GT Investigation: What's at stake for Australia to be US' attack dog?

By GT staff reporters Source:Global Times Published: 2020/5/15 18:48:40

GT Investigation: What’s at stake for Australia to be US' attack dog?

A cargo ship docks at the international container terminal in Zhoushan Port, East China's Zhejiang Province. Photo: cnsphoto

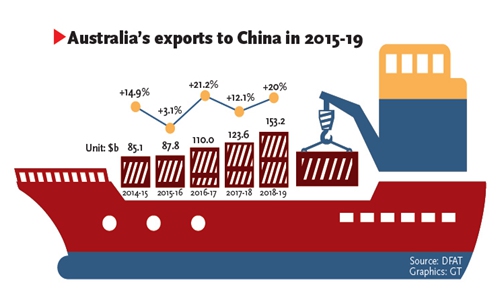

Editor's Note:Australia has $153.2 billion reasons not to pick a fight with China, its biggest trade partner. However, the country has emerged as one of the most loyal US attack dogs in a seemingly all-out campaign against China over the fallout of the COVID-19 pandemic.

While other countries, including Washington's close allies, have steered clear, at least publicly, from Washington's attempt to scapegoat China for its own failure to stem the virus, Canberra backed US officials' claims over the virus origin and called for an investigation into China's handling of the pandemic.

Beijing is not pleased with Canberra. It has repeatedly lodged complaints against Australia's position, yet has stopped short of taking concrete countermeasures, economic or otherwise, against Australia. But that hasn't prevented Canberra from claiming "economic coercion" from Beijing.

That could be an illusion on the part of Canberra. It would also be delusional to think that economic and trade cooperation between the two countries would not suffer from a deteriorating bilateral relationship.

The following is a Global Times investigation into the four trade areas between China and Australia that could be at risk if Canberra continues to exacerbate bilateral relations.

File photo: An FMG iron ore mining site in Australia Photo: cnsphoto

Disruption to raw material trade would be a 'nuke bomb': insider

China could ditch Australian iron ore for African alternatives should they choose to ban iron ore exports, a top industry body official said on Wednesday.

Li Xinchuang, a vice chairman of the China Iron and Steel Association (CISA), made the comments when asked about the likelihood that actions would be taken on the iron ore trade, the largest trade item in 2019. Comments have been found on Twitter calling for a boycott of Australian iron ore exports to China.

However, Li said that if China wants to tap iron ore deposits in Africa, there would be a gap period of four to five years. Li also said, "Once such a transition is completed, Australia's place as an iron ore supplier to China will be lost forever."

The danger of iron ore felling into victims of trade friction is also noted by scholars in Australia.

Stephen Bartos, director of Pegasus Economics and a former top official at Australia's Department of Finance, wrote in a piece on The Mandarin, an Australian news site, that the fate of the iron ore exports determines whether the country could have an annual fiscal surplus and warned off a recession.

Bartos argued that the Australian iron ore export markets are more vulnerable than its international student market as many Chinese steel mills are more likely to heed the direction of the government.

Although a growing list of Australian exports to China has run into domestic problems in recent weeks, traders, port operators and analysts contacted by the Global Times are unfazed by the likelihood of iron ore falling into the cross-hair of the economic rift from both sides, due to the dependent relationship between China and Australia over the steelmaking ingredients.

MiPengqi, a senior analyst at commodity information site 315i.com, said that the recent development in bilateral relationship reflects on Australia's age-old anti-Chinese tradition but noted that so far a ban on iron ore trade has never be mentioned by creditable sources from both countries.

For Australia, iron ore export generates a large chunk of the country's government revenue, Mi said.

The port of Rizhao, East China's Shandong Province has a shipping line to Australia. Photo: IC

In fact, iron ore is so important enough that large sections of Australian government budget papers were devoted to the equation of GDP forecasts and iron ore prices, according to Bartos.

About 62 percent of China's iron ore imports came from Australia while Brazilian iron ore accounted for 23 percent, Li said. Reversely, 80 percent of Australian iron ore exports are destined for China. "No one from both sides will be trigger-happy over iron ore trade. It is nuke bomb," Li said.

