UPDATE - China offers 170b yuan in anti-COVID-19 bonds

Source:Global Times Published: 2020/6/16 13:43:40

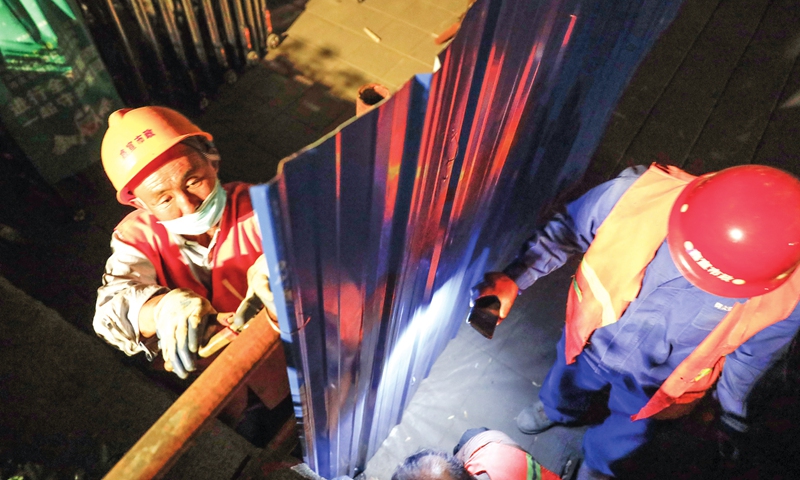

Workers install fences at the Shichahai scenic spot in downtown Beijing on Monday night to cordon off the area. Several districts in Beijing have upgraded their public health emergency response to Level II after a new COVID-19 outbreak began at a wholesale seafood market in Beijing last week. Photo: Li Hao/GT

China's Ministry of Finance on Tuesday announced the issuance of 170 billion yuan ($24.02 billion) in special bonds intended to fund anti-virus efforts, fueling speculation over monetary easing in the near term.

The offering comprises fixed-rate coupon bonds at three different maturities - 50 billion yuan in five-year anti-virus bonds, 50 billon yuan in seven-year bonds and 70 billion yuan in 10-year bonds - according to three separate announcements on the ministry's website. The five- and seven-year bonds will hit the market on June 23, while the 10-year bonds are scheduled to be available on June 30.

History shows that during times of intense bond issuance, such as the introduction of a massive program to swap local government debt for bonds in 2015, the central bank would be pro-issuance with reserve requirement ratio (RRR) cuts.

The bond sale is reportedly accessible to individuals. This adds to the central bank's softer-than-expected medium-term lending facility (MLF) operations on Monday, which fell substantially short of maturing MLF this month while the rate was unchanged from the month before, stoking expectations of monetary easing.

The central bank is expected to move toward an RRR cut to inject liquidity and "accommodate the massive amount of government bond issuance in the pipeline," Nomura economists said in a note sent to the Global Times.

The markets will likely cast down their outlook for growth recovery, pricing in the COVID-19 outbreak in Beijing over the past weekend, the economists reckoned, estimating that with inflation falling, interest rate cuts are also on the cards - including one-year benchmark deposit rates and MLF rates.

China's consumer inflation went up 2.4 percent year-on-year in May, down from a 3.3 percent gain in the month prior, official data showed. The nation's producer price index fell 3.7 percent in May from a year earlier.

Expecting policies to remain supportive, UBS economists led by Wang Tao wrote in a note sent to the Global Times that they maintain a call for an additional 50 basis point RRR cut and an MLF rate cut of up to 20 basis points this year.

Global Times