State-owned enterprises crucial to China’s recovery

By Ma Jingjing Source: Global Times Published: 2020/7/16 22:53:40

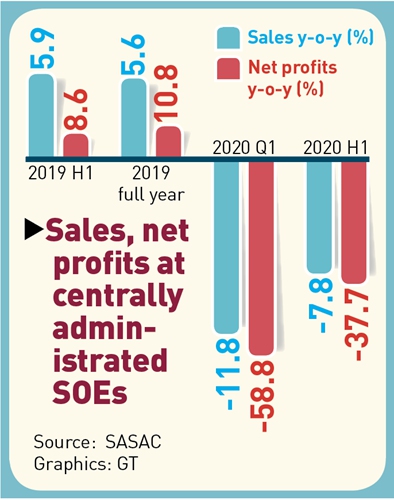

Revenue, profit grow in June for first time in 2020

The launch ceremony for Industrial Internet Convergence Platfrom for Central SOEs on Saturday in Chengdu, captial of Southwest China's Sichuan Province. (Photo: Courtesy of 2019 International Conference on Industrial Internet)

As China strives to control the coronavirus outbreak and restore normal economic and social order, state-owned enterprises (SOEs) are again playing an important role by leading business and production resumption, supporting small and medium-sized enterprises, and stabilizing investment.

Centrally administered SOEs' production and operation obviously improved starting last month, with sales up 0.6 percent year-on-year to 2.9 trillion yuan ($414.4 billion) and profits up 5 percent to 166.48 billion yuan, data from the State-owned Assets Supervision and Administration Commission of the State Council (SASAC) showed on Thursday.

In the first half, these enterprises posted aggregate revenue of 13.4 trillion yuan, down 7.8 percent year-on-year, while profits stood at 438.6 billion yuan, down 37.7 percent.

As one of China's institutional advantages, SOEs displayed their significance through such moves as ensuring people's basic needs during the battle against the coronavirus and waiving rentals for small and medium-sized enterprises, Liang Jun, a research fellow at the Guangdong Academy of Social Sciences specializing in SOE reforms, told the Global Times.

Despite the pressure of operations, centrally administered SOEs reduced costs for the public by 120 billion yuan by cutting electricity, natural gas and other costs in a bid to help small and medium-sized enterprises survive the outbreak, Peng Huagang, spokesperson of the SASAC, said at a press briefing on Thursday.

Peng said that centrally administered SOEs will strengthen cooperation with smaller firms in their industrial and supply chains, while continuing to reduce costs to support small companies.

"Unlike risk-averse private firms, SOEs tend to rush to the forefront during difficult periods by increasing investment, cementing their main business and providing more jobs," Dong Dengxin, director of the Finance and Securities Institute at the Wuhan University of Science and Technology, told the Global Times on Thursday.

According to the SASAC, domestic centrally administered SOEs' fixed-asset investment reached 1 trillion yuan in the first half of the year, up 7.2 percent year-on-year. During the period, their investment in sectors including electricity generation, vehicles and telecommunications soared more than 15 percent year-on-year.

Meanwhile, centrally administered SOEs launched special campaigns to stabilize employment, providing more than 1 million jobs by mid-June, China Business Journal reported, citing SASAC data. For example, China National Petroleum Corp plans to recruit 8,000 fresh graduates this year, an increase of 3,000 year-on-year, it said.

Peng said that the commission will launch more SOE reforms to spur market vitality, while promoting scientific and technological innovation so as to make key breakthroughs in important sectors.

According to a meeting of the central committee for deepening overall reform on June 30, one of the major tasks of SOE reform is optimizing the organization and structure of the state-owned economy to make it more competitive, innovative, controllable, influential and risk-resistant.

Dong said that the SASAC is expected to streamline administration to hand over more autonomy to SOEs, boost the market-oriented and dynamic supervision of state-owned assets to avoid losses, and strengthen these enterprises' economic and social responsibility.

"As economic stabilizers, many SOEs also face heavy pressure, but they could do a good job in turning challenges into opportunities and contributing more to the building of a moderately prosperous society," Dong said.

Newspaper headline: SOEs crucial to recovery