China’s outbound investment to drop 20% year-on-year: expert

Source: Global Times Published: 2020/9/16 10:18:38

Workers are seen on the construction site of the Hunutlu Thermal Power Plant in Adana, Turkey, on Sept. 22, 2019. The Hunutlu Thermal Power Plant, China's biggest project with direct investment in Turkey, officially started construction on Sunday in the southern province of Adana. (Photo: Xinhua)

Graphics: GT

More than 27,500 Chinese investors had established about 44,000 overseas enterprises in about 80 percent of the world's countries and regions as of 2019, new government data showed on Wednesday.

China's overseas direct investment (ODI) amounted to $136.9 billion in 2019, down 4.3 percent year-on-year, still making it the world's second-largest outward investor after Japan, according to a report released by the Ministry of Commerce, the National Bureau of Statistics and the State Administration of Foreign Exchange.

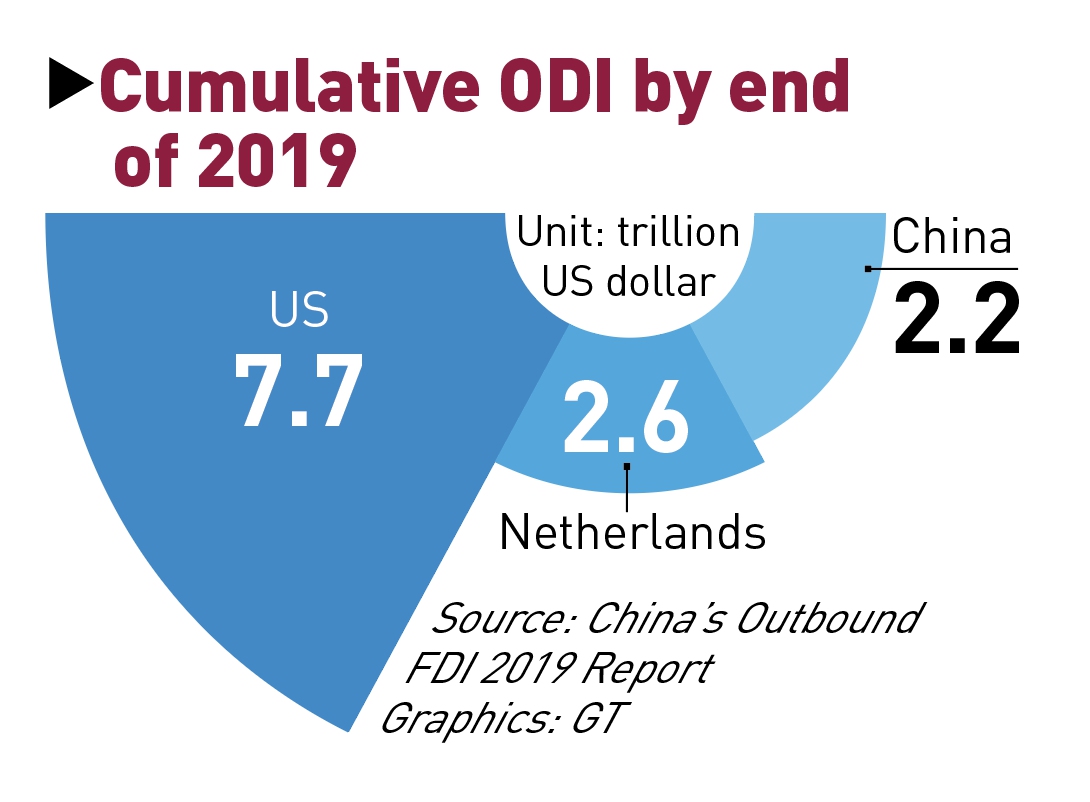

As of the end of last year, China's cumulative ODI reached $2.2 trillion, ranking third in the world after the US and the Netherlands, according to the report.

Chinese ODI covered 188 countries and regions, and investment in countries and regions along the Belt and Road Initiative (BRI) saw steady growth. Between 2013 and 2019, China's cumulative investment in BRI countries and regions stood at $117.3 billion.

China's ODI is diversified, with about 80 percent in the services sector including leasing and business services, wholesale and retail, and finance.

Chinese ODI made a great contribution to host countries' tax revenue and employment. In 2019, Chinese enterprises overseas generated profits or at least broke even. They paid taxes of $56 billion in the countries and regions where they operated and employed 2.27 million foreign nationals.

Dong Dengxin, director of the Finance and Securities Institute at the Wuhan University of Science and Technology, estimated that the country's ODI may drop 20 percent in 2020 under the impact of the global pandemic and geopolitical factors.

"The US has been increasingly sensitive to Chinese companies' acquisitions, and thus some deals may be delayed or abandoned," Dong told the Global Times, adding that China's ODI may stand at around $100 billion this year. During the peak years of 2016-17 when Chinese enterprises rushed to buy real estate like hotels overseas, China's ODI reached around $160 billion, according to Dong.

In the first seven months of this year, China's non-financial ODI stood at 423.65 billion yuan ($60.3 billion), down 2.1 percent year-on-year, latest data from the Ministry of Commerce showed.

Posted in: ECONOMY