Chinese economy may have grown as much as 3% in Q2, no huge monetary stimulus seen

By Li Qiaoyi Source:Global Times Published: 2020/6/30 20:18:40

Economy may have grown as much as 3% in Q2

A worker is busy with producing and packaging zippers at a zipper manufacturer in Yiwu, East China's Zhejiang Province. Photo: Yang Hui/GT

Graphics: GT

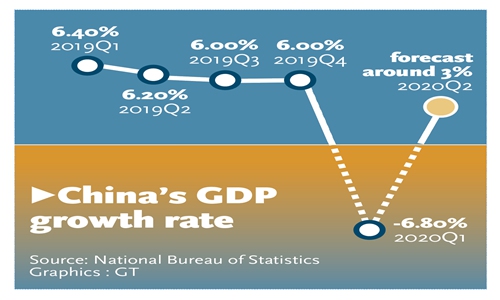

China's economy is expected to have expanded as much as 3 percent in the second quarter as it gradually emerged from the shadow of the COVID-19 outbreak, said veteran market watchers, who played down the possibility of any drastic monetary policy moves.Second-quarter GDP growth probably hit about 3 percent, with industrial added value back on the expansion track, faster fixed-asset investment growth, and a possible renewed rise in retail sales, economists at Zhixin Investment Research Institute said in a research report sent to the Global Times.

They also cited a continued rebound in property sales and still-weak imports and exports.

Estimates by the research institute of Bank of China were also published Tuesday, saying that decisive achievements in virus containment during the second quarter and the continued push for reopening positioned the economy well for a recovery across the board.

The bank estimated that second-quarter GDP expanded 2.8 percent and forecast 5.2-percent growth in the third quarter, paving the way for a yearly gain of about 2.5 percent.

But there were also less jubilant voices.

Describing market forecasts as "overly optimistic," Yao Yang, director of the China Center for Economic Research and dean of the National School of Development at Peking University, told the Global Times on Tuesday that the economy probably didn't grow at all in the second quarter due to insufficient consumption.

But even a flat performance is an improvement from the first quarter, when the economy posted a contraction of 6.8 percent amid the pandemic.

It's generally reckoned that Chinese policymakers won't resort to stimulus packages that have been widely adopted in developed economies, notably the US.

As Zhixin Investment Research Institute economists put it, the nation would continue a countercyclical monetary policy, but there's little chance of massive policy easing in the short term.

With the renewed domestic spread of the virus well under control, returning to normal and eradicating poverty would be the focus of the Chinese economy for the remainder of the year, Wei Fengchun, chief macro strategist of Bosera Asset Management Co, told the Global Times on Tuesday.

Concerns over a second outbreak are easing as Wu Zunyou, chief epidemiologist at the Chinese Center for Disease Control and Prevention, said on Monday that Beijing could report zero new injections in about a week.

The nation is expected to hold onto its pre-virus road map for economic rebalancing, Wei said, noting that a non-massive stimulus approach to monetary policymaking indicates that the capital market would be relied on more heavily to fund businesses, in especially emerging sectors.

In recent years, China undertook supply-side reform of the real economy and it's now time for financial-sector reforms on the supply side, he said.

Speculation emerged over the weekend that commercial banks might be allowed to get securities licenses, a major step forward for supply-side reforms in the financial arena.

The equity market doesn't have enough resources to finance China's industrial upgrade, while its gigantic banking sector is unsuited to direct fundraising for emerging sectors, given the risks associated with investing in early-stage businesses.

Instead of acquiring existing brokerages, it's more likely that banks would form partnerships with those securities firms, Wei speculated.

Newspaper headline: Economy may have grown as much as 3% in Q2

Posted in: ECONOMY