Four decades on, Shenzhen-HK ties deepen

By Li Xuanmin in Shenzhen Source: Global Times Published: 2020/8/26 22:03:40

Neighbors seek complementary roles, not rivalry

People walk out of a subway station to head to their office buildings in Shenzhen, South China's Guangdong Province, on Tuesday. Photo: Li Hao/GT

Shenzhen, the pioneer city in South China's Guangdong Province that was designated as China's first special economic zone (SEZ), will continue working with neighboring Hong Kong and deepening their financial cooperation against the backdrop of the US dollar-dominated financial system and the implementation of the national security law that helped Hong Kong restore a normal social order.

As Shenzhen celebrates 40th anniversary of SEZ, the city's closer ties with Hong Kong in the new chapter of China's reform and opening-up is of special significance. Hong Kong has helped bring in foreign capital that powered Shenzhen's rapid rise, while Shenzhen's vibrant technology companies have diversified Hong Kong's capital market.

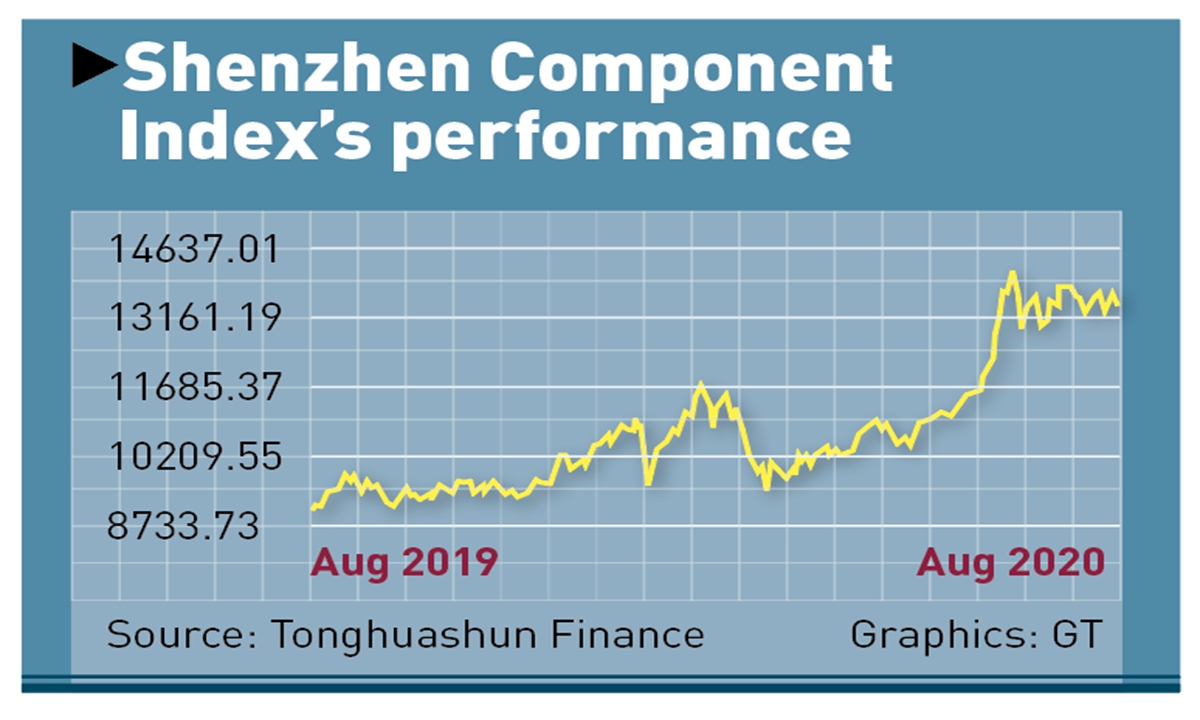

Wednesday marks the 40th anniversary of the establishment of the Shenzhen Special Economic Zone. During these 40 years, the coastal city has transformed itself to one of China's most vigorous capital markets now.

On Monday, Shenzhen's technology start-up board, the ChiNext board, welcomed the listing of 18 technology companies under landmark new rules that are more accommodating for growing companies.

"Hong Kong, an international financial center, has helped build Shenzhen's multi-layer capital market and a more open financial system. Geographic proximity has made Shenzhen the bridgehead in attracting international capital from Hong Kong," an employee at a Hong Kong financial institution surnamed Hai, who frequently travels to Shenzhen, told the Global Times on Wednesday.

Hai added that Shenzhen's financial services industry has drawn on the rich experience of its Hong Kong peers in asset management and market-oriented system reform.

In the first half of 2019, the Shanghai-Hong Kong Stock Connect and the Shenzhen-Hong Kong Stock Connect generated record revenue and other income of HK$508 million ($64.75 million), compared with HK$365 million a year earlier.

Graphics: GT

Hong Kong's position as the world's largest offshore yuan trading center also paves the way for trials of the yuan as the settlement currency for cross-border trade in Shenzhen, Qi Mingyang, chairman of Shenzhen-based asset management firm Fortune Valley Capital Investment Group, told the Global Times Wednesday.

"Shenzhen is home to thousands of tech startups that need financing. Their listings in Hong Kong have helped cement the city's competitiveness as a financial center," Qi said.

Chinese observers noted that Shenzhen's ChiNext board reform will not make it a rival of Hong Kong Exchanges and Clearing (HKEX) - rather they will inspire each other to do better.

"Forty years on, the roles of Shenzhen and Hong Kong are still complementary. While Shenzhen serves as a gateway to the massive market in the Chinese mainland, Hong Kong can use its advantage in connecting Chinese capital with the world," Qi noted.

Florence Yip, PwC Asia Pacific Asset & Wealth Management Tax Leader, told the Global Times that in the future, Wealth Management Connect will be one of the most significant areas of development not only between Shenzhen and Hong Kong, but also in the Greater Bay Area (GBA).

"A number of insurers are interested in setting up service centers in the GBA to serve Chinese mainland holders of Hong Kong-issued policies. At the same time, lenders on both sides of the border are beginning to offer mortgages to Hong Kong-based investors in GBA properties, thus promoting broader use of the yuan," Yip noted.

Goh Nai Shin, South China CEO and general manager of Shenzhen branch of Standard Chartered China, told the Global Times that the bank will facilitate financial connectivity between Shenzhen and Hong Kong in such sectors as payments, settlement, financing, investment and insurance.

Standard Chartered has co-developed a blockchain trade and finance platform for the GBA, according to Goh. The platform has been put into trial operation in Shenzhen.

Shenzhen's 40th anniversary also comes amid US politicians' threats to cut Chinese financial institutions out of the Society For Worldwide Interbank Financial Telecommunication (SWIFT) system. Analysts suggested that Shenzhen and Hong Kong should play a twin role in speeding up the yuan's internationalization.

Collin Xiong, PwC China tax partner, told the Global Times Wednesday that the yuan's future role needs to be considered in light of the future of cooperation between Shenzhen and Hong Kong.

"The central bank-led digital currency is currently undergoing trial in four cities in the Chinese mainland, including Shenzhen, and these are likely to expand further. Such a currency will reduce the need for physical monitoring of currency flows and enable greater use of the offshore yuan," Xiong said.

Newspaper headline: Shenzhen-HK ties deepen

Posted in: ECONOMY