Pandemic no damper on China’s financial opening-up

Source:Global Times Published: 2020/6/18 19:58:40

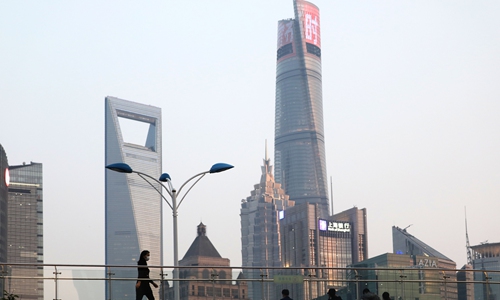

A resident walks through the overpass at Lujiazui area of Pudong, one of the influential financial centers in China. Photo: Yang Hui/GT

The COVID-19 pandemic hasn't put a damper on China's financial opening, financial sector regulators said Thursday at an influential forum in Shanghai as they called for broader international cooperation to avert global economic and financial crises.

The nation's capital market opening-up hasn't been slowed by the coronavirus outbreak, but has instead been accelerated, Yi Huiman, chairman of the China Securities Regulatory Commission, said at the annual Lujiazui Forum.

In a fresh sign of continued financial deregulation, the CSRC announced on Thursday that JPMorgan Chase & Co's Chinese futures business had gained regulatory approval to become the first wholly foreign-owned futures firm in Chinese mainland.

The securities regulator pledged to continue improving the Shanghai-London Stock Connect regime, push for Shanghai to be built into an international financial hub, and support Hong Kong's role as a global financial hub.

A recent example of the nation's closer financial ties with its global counterparts was China Pacific Insurance Co (CPIC)'s debut of its global depository receipts (GDR) through the Shanghai-London Stock Connect in a $1.8 billion listing Wednesday.

CPIC was the second company to float on the linkup after Huatai Securities's GDR listing in June 2019. US investment bank Citi was appointed as the depositary bank for the Chinese insurer's GDR offering, said a Citi statement sent to the Global Times.

CPIC's GDR debut is set to boost China-UK economic and trade ties, showcasing the opening-up of China's capital market to the world, said the statement, citing CPIC Chairman Kong Qingwei.

In another sign, Hong Kong Exchanges and Clearing Limited (HKEX), the operator of the Hong Kong bourse, announced Thursday plans to launch the HKEX Sustainable and Green Exchange, the first-of-its-kind sustainable and green finance platform in Asia.

Investors from across the world are welcome to invest in the Chinese market, said the CSRC chief.

China's bond and stock markets are now both ranked No.2 globally in terms of capitalization, according to China Banking and Insurance Regulatory Commission Chairman Guo Shuqing.

Speaking at the forum, Guo stressed that the US Federal Reserve to some extent acts as the world's central bank in the US dollar-dominated international monetary settlement system, and it should play an important role in maintaining global economic and financial stability.

However, the Fed has been shown to be too "inward-looking" in policy-making, which might undermine the fundamentals of global financial stability and harm the dollar's global reserve currency status, he said.

The pandemic that is spreading across the globe has had profound implications for the global economic and financial landscape, Yi stated, noting that global crisis call for global common solutions.

Only by pushing for unified and coordinated efforts can another "Great Recession" be averted, Yi added.

Newspaper headline: Pandemic won't dampen China’s financial opening