China's economy is recovering in May, but statistics underline growth difficulty

By Chu Daye Source:Global Times Published: 2020/6/15 19:28:40

Weaker-than-expected May figures bring calls to adjust GDP outlook

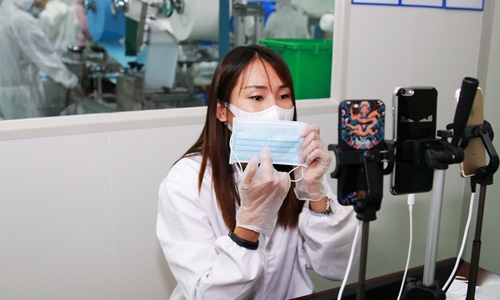

A salesperson promotes company products in a factory through a livestreaming platform in Tongling, East China's Anhui Province on Wednesday. The company is the first mask manufacturer in the city, and it's using the online platform to broaden its sales channels and enhance market competitiveness. Photo: cnsphoto

China's industrial output, fixed-asset investment and retail sales continued to rebound in May, the second full month after the world's second-largest economy reopened after it largely contained the COVID-19 outbreak.

However, the recovery has shown signed of weakening, underlining the difficulty of a complete economic reboot.

All three major economic indicators, closely watched to help gauge the extent of the manufacturing and consumer recovery, continued to recover in May. Industrial output grew 4.4 percent year-on-year in May, compared with a 3.9-percent rise in April, the National Bureau of Statistics (NBS) said on Monday. That was less than the expected 5 percent gain.

Retail sales fell 2.8 percent year-on-year in May as consumers returned to streets, restaurants and malls. The decline in retail sales in May narrowed from a 7.5 percent fall in April, with auto sales also regaining traction.

Urban fixed-asset investment went up 5.87 percent from April.

The NBS said in a statement on Monday that China's economic performance in May continued to improve from April, but the extent of the recovery in industrial output and consumption lost steam and export-oriented industries are seeing signs of contraction due to weak overseas demand.

Wan Zhe, chief economist at the China National Gold Group Corp, told the Global Times on Monday that a continued narrowing of the deceleration in investment and retail sales showed that China's economic reopening was being carried out in an orderly fashion.

China is one step ahead of other major economies on the path to recovery amid the COVID-19 pandemic, said Wan.

"The newly released data are weaker than expected. This demonstrates lingering pressure against a full recovery in retail and suggests some of the earlier predictions were too optimistic," Wan said.

The NBS press conference shifted from offline to online at the last minute as a sudden outbreak of COVID-19 infections struck a wholesale food market in a Beijing district over the weekend.

Fu Linghui, an NBS spokesperson, said both positive and negative factors can be found in determining the growth rate of the second quarter, and whether China's overall economy will return to growth will rely on the performance in June.

Analysts have warned there will be mounting pressure to maintain momentum given the persisting impact of the COVID-19 pandemic at home and abroad.

Liao Qun, chief economist at China CITIC Bank in Hong Kong, told the Global Times on Monday that the recoveries on the supply and demand sides are diverging, with the former stronger than the latter.

"Weaker-than-expected May economic data, plus a rekindled fear that sporadic COVID-10 infections may persist, call for rethinking the assumption that China's GDP could return to growth in the second quarter," Liao said.

"We will also be more cautious in predicting whole-year GDP growth, and may tune down a previous whole-year forecast of two to three percent growth," Liao said.

A research note by Everbright Securities also warned of a drop in exports as order backlogs have been cleared, and demand was ebbing.

Wan said that the government should do more to ease the difficulties of China's vast number of small and medium-sized enterprises, which play a crucial role in maintaining employment and incomes.

The country created 4.6 million urban jobs during the January to May period, down 1.37 million from the same period last year.

Newspaper headline: Economy on slow rebound

RELATED ARTICLES: