Gold price soars to 9-year high amid US diplomatic tensions

By Ma Jingjing Source: Global Times Published: 2020/7/23 19:48:40

A customer shops for gold ornaments at a jewelry shop in Yangon, Myanmar, Aug. 13, 2019. Myanmar's domestic gold price edged higher with around 1.23 million kyats (816 U.S. dollars) per tical on Tuesday, U Aung San Win, vice-chairman of Myanmar Entrepreneurs Association, told Xinhua. (Xinhua/U Aung)

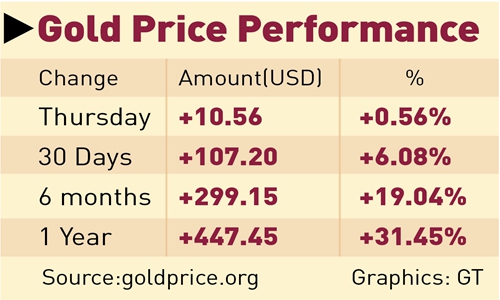

The international spot gold price hit $1,883.16 per ounce and silver $22.85 per ounce at 6 pm on Thursday (Beijing time) as risk-aversion sentiment soars amid escalating China-US diplomatic tensions and the continued spread of COVID-19.

The gold price has risen over 21 percent this year, hitting its highest point since September 2011 and approaching a record high of $1,920.80 per ounce.

The silver price has grown around 17 percent, now at its highest level since September 2016.

Driven by the international gold price, domestic spot gold and gold future prices both exceeded 410 yuan per gram ($1,672.80 per ounce) on Thursday. The price of spot gold at the Shanghai Gold Exchange closed up 0.6 percent to 412.66 yuan, and the main contract, Au2012, was up 1.11 percent to 416.52 yuan.

Observers noted that escalating tensions between the world's two largest economies, as well as the uncertainties of the global pandemic, have pushed up metal prices.

Wan Zhe, chief economist at the China National Gold Group Corp, said global risk-aversion sentiment has increased as many countries face great challenges in returning their economies to normalcy due to the uncertainties of the global pandemic, and some central banks are pumping liquidity into the market which may depreciate cash values.

Factors supporting gold price growth have not fundamentally changed, Wan said. "Gold prices may remain at a high level in the coming months as panic over a resurgence of COVID-19 cases in fall and winter lingers," she said.

On Wednesday, the US ordered the Chinese Consulate General in Houston to close in an unprecedented escalation of tensions in bilateral diplomatic relations, sending another shockwave into financial markets.

The domestic share market slightly edged down in the morning session but recovered to close just around the flatline. The Shanghai Composite Index closed down 0.24 percent to 3,325.11 yuan ($475.43) and the Shenzhen Component Stock Index inched 0.03 percent to 13,661.50 yuan. The tech-heavy ChiNext board closed up 1.11 percent to 2,799.67 yuan.

Yang Delong, chief economist at the Shenzhen-based First Seafront Fund Management Co, told the Global Times that the impact of the abrupt escalation of China-US tensions on A-share market is short-term.

"Looking forward, the A-share market will be increasingly immune to such political incidents, with shares relevant to military equipment and COVID-19 vaccines going robust," Yang said.

AVIC Shenyang Aircraft Company Ltd saw its shares rise up daily limit of 10 percent to 68.91 yuan per share and Harbin Dongan Auto Engine Co rose by 9.97 percent to 8.49 yuan per share. Fosun's medical branch Fosun Pharma posted 10 percent growth to 47.6 yuan per share.

That came as China launched its first Mars mission on Thursday, intensifying international competition in deep-space exploration. Meanwhile, media reports said that a COVID-19 vaccine candidate developed by China National Pharmaceutical Group is expected to hit the market by the end of 2020.