China's aviation logistics take off

By Global Times-Xinhua Source: Global Times Published: 2020/8/20 17:28:40

CAAC introduces new policy on airport slot allocation for cargo flights

An airplane unloads cargos in Beijing Daxing International Airport in June. Photo: IC

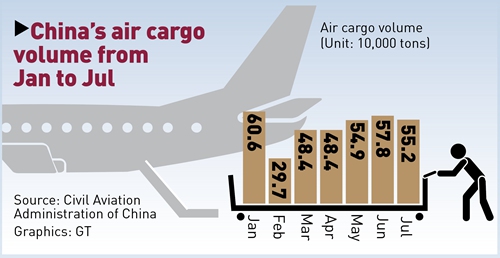

China's air cargo volume

China has adopted a new policy on airport slot allocation for cargo flights to boost the country's air logistics industry.

This is the first slot allocation policy specifically designed for cargo flights and will be implemented starting from October 25, according to the Civil Aviation Administration of China (CAAC).

The new policy is aimed at increasing the daily utilization of cargo airplanes and airport facilities, improving China's international air cargo capacity, and strengthening the competitiveness of its aviation logistics sector, CAAC said. China's aviation logistics has developed rapidly and maintained an upward trend in recent years, but the development of cargo and mail aviation still lags behind that of passenger aviation.

However, thanks to its speed, air cargo has played an important role in the transportation of epidemic prevention materials amid the global epidemic. And China, as the world's factory, has been the main exporter of global epidemic prevention supplies, pushing the volume of air cargo higher, analysts said.

CAAC said the aviation industry transported a total of 552,000 tons of cargo and mail in July, a year-on-year decrease of 10.4. However, all-cargo air cargo and mail transportation continued to grow quickly, completing a total of 229,000 tons: a year-on-year increase of 20.4 percent.

Zhengzhou Xinzheng International Airport had a cargo and mail throughput of 53,500 tons in July, and a cumulative cargo and mail throughput of 308,600 tons from January to July, also a year-on-year increase of 21.9 percent.

In addition, airports in Shenzhen, Chongqing and Shanghai all witnessed a positive growth in cargo transportation in July, with Shenzhen Bao'an International Airport's cargo transport up 15.28 percent from the same period last year. Delivery firm SF Express said its express delivery and supplies income was up 35.96 percent in July year-on-year. So far, SF Airlines owns 60 all-cargo aircrafts.

Wuhan, the virus-hit city in Central China's Hubei Province, is reportedly planning to open eight new international all-cargo aircraft routes, extending to cities such as Chicago, London and Amsterdam.

The plan has been drafted in accordance with the functional orientation of various other airports, and the supply-and-demand status of flight schedules, the CAAC said.

The policy calls on airports to implement slot allocation for cargo flights in classified, quantitative and differentiated ways. It takes into consideration the differences in flight densities, passenger and cargo flights, as well as scheduled and nonscheduled flights among various airports.

According to the CAAC, optimizing the flight schedules would greatly improve timetables for cargo flights.

The policy relaxes the timetable limits for cargo flights by balancing the airport's current operations, peak and down time windows and other major factors.

Hub airports with stronger freight-handling capacities can schedule international cargo flights during the peak time window, according to the new policy.

The cargo flight slot allocation will examine the carriers' previous flight records, the value of flights, on-time performance, safe operation records and other major indicators.

The CAAC has introduced a series of additional measures such as simplifying approval procedures and offering flexible flight timetables to ensure the timely transportation of anti-pandemic supplies and sustain the global supply chain.

In the summer flight season of 2020, the total slot numbers for cargo flights has seen a 50 percent increase compared with that in 2019, said statistics from the CAAC.

The International Air Transport Association (IATA) released data for global air freight markets in June showing improvement, but at a slower pace than some of the traditional leading indicators would suggest.

Asia-Pacific airlines saw demand for international air cargo fall by 20 percent in June 2020 compared to the same period a year earlier. This was a slight deterioration over the 18.8 percent drop in May.

Despite manufacturing starting to pick up in the region, demand was impacted by the reduction in shipments of PPE by air. International capacity decreased 32.3 percent.