China to cut 2.5 trillion yuan in corporate taxes, fees to bolster smaller businesses

By Ma Jingjing Source:Global Times Published: 2020/5/22 14:06:15

A worker works at a factory of a plastic products company in Ning'an City, northeast China's Heilongjiang Province, May 21, 2020. Up to now, all the enterprises above designated size in the city have resumed production.Photo:Xinhua

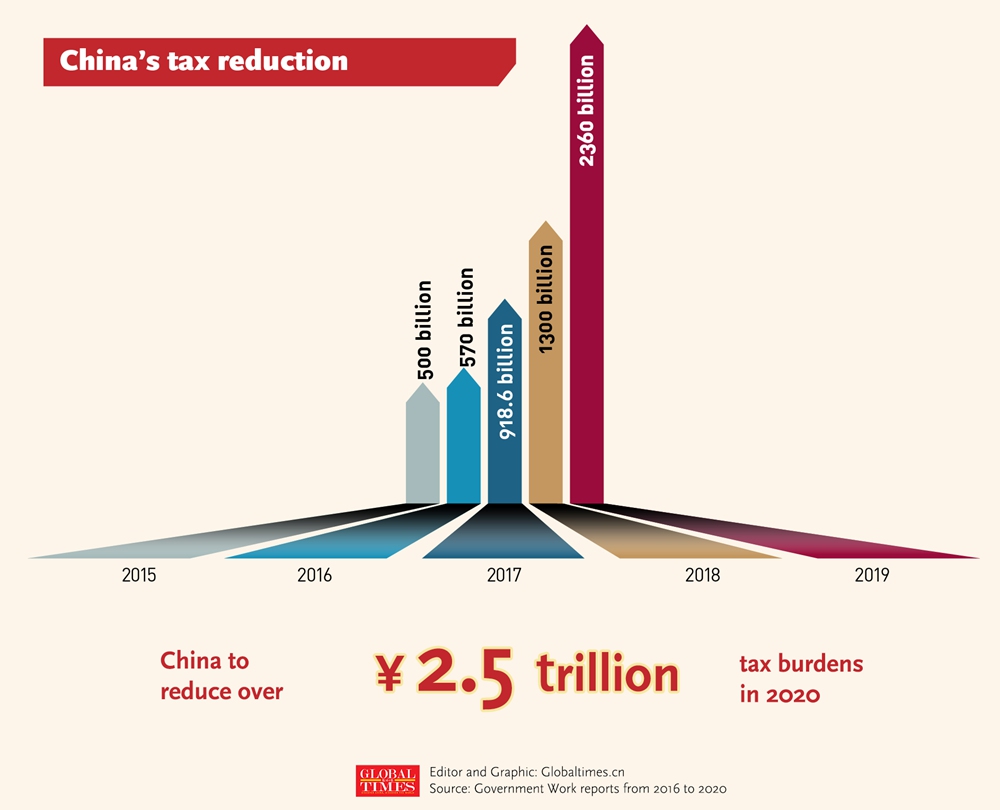

China plans to further cut taxes and fees paid by corporations by 2.5 trillion yuan ($353 billion) this year, up 25 percent from last year's target, signaling the country's strong support for smaller firms as they recover from the fallout of COVID19.

The plan was revealed in the Government Work Report delivered by Premier Li Keqiang at the opening of the third session of the 13th National People's Congress on Friday.

Tax reduction 2020

Among the overall tax cut targets, the country will continue to lower companies' value added tax rate, endowment insurance fees and other measures, to reduce tax and fees by about 500 billion yuan, according to the report.

Previous tax and fee cuts that were to conclude in June will be extend to the end of this year, including exempting smaller firms from paying endowment insurance fees, unemployment and employment injury insurances. And micro firms and individual business income tax payments will be delayed to next year.

Li stressed that the country will try its best to help companies, especially small, medium and micro firms and individual businesses to survive the difficult period, which is necessary to guarantee employment and people's livelihood.

Some 35 million people in the country are expected to receive vocational training over the next two years, according to the report.

The policies were applauded by company leaders interviewed by the Global Times. Yao Jinbo, founder and CEO of Chinese classifieds site 58.com, said that online vocational training will build a foundation for a flexible and orderly labor market. He proposed adopting new modes like flexible employment to effectively reduce labor costs and increase employment capacity.

Financial institutions could cooperate with big data platforms to assess smaller firms' credit and operation risks to more efficiently approve loans and help the resumption of business, Yao said.

According to the Government Work Report, the country will strengthen new development momentum by stimulating market players' vitality, including optimizing the business environment of the private economy, boosting manufacturing upgrading and the development of emerging industries.

"This is inspiring, and will definitely boost companies' confidence," Yang Yuanqing, chairman and CEO of Lenovo and a deputy to the National People's Congress, told the Global Times on Friday.

Yang said that he advised upgrading of the country's manufacturing sector by stepping up efforts to develop the smart economy driven by digitization and intelligent technologies.

China will continue to maintain a prudent monetary policy with more flexibility to ensure ample liquidity, reduce financing cost and tilt loans toward smaller firms to mitigate the impact of the COVID-19, Chen Yulu, a deputy governor of the People's Bank of China, the country's central bank, said Friday.

If current difficulties facing small, medium and micro firms can be appropriately resolved, the country's labor market will be sound and China's economic growth momentum sustainable, Yao said.

China's plan for the 2.5-trillion-yuan tax and fee cut, plus issuance of 3.75 trillion-yuan worth of special local government bonds, is expected to bolster GDP growth by at least 2 percent this year, a veteran analyst surnamed Li told the Global Times on Friday.

In 2019, China's tax and fee cuts totaled over 2.3 trillion yuan ($281.43 billion), slightly higher than the initial goal of 2 trillion yuan.

RELATED ARTICLES:

Posted in: ECONOMY