HOME >> SOURCE

Yuan systematically transforms into global currency

By Xie Jun Source:Global Times Published: 2019/12/5 0:33:39

The Chinese currency, the yuan, is systematically transforming into a global currency despite seasonal fluctuations as well as political uncertainties, according to financial experts and currency data recorded by the Society for Worldwide Interbank Financial Telecommunications (SWIFT), the current international payments network.

"It's just a matter of time until the yuan surpasses major international currencies, like the pound and the yen, in global payments usage," said Zhou Yu, a currency expert at the Shanghai Academy of Social Sciences, on Wednesday.

He predicted that the yuan would become the third most active currency for global payments, just behind the US dollar and the euro, in about five to 10 years.

Although the yuan's share of currencies across global payments edged down to 1.65 percent in October from 1.95 percent in September, as shown by SWIFT data, the figure was seen largely hovering around close to 2 percent throughout the year.

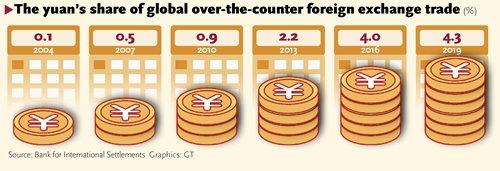

Also, data from the Bank for International Settlements indicates that the yuan has achieved impressive gains over the past 15 years, as measured by its share of global over-the-counter foreign exchange trade. The ratio stood at a mere 0.1 percent in 2004 and climbed to 4.0 percent in 2018 before rising further to 4.3 percent this year.

When examined over a longer time - say, in the past five to 10 years - one would hardly suspect the Chinese currency would rise to global prominence backed by China's flourishing economy. For example, in January 2012, the yuan was only the 20th most active world-payments currency, with a share of 0.25 percent. But the currency managed to climb by six positions to 14th by the end of that year, with a share of 0.57 percent, SWIFT data showed.

Graphics: GT

According to Zhou, the yuan's share across global payments has been increasing in recent years, rising particularly fast between 2009 and 2015, as the currency is more widely used in trade settlements and cross-border direct investment with the rising influence of the Chinese economy.

This trend has been spurred by the Belt and Road Initiative (BRI), which fuelled overseas investment, he said.

"Most of the countries along the BRI route are developing economies that lack foreign exchange sources. Therefore, they are willing to settle business in the yuan to broaden their foreign exchange sources," Zhou said. More than 1,900 international financial institutions now use the yuan for payments with the mainland and Hong Kong, according to SWIFT data.

Recently, the yuan's internationalization progress has been halted by factors such as a depreciating yuan, arising mostly from the China-US trade war, experts said.

He predicted that in the long term, the yuan's cross-border transactions will "take a leap" as the government further opens capital accounts. Capital accounts include foreign indirect investment, portfolio investments, the reserve account and other investments. They are still managed by the State due to concerns about abrupt capital flows moving in and out of the country.

Posted in: ECONOMY