HK will not be swayed by frosty US relations

By GT staff reporters Source:Global Times Published: 2020/6/30 16:53:40

Closer mainland ties since 1997 have prepared the city to weather the storm

A view of Hong Kong Photo: VCG

Contrary to foreign media claims that the new national security legislation would bring an end to the Hong Kong Special Administrative Region (HKSAR)'s status as an international financial and commercial hub, observers and industry insiders said just ahead of the 23rd anniversary of the city's return to the motherland on Wednesday that the legislation would only sharpen the HKSAR's financial prowess.

The ever-closer economic ties between Hong Kong and the Chinese mainland over the past two decades have not only beefed up the city's finances and made the HKSAR into the eastern pearl of global capital markets, but have readied the city for a frosty relationship with the US in the wake of Washington's growing hostility toward Hong Kong, they noted.

China urges the US to stop reviewing or implementing any Hong Kong-related acts, Chinese Foreign Ministry spokesman Zhao Lijian said on Monday, after the US Senate approved the HK Autonomy Act. He said previously imposed acts are "waste paper."

Eastern pearl of global capital markets

After the implementation of the national security law, the central government will introduce measures to further consolidate Hong Kong's financial status, making it an international financial center not only in China, but also in the Asian zone, Liang Haiming, chairman of the China Silk Road iValley Research Institute and a Hong Kong-based economist, told the Global Times on Monday.

The People's Bank of China, the country's central bank, on Monday announced the launch of a pilot program known as the cross-border wealth management connect in the Guangdong-Hong Kong-Macao Greater Bay Area.

The wealth management program is the latest addition to an enriched portfolio of market links between the mainland and Hong Kong that already cover stocks and bonds.

Charles Li Xiaojia, chief executive of the Hong Kong Exchanges and Clearing (HKEX), wrote in mid-June on his personal blog on the website of the local bourse operator, that "the rising tension between the US and China, the two pillars of today's global order, is a key focus for international financial centers such as Hong Kong."

Emphasizing that "China and the rest of the world need each other," Li reckoned that "China is on an irreversible track to being more closely integrated with international markets," with Hong Kong, and the HKEX in particular, continuing to "play critical roles of connector, translator, and a bridge between China and the world."

Attesting to the city's greater, rather than lesser, clout on the global capital market is a rising trend among US-listed Chinese companies to launch secondary listings in the Hong Kong.

Upon the debut of mainland-based internet giant NetEase on June 11, the first secondary listing on the HKEX had for 2020, Li revealed that 55 companies had floated on the Hong Kong market this year, raising more than HK$25 billion ($3.23 billion). He said more companies would follow and find success in Hong Kong.

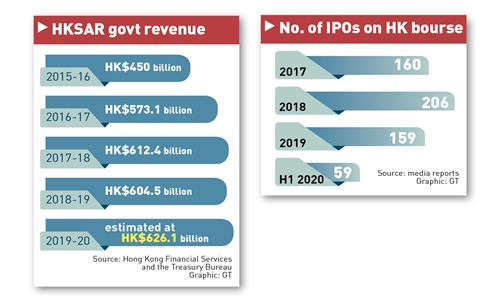

The swelling finances of the local government, underpinned by the city's financial sector - local government revenue for 2019-20 was estimated at HK$626.1 billion, nearly triple the reading for 1997-98 - have laid a foundation for the city to resist US pullback.

In the words of Hong Kong Financial Secretary Paul Chan Mo-po, Hong Kong has fully assessed and prepared for potential economic sanctions threatened by US officials over the national security law. He offered a staunch defense of the law, calling it a boost to the city's economic outlook rather than a drag.

"The government of the Hong Kong Special Administration Region has made a full assessment... and has made contingency plans accordingly," Chan wrote in a blog post on Sunday, stressing that national security is both a responsibility and an obligation that Hong Kong cannot ignore and that when prepared and vigilant, "Hong Kong fears no storm and will move forward firmly."

Turning Achilles' heel into armor

More importantly, closer mainland-Hong Kong links can be seen as turning what was feared to be an Achilles' heel into armor.

A compelling example is the strength of the Hong Kong dollar, thanks to capital inflows amid a flurry of secondary listings. These inflows have had the city's monetary authority moving frequently in recent weeks to sell the local currency to keep it from hitting the strong end of its pegged trading limit of 7.75-7.85 to the US dollar.

"Under increasing political pressure from the US government aiming to delist Chinese companies, a rising number of mainland-based tech giants are flocking to the HKSAR's stock market for secondary listings, which have created closer financial ties and further consolidated the HKSAR's status as a financial center," a manager of the Hong Kong branch of a Beijing-based financial institution, who spoke on condition of anonymity, told the Global Times on Monday.

The US is unlikely to impose financial sanctions such as banning access to the SWIFT system, as "Trump is just making a threat, hoping the Chinese government will give him some advantage that will help him get reelected," according to Liang.

The linkage of the Hong Kong dollar and the US dollar is helping maintain and consolidate the status of the US dollar in the international monetary system, he explained, and if the US does not allow Hong Kong to use US dollars, that would greatly damage the interests of the US itself.

In addition, even if Hong Kong cannot use the US dollar any longer, with the support of the central government, Hong Kong can develop into an international financial center with transactions denominated by the yuan or other currencies, the economist stated.

Internationally, de-dollarization has already become a trend due to the Federal Reserve's unlimited quantitative easing programs and its poor performance in handling the impact of the pandemic, experts said.

As Liang put it, the US is passing on the crisis by turning on the money-printing machine, which not only abuses the hegemony of the US dollar but harms the interests of other countries and international investors.

It is also making the world lose further confidence in the provision of global public goods by the US.

Posted in: ECONOMY