China unswerving in financial opening-up

By GT staff reporters Source: Global Times Published: 2020/9/6 19:33:40

Policy will ease concerns over possible decoupling with US

The exhibition area for financial services at the China International Fair for Trade in Services in Beijing on Sunday Photo: Li Qiaoyi/GT

Graphics: GT

China's securities regulator on Sunday vowed an unswerving push for two-way opening-up of the capital market, a pivotal part of the economy's deregulation that has attracted foreign investors despite concerns over US-China economic decoupling.

China's capital market has become the world's second-largest by capitalization, underpinning the nation's economic development, Fang Xinghai, vice chairman of the China Securities Regulatory Commission (CSRC), said at an international finance forum during the ongoing China International Fair for Trade in Services (CIFTIS).

The continued deepening of capital market deregulation is shown by the expansion of the market's two-way opening-up and a continued rise in overseas investors' holdings of Chinese securities, the opening of the domestic futures market and more convenient international financing for companies, Fang said.

He disclosed new advances at the forum, including a planned expansion of eligible securities for stock links between the Hong Kong and Chinese mainland exchanges. No specific timeframe was given.

Revised rules for the Qualified Foreign Institutional Investor (QFII) and the Renminbi Qualified Foreign Institutional Investor (RQFII) programs will also be unveiled and implemented as soon as possible, according to Fang.

The QFII and RQFII programs allow specified licensed overseas investors to participate in the Chinese mainland's stock and bond markets.

Describing the nation's financial deregulation and efforts to allow for market-based competition as a top-down and systemic push, Stephen Xie, PwC China corporate finance partner, told the Global Times on Sunday on the sidelines of CIFTIS that China has ramped up its financial deregulation since the China-US trade war began as a sign of the government's resolve to open the market .

The nation has for years pushed for direct financing and the creation of a multi-layered capital market, and the efforts are developing into action plans, making China's financial markets a magnet for foreign investment, Xie said.

Speaking at the forum, Chen Yulu, deputy governor of the People's Bank of China, the country's central bank, stated that the negative list for foreign investment access to the financial sector, as part of special management measures for foreign business access, has been officially eliminated.

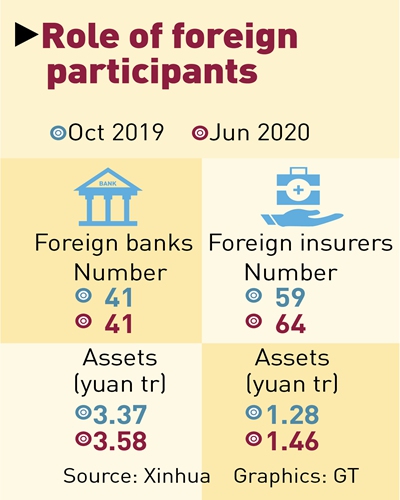

More foreign investment and foreign institutions are moving into China's financial market in an orderly manner, Chen said.

Among the recent moves are Citibank (China) Co's announcement on Wednesday that it has received a domestic fund custody license from the CSRC and a declaration on the same day from DBS Group saying it has received regulatory approval to set up a securities joint venture in which it will have a controlling stake.

In a statement sent to the Global Times, Piyush Gupta, CEO of DBS Group, said "the ability to set up a securities company in China represents yet another key milestone, enabling us to make available the best of DBS' capabilities and offerings, and provide customers in China with a full range of onshore and offshore financial services."

The securities regulator on Sunday pledged to encourage overseas securities, funds and futures institutions to expand in the Chinese market and support domestic financial institutions to explore overseas opportunities.

Yin Yong, vice mayor of Beijing, expressed support for foreign-invested financial institutions with operations in Beijing to take part in stock, bond, foreign exchange and fund trades.

At a booth of Banque Internationale à Luxembourg, the oldest private bank in Luxembourg, visitors asked Ray Liu, representative of the bank's Beijing representative office about potential cooperation opportunities in the European market.

The office, only founded in September 2019, has helped many Chinese businesses, mainly in technology, healthcare and new economy, establish a footprint and raise funds in Europe, Liu told the Global Times on Sunday.

There has been growing interest among foreign financial businesses, especially from Europe, in the asset-light segments of China's financial markets such as securities and funds, as buoyed by broad-based efforts to lift foreign shareholding limits on financial services, Huang Tao, supervisor of the general administration department of the Beijing Asset Management Association, told the Global Times on the sidelines of the services trade fair.

There's not much foreign interest in the arena of asset-heavy retail banking, where Chinese domestic institutions retain a compelling edge, he said.

The association, the first self-regulatory body of the asset management industry in China, has 74 members that manage combined assets of roughly 40 trillion yuan ($5.85 trillion).

As of Thursday, Chinese mainland shares held by overseas investors through the stock linkups hit a market valuation of 2.01 trillion yuan, accounting for 3.28 percent of the total A-share capitalization. This, added to stocks held by overseas investors thorough the QFII and RQFII programs, totaled 4.69 percent of the entire circulated market capitalization, according to Fang. The ratio is much lower than in Japan and South Korea.

There's still great potential to channel overseas funds into the mainland stock market, the CSRC vice chairman said.

The total capitalization of the A-share market has reached 70 trillion yuan, equal to 70 percent of China's GDP. The number of listed companies in China is near 4,000, and the stock market has maintained stable performance this year with an average daily turnover of 800 billion yuan.

Posted in: ECONOMY