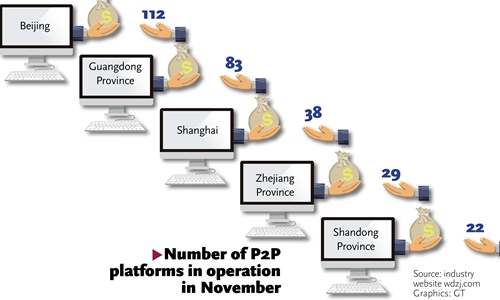

There were about 800 P2P platforms in Beijing as of April, according to data from industrial news site wdzj.com.

More than two-thirds of China's online lending institutions have been shut down and all virtual currency trading platforms have been closed as the country moves to clear its financial markets of speculation and potential risks, said the People's Bank of China (PBC), China's central bank, in a report on November 25.

According to the PBC's report, titled China Financial Stability Report (2019), the number of online lending institutions in China has fallen to 1,490 from 5,000 and all of the country's 173 virtual currency trading platforms and initial coin offering issuance and financing platforms have been closed since 2018.

Yolanda Li, who was worked in a Beijing-based asset management company, told the Global Times that her former company is under investigation due to fraud in both traditional investment projects and P2P.

"No financial activity or business is exempt from regulation," Zhao Xijun, vice director of the School of Finance at Renmin University of China, told the Global Times on Tuesday.

The financialization of the economy has led to a high leverage ratio in the macro economy with firms putting too much capital in financial investment and residents excessively participating in financial activities likes P2P, Zhao said.

Financial industries should resume their essential purpose of supporting the real economy instead of seeking speculations, Zhao said.

The PBC report demonstrated the effects of regulating shadow banking. Capital idling has been eased and capital management products in the real economy have seen recovery growth to 37.9 trillion yuan ($5.37 trillion), accounting for 43.9 percent of the value of total products, 1.6 percentage points higher than in the end of 2018.

P2P reforms have offered experience for regulating other financial businesses, Dong Shaopeng, an adviser for the China Securities Regulatory Commission, told the Global Times.

Enhanced financial regulation

Zhao said that China's financial activities and businesses expanded alongside its economic stimulus package that helped dodge adverse effects of the US' subprime crisis in 2008.

The financial sector has also grown with the rapid development of technology, Zhao said, emphasizing the role of the internet.

However, financial innovation may not be allowed to develop without matched regulations or laws in the future, Dong said, adding that pilot projects should be specified in scope and area.

With resolute measures to shut down highly risky and illegal financial businesses in the past two years, China's financial system has been improved, with exposed financial risks under management, experts noted.

Against the backdrop of China's support of blockchain research and development, and plans to issue cryptocurrency, experts noted that it is necessary to clear the market environment beforehand.

Related regulation departments have enhanced the crackdown on illegal cryptocurrency speculation and guided the research and application of blockchain technology in the financial area, according to a report by Xinhua News Agency.

Market players still expect the development of innovative financial industries in China after this period of comprehensive reform of risky financial businesses and illegal speculations.

A senior executive at a Beijing-based blockchain start-up surnamed Zheng told the Global Times that he plans to move the company's exchange in Indonesia back to Hong Kong.

He predicted that China could gradually loosen its policies and allow the setup of digital currency exchanges in pilot areas in the Chinese mainland such as Shenzhen in South China's Guangdong Province and South China's Hainan Province.