China to further push opening-up on credit rating sector

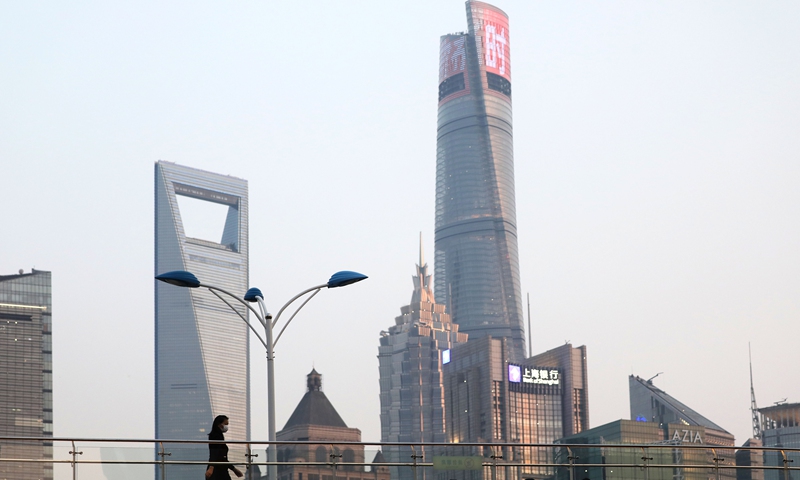

A resident walks through the overpass at Lujiazui area of Pudong, one of the influential financial centers in China. Photo: Yang Hui/GT

China’s credit rating sector is set to embrace further opening-up both domestically and globally, beefing up financial services’ support for the real economy, China’s central bank said on Friday.

The opening-up of the credit rating sector is an important part of China’s financial opening, and bodes well for the global development of China’s credit rating sector and international financial markets, as well as ramping up financial support for the real economy, China’s central bank, the People's Bank of China, said.

China's corporate credit bond market has grown rapidly in recent years. At the end of April, the balance of corporate credit bonds had reached 24 trillion yuan ($3.36 trillion), ranking second in the world, central bank data showed.

The central bank said the next step will allow more qualified domestic and foreign rating agencies to carry out bond rating business in the inter-bank market, and the scope of rating agencies’ bond rating business will continue to expand, adding it will also encourage domestic rating agencies to carry out international business.

In 2017, the central bank said qualified foreign rating agencies can conduct inter-bank bond rating business in China.

Fitch Ratings, a US-based rating agency, was granted access to China's credit rating market via its wholly owned subsidiary in May, which followed the entry of S&P Global Ratings in January 2019.

Global Times