In 2019, China imported 1.07 billion tons of iron ore from abroad. 665 million were from Australia and 229 million tons were from Brazil, according to data provided to the Global Times by the Beijing Lange Steel Information Research Center, an industry consultancy.

An iron ore trader at Lianyungang Port, a major iron ore port in East China's Jiangsu Province where half of the throughput is iron ore, said he doesn't believe either side will restrict iron ore trade.

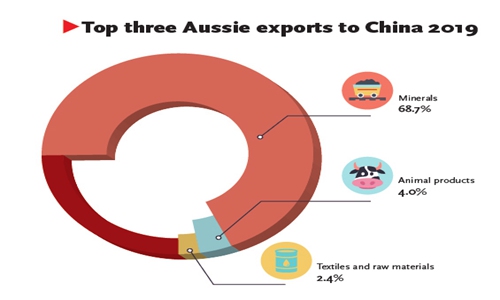

In 2019, iron ores and concentrates replaced coal as Australia's top exports to China with a 19.5 percent year-on-year increase as trade value rose to $96.2 billion.

Also at stake is Australia's coal export to China, the top export in 2018, valued at $66.8 billion, according to Australia's department of foreign affairs and trade.

China has alternate for Australian coal with more diversified import sources and abundant domestic deposit. In 2019, Australia moved to ban on Huawei from supplying equipment to its 5G network. It is reported that some ports in China restricted Australian coal exports and the move has caused Australian coal price to plunge.

Graphics: GT

'I'm not worried… I have many import sources': agricultural trader

China is Australia's biggest market for agricultural products, but that could change if relations continue downward on top of rising competition in the Chinese market for Australian goods, Chinese traders said.

Fu Denghua, general manager of a Chinese meat importer Haiyunda, told the Global Times that, despite Australian beef's good reputation in China, its advantage in Chinese market is shrinking as more beef are available from South America and other places whose profit margin are higher.

"I don't worry a lot about the suspension, as I have many import sources," Fu said.

China hasn't imposed any trade sanction on Aussies products, even though it is angered by Australia's move, and trade barrier should not be the first choice to response, but if Beijing is forced to do so, Australia will face much more pressure than China as its economy mainly relies on export, Li Guoxiang, a research fellow on the agricultural sector at the Chinese Academy of Social Sciences, told the Global Times on Thursday.

Li noted that, politics should be divided from trade, but trade requires a good environment.

According to Australia's Department of Agriculture, about 65 percent of agricultural products are exported, with the majority going to China, Japan, and the US, and China being the largest export market. Beef, wine, wool, and barley are among China's major imported goods from Australia.

In 2019, Australia's agricultural, fisheries and forestry exports to China were worth $15.1 billion, according to the Australia's Department of Agriculture.

"China, with its huge consumption power, is a big agricultural products buyer worldwide, which has attracted many countries racing to take its market share," Li said, adding: "Without buyers like China, it's hard for those export-oriented countries especially Australia to solve agricultural goods surplus."

According to Meat & Livestock Australia, a meat export statistics website, Australia exported 1,224,021 tons of beef during the year ending April, of which 307.546 tons were imported by China.

After China's beef suspension, Queensland Premier Annastacia Palaszczuk said that 3,200 jobs related to the beef companies could be under risk, ABC reported.

Australian wine could also be at risk, according to traders.

Long Guanyu, a Xiamen based wine importer who sells Australian wine brands, told the Global Times that because of the free trade agreement between China and Australia, Australian wine has dominated the China's imported wine market.

"I worry my business will be affected if there are trade ban on Australian wine or the bilateral ties are damaged," Long said, adding "but Australia could face more pressure, because finding a supplier is always easier than finding a buyer in wine sector," Long said.

Graphics: GT

'There may not be a single Chinese tourist in the whole year': travel agent

China is the largest source of income for Australia's tourism sector, but the tough stance the Australian government has chosen to impose on weakened China-Australian relations sets an ugly look for the sector, industry insiders said.

From 2009 to 2019, Chinese tourists to Australia increased 297 percent, but this year, however, the numbers are expected to be dire, with a decline that could see zero Chinese travelers, Yang Jinsong, a senior researcher at the China Tourism Academy, told the Global Times on Wednesday.

