China prepares for return of US-listed companies

By Xie Jun Source:Global Times Published: 2020/5/25 19:58:01

Nation prepares for return of US-listed companies

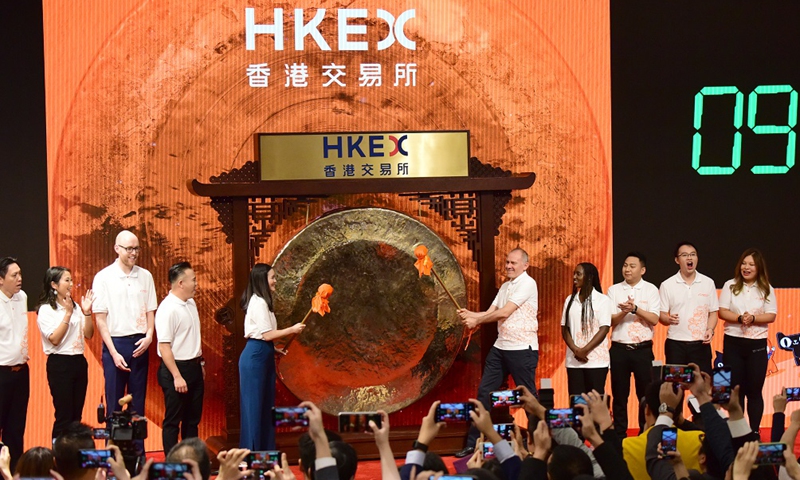

Photo shows guests attending a ceremony of Alibaba's debut on the main board of Hong Kong stock exchange in Hong Kong, south China, Nov. 26, 2019. Photo:Xinhua

The prediction came after a representative of the China Securities Regulatory Commission criticized the US for "politicizing securities management," as the US Senate passed legislation last week that could restrict Chinese companies from listing on American exchanges or raising money from US investors. The move could trigger US-listed Chinese companies including tech giants like NetEase and Baidu to list elsewhere.

Dong Dengxin, director of the Finance and Securities Institute at Wuhan University of Science and Technology, said that the new US legislation is "ill-willed and malicious" as it particularly targets Chinese companies.

"From Huawei to US-listed Chinese companies, the US is extending its attack on Chinese firms. It shows that the trade war between China and the US might escalate," he said.

Rukim Kuang, founder of Lens Company Research, said that if the US actually moves to disrupt trading of Chinese company shares on US bourses, US investors will bear the brunt of that decision as they account for the majority of stock traders behind companies like Alibaba.

Chinese companies are rendering the risks and are expected to take actions. Baidu is mulling a secondary listing in Hong Kong. Reports also indicate that Netease and JD.com aim to list shares in Hong Kong too.

Stock exchanges in Hong Kong and the mainland have been preparing in recent years to welcome Chinese companies that are listed overseas. The Hong Kong stock exchange has lowered its IPO threshold while launching reforms to allow special equity structures to list on the market, while mainland boards like the science and technology innovation board accepted IPO applications from companies that temporarily are not making money.

Xie Dong, director of the Shanghai Municipal Financial Regulatory Bureau, said during a recent interview that the science and technology innovation board should prepare for the return of qualified Chinese firms that are traded abroad.

In the first four months of this year, only 26 domestic companies completed overseas IPOs, compared with 117 in 2019 and 110 in 2018, Xie said.

Xie suggested that China should roll out reforms to help "red chip" mainland companies that are incorporated outside the mainland and listed on the Hong Kong Stock Exchange, to list on the sci-tech board "as soon as possible."

According to Kuang, currently the variable interest entities (VIE), a commonly used structure enabling Chinese companies to get listed on overseas stock markets, is not accepted in Chinese securities laws. That hinders many companies from seeking IPOS in the mainland unless they are willing to first delist abroad, and do away with the structure, which often costs a sizeable amount of money to repurchase tradable shares.

A more feasible option is that they might choose to seek a secondary listing on the Hong Kong stock market and then issue a Chinese Depositary Receipt (CDR) in the mainland based on the Hong Kong-listed shares, Kuang said.

"I expect the regulators to take steps this year to implement the CDR channel this year, but reforms to the VIE will take longer," he noted.

Under a depositary receipt system, Chinese companies listed overseas can transfer their shares to a custodian bank, which acts as a middleman broker and sells the shares in the mainland.

Newspaper headline: Nation prepares for return of US-listed companies