HOME >> SOURCE

Revolt brews against dollar hegemony

By Wang Cong Source:Global Times Published: 2019/12/5 0:28:39

As US bullying intensifies, major economies seek alternatives

An oil well in Panjin in Northeast China's Liaoning Province Photo: VCG

As the US continues to disregard the international rules that have helped govern the global financial and trade order for decades and imposes sanctions on any country that does not bend to its political will, a revolt is slowly but surely shaping up against Washington's financial hegemony.

While the US dollar remains the dominant currency in global financial and trade transactions, as well as foreign exchange reserves of governments around the world, the contempt for and distrust of Washington's bullying tactics is also on a rapid rise in many countries, including China, Russia and even some of the US' closest allies, forming a strong force that, analysts said, will pose a serious threat to the US' currency's dictatorship.

"The global payments system with the dollar at its core is slowly losing the trust of the world and the US financial hegemony is starting to shake," Dong Dengxin, director of the finance and securities institute at Wuhan University of Science and Technology, told the Global Times Wednesday.

"More importantly, it is starting to fall apart from within," he said.

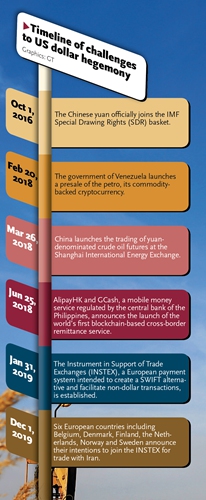

Dong was referring to an attempt by some of the US' European allies to establish a euro-denominated payment mechanism for trade with Iran, known as the Instrument in Support of Trade Exchanges (INSTEX), which is designed to circumvent unilateral sanctions by Washington on Iran.

On Monday, Belgium, Denmark, Finland, Sweden, the Netherlands and Norway announced that they would join France, Germany and the UK in the INSTEX, giving a serious boost to the effort. The US withdrew from the Iran nuclear deal and reinstated crippling sanctions against Iran, which also affect trade between Iran and other countries.

Graphics: GT

Global de-dollarization

"This is just a start," Dong said, noting that the US' bullying actions in trade against not just Iran but also a host of other countries, including Russia, Venezuela and China, have unleashed a de-dollarization process to avoid US sanctions.

As the dominant global currency, the dollar is still the most widely used currency in financial and trade transactions and is the primary foreign exchange reserve held by most countries. But its share in global reserves dropped to 61.6 percent in the second quarter of 2019, the lowest level since 2013, according to the IMF. Most global transactions must go through the US-dominated SWIFT payment system, which is linked with US financial institutions.

That allows the US to impose sanctions on any country or any company in the world whenever and however it wants, as is the case for Russia and Venezuela. Both of those countries have started to seek alternatives to dollar-denominated payments in energy and other trade, including yuan payments in oil and natural gas transactions with Chinese companies.

Russia, which is at the forefront of de-dollarization, saw a 56.1 percent drop in dollar payments in its foreign trade between 2013 and 2018, while its euro and yuan payments in trade skyrocketed, the Sputnik news agency reported in April. In November, China and Russia signed an agreement to further boost the use of their currencies in bilateral and global trade.

China is also seeking to boost the use of the yuan in its massive foreign trade, which reached a whopping 30.51 trillion yuan ($4.33 trillion) in 2018. It is also promoting the internationalization of the yuan through multilateral initiatives, such as the Belt and Road Initiative.

Cao Heping, an economist at the Peking University in Beijing, said that while no currency, including the euro and the yuan, could take on the dollar for now, together they will slowly undermine US hegemony.

"There is no doubt that US financial dominance will continue to decline as more countries join the fight against US hegemony," he told the Global Times on Wednesday, noting that while there is also competition among different currencies, the top priority for these countries should be uniting to take down the dollar rather than each trying to replace the dollar.

That has appeared to be the case for China. On Tuesday, the Foreign Ministry applauded the EU countries for their efforts to establish the INSTEX, calling the move conducive to disrupting US financial hegemony, although the mechanism will be based on the euro.

Ultimately, Cao said, the global financial system will be a diverse one with multiple currencies rather than one dominated by a single currency.