China's major bourses rise after two sessions dates unveiled

Source:Global Times Published: 2020/4/29 11:37:31

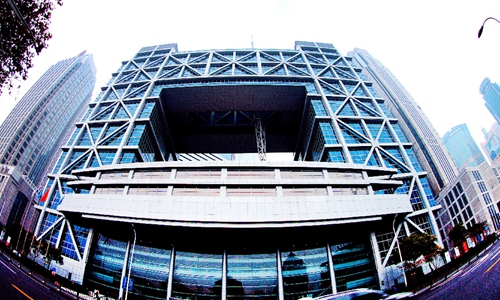

Photo:Xinhua

China's major bourses including the Shanghai and Shenzhen stock exchanges and the tech-heavy ChiNext board all rose on Wednesday morning as markets were boosted by news that the country's top political advisory body proposed opening its annual session on May 21 and the top legislature will open its annual sessions on May 22.

The Xinhua News Agency reported that the 13th National People's Congress (NPC) will open its third annual session in Beijing on May 22. The decision was made on Wednesday during a regular session of the NPC Standing Committee held from April 26 to 29.

Prior to the announcement, the Chinese stock market opened lower but then moved higher, quickly turning from green to red.

The Shanghai Composite Index opened at 2,801 this morning, and reached 2,828 points after a rapid rise, an increase of 0.65 percent. The volume of transactions within one hour was nearly 100 billion yuan, showing the market is now more bullish.

The announcement has sent a "clear and positive signal" that China's COVID-19 situation is contained and the country is ready for a complete resumption of economic activities, Xu Hongcai, an economist at the China Center for International Economic Exchanges, told the Global Times on Wednesday.

"For the stock market, it is a message that's been long awaited and will be well received," Xu said. "In the short term it can give an immediate strong injection of confidence to investors."

The NPC customarily kicks off its plenary meeting on March 5 every year, but this year's meeting was postponed due to the COVID-19 epidemic. It is widely believed that unveiling an opening date shows China has effectively controlled the virus.

However, Xu also noted that given the severity of the pandemic overseas, including across China's major trading partners such as Europe and the US, China's exports will remain under pressure, and resumption will take a longer time for many export-reliant provinces.

Global Times

Posted in: ECONOMY