Private Chinese carriers face reorganization amid pandemic; local government takes stake in Ruili Airlines

By Tu Lei Source: Global Times Published: 2020/8/6 19:53:40

Ruili Airlines planes parked at Kunming Changshui International Airport in Yunnan Province Photo:IC

Although an industry depression resulting from the global COVID-19 outbreak has caused many airlines around the world to go bankrupt or face bankruptcy, dozens of Chinese airlines seem to have successfully avoided entering such a situation.

But that doesn't mean Chinese airlines are in a healthy state.

A trend had begun to appear even before the coronavirus outbreak. Some small-scale local aviation companies are increasingly funded by state-owned capital, and others that have not yet received funding boosts have been selling equity or licenses.

And yet another private aviation company is about to change ownership.

Wuxi Communications Industry Group Co said on Tuesday that it had signed an agreement with Yunnan Jincheng Group Co regarding its equity purchase of Ruili Airlines.

In a notice posted on its official website, Wuxi Communications said that owning a local airline is of special significance as it will both accelerate its development of an aviation hub and achieve high-quality development in the hub economy.

Wuxi is a city in East China's Jiangsu Province. Sunan Shuofang International Airport, located in Wuxi, handled nearly 8 million passengers and 145,100 tons of cargo and mail in 2019. By January 2020, the airport had covered routes to 33 Chinese cities and nine foreign cities.

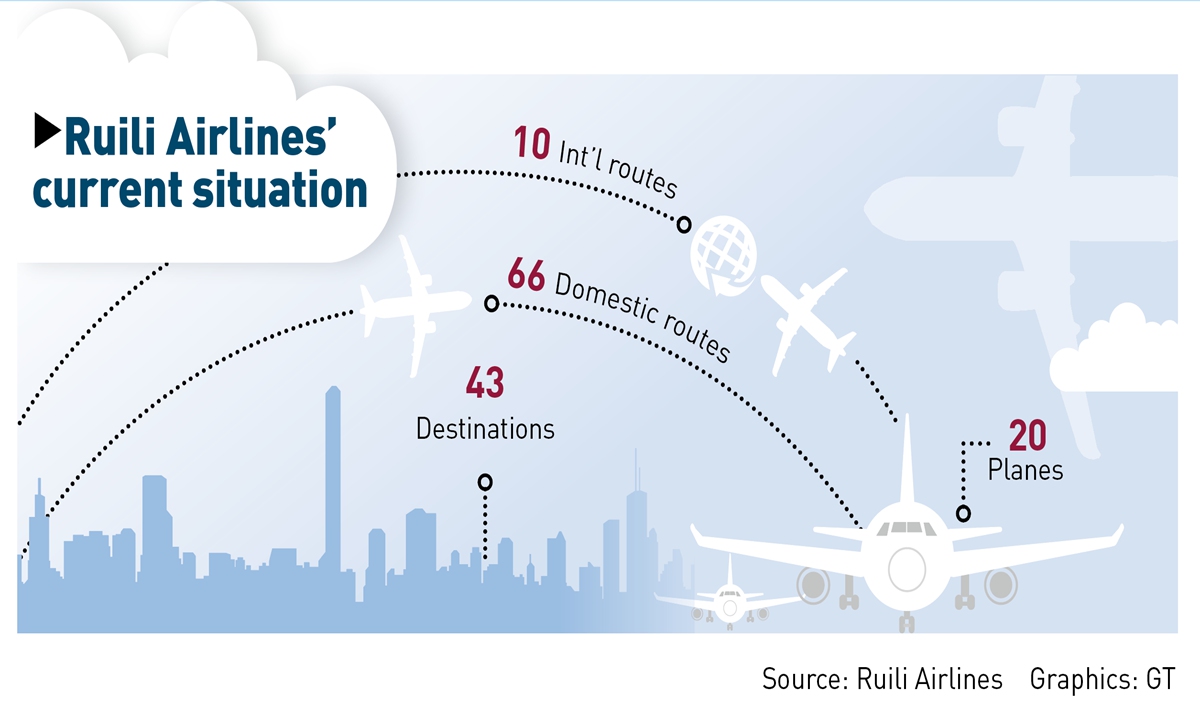

The airline's specific shareholding structure as determined in the agreement has not yet been released, and the location of its headquarters has not yet been decided. Approved by the regulator in May 2013, Ruili Airlines began operations in May 2014. At the end of June 2020, it had 20 aircraft flying 76 routes, covering 43 domestic and foreign cities.

Yunnan Jincheng Group owns 70 percent of Ruili Airlines. Wuxi Communications is a wholly state-owned company under the Wuxi municipal government, with investments in buses, subways, highways, citizenship cards and airports.

State capital rushes in

China encouraged and supported private capital to enter the air transport field in 2004, attracting many enthusiastic investors. But it later became apparent that private aviation companies were facing difficulties - well before the epidemic.

Since 2018, China's civil aviation industry has been experiencing an unprecedented wave of private capital withdrawal. By December 2019, many airlines had undergone various degrees of reorganization.

In November 2018, Urumqi Air's parent company Hainan Airlines Holding Co signed an equity restructuring deal with the Urumqi municipal government which transferred a 70 percent share of Urumqi Air's equity, with Hainan Airlines retaining the remainder.

In December of 2018, state-owned Beijing Tourism Group increased its holdings in Capital Airlines, acquiring shares from HNA Group.

Two other private carriers, Qingdao Airlines and Air Travel, in 2019 also gained investment from companies or funds under local governments.

In December 2019, OK Air, the first private airline in China, received capital from China Huadian Corporation Ltd and Hong Kong-listed real estate company Sino-Ocean Group Holding Ltd.

It has long been rumored that Ruili Airlines is seeking a capital injection, and it is no surprise that the company has changed ownership, insiders said. The coronavirus pandemic has dealt another blow to airlines, particularly small and medium-sized private airlines.

The civil aviation industry is characterized by heavy assets, high investment, high volatility and high risk. Under the severe impact of the pandemic, small and medium-sized private airlines are facing network, professional and financing challenges, Yu Zhanfu, global partner of strategy consultancy Roland Berger, told the Global Times on Friday.

But local governments remain willing to own airlines to develop their local economies, thus they are willing to cooperate with one another in sales and purchases, Yu added.

It is currently not easy for small and medium-sized airlines to remain profitable due to insufficient resources and high operational pressure. And once they enter a downward cycle caused by high oil prices, weak exchange rates and low demand, mergers will be inevitable, civil aviation industry watcher Lin Zhijie told the Global Times on Tuesday.

Other carriers also hit

Other Chinese carriers are also trying to find their way back to normal operations.

Several carriers including China Southern, China Eastern, Shandong Airlines and Spring Airlines are flocking to launch unlimited flight packages to woo customers, hoping to lift their load factors and revive the pandemic-ravaged air travel market. Prices for these unlimited flight packages average around $500.

According to data from July 1 to August 3 calculated by civil aviation data provider CADAS, passenger load factors ranged from 65 percent to 82 percent for five Chinese airlines: China Eastern, China Southern, Air China, Hainan Airlines and Juneyao Air.

Graphics

RELATED ARTICLES:

Posted in: COMPANIES,BIZ FOCUS