Data released by the Australian Bureau of Statistics (ABS) in 2018 shows that the number of Chinese visitors to Australia had tripled since 2010 and Tourism Australia expects further growth up to 3.9 million every year by 2026.

Meanwhile, Tourism Australia expected 42 percent of all international visitors to Australia to come from the Chinese mainland by 2020.

However, the continued spread of the global pandemic and the deterioration of bilateral relations caused by the Australian side will lead to a dramatic reversal this year, analysts said.

A manager with Galaxy Dragon Travel based in Sydney, who spoke under conditions of anonymity, told the Global Times on Wednesday that business from China this year will be 100 percent lower from last year, and there may not be a single Chinese tourist visiting throughout the year.

The company's main customers are Chinese, accounting for 80 percent of their customers. Because of the pandemic, no delegation came in late January. So they closed the office and did not open till now.

"This year's outbreak will determine the situation in the second half of the year, and the peak season for tourism in Australia is between October and April, so it is hard to tell now," she said, adding that when their business can return to normal depending on the Chinese market.

Even if the pandemic is over, the situation may also be a concern as the bilateral ties has its impacts over the decision-making process of tourists for their destinations, she said.

To avoid uncertainties, the company will try catering to domestic tourists hoping to make up for losses, as well as for those from New Zealand.

However, with Australia's tourism industry and the country's economy, the difference in size and consumption volume means that tourists from other countries can't compare with Chinese tourists.

Chinese visitors contributed more to the Australian economy. The average Chinese tourist spent per trip was $6,008. This compared with $3,866 for Germans, $3,395 for Americans, and $1,322 for New Zealanders.

"China is Australia's largest source of tourists and the largest source of tourists in the world, but now, affected by the epidemic and bilateral relations, it has been curbed," Li Bowen, an expert in the hotel industry and professor at the Tourism College of Beijing Union University, told the Global Times.

A Chinese tourist buys clothes at store in Sydney, Australia. File photo: cnsphoto

Chinese students turned away by rising discrimination amid tensions: insider

As bilateral tension rises between Australia and China, higher education, one of Australia's key components in its trade service export might be heavily weighed on, as concerns over safety and future development arises among the Chinese international student communities.

Experts said over the next three years revenue loss could hit 3 to 4.6 billion Australian dollars ($1.93 billion to 2.96 billion), with long term economic impact on related industries, such as accommodation and catering, projected to be even larger.

"There will be an especially sharp drop in Chinese students, not just from the effect of the COVID-19 restrictions, but also from the mounting tension from the bilateral relations," Liu Qing, director of the department for Asia-Pacific security and cooperation at the China Institute of International Studies told the Global Times on Thursday.

There were 152,591 Chinese students in Australia for higher education in 2018, accounting for more than one third of total number. However, according to Liu, the relationship between China and Australia has dropped "below the bottom" recently, and the unclear future is likely to weigh heavily on families' consideration for higher education destinations.

An anonymous education consultant from one of Australia's biggest agencies told the Global Times that inquiries from China to apply to Australian universities have dropped sharply, and said there will probably be fewer Chinese students among the incoming students next year.

"One big reason is that it is not yet clear when or how the COVID-19 will be contained," he said, "but for many students coming to Australia it is very important to be able to join and assimilate in the local communities, and that looks increasingly difficult now."

A student at the University of Melbourne. Photo: IC

Guo Chunmei, an expert on Australian studies at the China Institutes of Contemporary International Relations said the rising discrimination during the pandemic has caused concern among Chinese parents.

In April, two Asian-looking students were assaulted in an alleged attack in Melbourne's CBD area, leading to wide distress and concerns for safety in Asian communities, especially among Chinese students studying in Australia.

For many students, rising sentiments against foreigners is a top concern. When last month, Scott Morrison, prime minister of Australia urged that people should "make your way home" if they are visitors or international students, Chinese students felt reduced to residents only for economic purposes.

"His statement makes me feel we are only welcomed when our tuition fees and its economic effects are needed," Cindy, Chinese marketing major at the University of Melbourne told the Global Times.

"Chinese people were already turned against and sometimes attacked because of the COVID-19. Such direct statement from the PM is sure to fuel the discrimination," Cindy said.

RELATED ARTICLES: