Blaming China for Australian industries' plight lacks common sense

By Guo Chunmei Source:Global Times Published: 2020/4/26 21:17:15

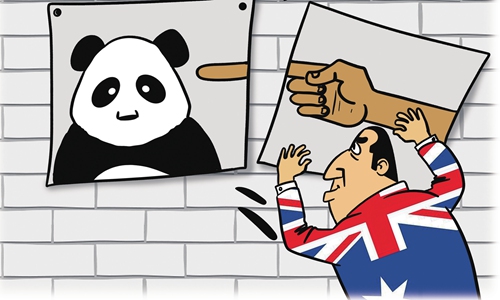

Illustration: Luo Xuan/GT

It is clearly a lack of common sense for some people in Australia to claim that the country's industrial hollowing-out is because of China, as Australian manufacturing has been in a weak position itself and its investment in China has lagged far behind its investments in the US and UK.Not to mention that the Chinese market helped the Australian economy to avoid a recession after the 2008 financial crisis.

As the coronavirus pandemic rips through the planet, certain countries have tried to agitate for the so-called "China threat theory". Australia claims that its dependency on China is threatens its economic security and says that it will retrieve its industries back from China under the guise of its shortage of medical supplies.

Such a declaration clearly lacks common sense.

Although it is understandable for Australia to reflect on its supply and industry chains due to the fallout of the pandemic, it is indeed farfetched for it to blame China for its industrial hollowing-out.

Australia's manufacturing sector has been in a weak position due to historical deficits and unsatisfying developments afterward, and it has nothing to do with China. Australia was a raw material supplier for the UK for a long time before the establishment of the federation, and most of its manufactured goods were from the UK, which led to a weak start for its manufacturing sector.

Australia's manufacturing was initiated with the second World War, as a "munitions factory" for the US and the UK. The nation later set up its own self-sufficient industrial system in the 1960s because of the need for post-war reconstruction, and this sector accounted for nearly 30 percent of its GDP.

However, with a limited domestic market and shortage of skilled workers, Australia's manufacturing industry was not internationally competitive, with a long-term trade deficit. Most of its large enterprises are controlled by foreign investors, making it difficult for local enterprises to develop.

Australia discovered huge iron ore reserves in 1952, and it lifted a related export ban in 1960. It then formed a perfect match with Japan, which was going through rapid industrialization but lacked raw materials. The flourishing mining industry further curtailed the momentum of manufacturing. Currently, the manufacturing sector ranks seventh among Australian industries, accounting for only 6 percent of GDP.

It is unreasonable for Australia to try to blame China, since the Chinese market helped it to remain "lucky" amid the 2008 financial crisis when Western countries were generally hit hard. Bilateral trade grew rapidly since the turn of the century due to the economic complementarities of China and Australia, and the huge resource demand in China helped Australia to avoid a recession after the financial crisis.

Despite Australia's repeated unilateral provocations in recent years, which hindered bilateral relations, China still follows the market principle and remains Australia's largest importer.

Under the pressure of deadly forest fires and the pandemic this year, bilateral trade between China and Australia has inevitably been affected, and Australia's 30-year economic growth record may come to an end. To claim that dependency on trade with China threatens Australia's economic security and even to blame China for the recession is turning the facts upside down.

Moreover, it doesn't make sense to retrieve industries from China as most of Australia's foreign investments are in the US and the UK, which combined accounted for 44.4 percent of all its foreign investment in 2018. Its investment in the Chinese mainland ranked eighth, with only 3 percent.

Australia's investment in China started late and on a small scale, and it mostly focuses on the agricultural and service sectors. Even if it could relocate its industries from China, it would not be able to resolve the shortage of medical supplies, as well as other problems.

The author is an expert on Australian studies at the China Institutes of Contemporary International Relations. bizopinion@globaltimes.com.cn

Posted in: INDUSTRIES,MARKETS