Why doesn’t US pressure discourage Chinese companies’ IPOs?

By Dong Shaopeng Source: Global Times Published: 2020/8/17 20:18:40

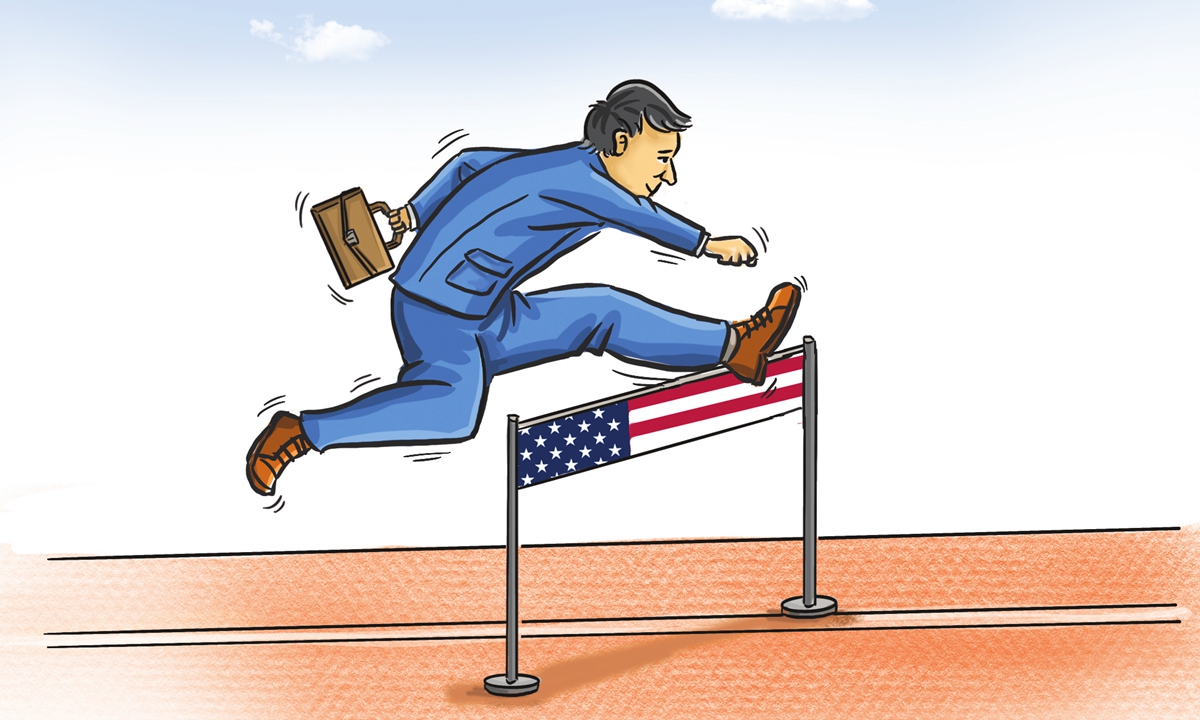

Illustration: Xia Qing/GT

Chinese companies haven't slowed their pace of IPOs in US capital markets despite an intensifying US political crackdown and threats amid spiraling tensions.Since the beginning of this year, Chinese companies' IPO financing in the US has reached $5.23 billion, more than twice that of the same period last year. Why don't continuous threats from Washington keep Chinese companies from listing in the US?

For starters, what the US is trying to do is set up "institutional barriers" for Chinese companies to go public in the US, but this is not in line with the rules of free flows of market resources.

Earlier this month, the Trump administration threatened that Chinese companies with shares traded on US stock exchanges would be forced to give up their listings unless they complied with US audit requirements by 2022, under a newly recommended plan, according to the Wall Street Journal.

The currently listed Chinese companies are in compliance with US securities market rules, otherwise it would be impossible for them to list in the US in the first place. The main companies that provide audit services for Chinese companies listed on the New York Stock Exchange and NASDAQ market are the "Big Four" accounting firms, which are registered with the Public Company Accounting Oversight Board (PCAOB), a specialized audit regulator overseen by the US government, and they comply with US audit rules.

However, under the US' new plan, US-listed Chinese companies would have to share their work papers with the PCAOB, or else give up their listings on US exchanges.

The US' "repeat audit" requirements do not aim at watching companies' quality, but are a politicized form of long-arm jurisdiction that would bring obstacles to Chinese companies going public in the US. But this plan is expected to bring about a limited impact.

The opening-up trend of capital markets across the world is hard to reverse, and Chinese firms could still choose among markets. Going public in accordance with local laws and regulations, these firms' listings in the US are not only a means to financing, but also a path to distribute the benefits of China's rapid development to the world.

Choosing to list in the US despite the Trump administration's threats is a decision based on these companies' own development agendas. Since some of them have been preparing for the listings for some time, it will cost them enormously if they decide to switch plans.

Going public in the US under such severe circumstances could, in turn, prompt Chinese companies to enhance their legal awareness, and shore up their capacity to fairly compete with others in the global arena.

Firms going overseas to do business or raise financing should abide by both the laws and regulations at home and abroad. Regulators on both sides have the responsibility to effectively supervise listed companies and professional service institutions, and protect the legitimate rights and interests of investors.

Only by strengthening regulatory cooperation can China and the US effectively solve problems, achieve effective regulation and benefit each side. Politicizing market issues would create secondary problems.

The US' unilateralism and protectionism have damaged global trade and financial cooperation. With certain US politicians trying to extend the animosity to the financial markets, it may further exacerbate the trend of politicizing market issues, and undermine the principle of free and fair markets.

The author is deputy managing editor of Securities Daily and an expert adviser for the China Securities Regulatory Commission. bizopinion@globaltimes.com.cn

Posted in: EXPERT ASSESSMENT