Time for transformation amid export slump

By GT staff reporters Source: Global Times Published: 2020/10/14 18:48:40

China’s rare earth still needs an edge up in technology for high-end products

A rare-earth mining operation in Baotou, North China's Inner Mongolia Autonomous Region Photo: cnsphoto

China is the world's biggest supplier of rare-earth elements, the crucial component in an array of high tech and military applications. However, due to a lack of technology patents - which would transform the production chain from mining and extraction to more value-added products - the industry continues to be cursed by thin margins and illegal mining and exports.China's mines account for about 70 percent of global output and are the most important sources of rare-earth elements for many countries. According to US government statistics, from 2014 to 2017, the US sourced 80 percent of its rare-earth imports from China.

The Bayan Obo Mining District in North China's Inner Mongolia Autonomous Region is often regarded as the biggest rare-earth mine in the world, with 17 different rare-earth elements.

The mine has been put into use for 63 years, far exceeding its designed working duration, and the cost of mining has been climbing with extra thin margin.

Although Bayan Obo mine was designed as an iron mine back in the 1960s, in 2016, the Inner Mongolia BaoTou Steel Union, the group that currently oversees the Bayan Obo mine finally shifted its strategy and began to develop its rare-earth sectors. According to the Xinhua News Agency, the revenue from its rare-earth sector has reached 18 billion yuan ($2.66 billion) in 2019.

But despite being the biggest and richest rare-earth mine in the world, Bayan Obo is still facing potential challenges as more rare-earth mines are being developed in other countries, according to Yang Zhanfeng, director in China Northern Rare Earth Group.

Among the latest emerging rare-earth mines, Round Top, a rare-earth mine in the US east of El Paso, has been found to hold 16 out of the 17 rare-earth elements. Malaysia has also agreed to have Australia to operate in its rare-earth mines.

"To maintain the competitiveness, it is important to understand the extract value and volume of China's rare-earth mines," Yang said, "and to have a differentiated plan on different rare-earth elements, including heavy rare earths which have more national strategic value."

The Bayan Obo mine represents a tip of an iceberg of the rare-earth industry in China. According to an industry insider surnamed Zhong based in Ganzhou, East China's Jiangxi Province, most of China's exports to overseas are still restricted to semi-processed products such as rare earth purified from oxide compounds.

"One of the more advanced products from the rare-earth industry is the permanent magnets," Zhong said: "About 70 percent of rare-earth metals are used in magnets that are needed in almost everyone's daily lives. These metals are used in electronics, airplanes, mobile phones and even medical products such as ventilators."

To produce more value-added rare-earth products, Chinese companies still need to pay countries including Japan for technology patents.

Apart from the lack of the high-end processing technologies, smuggling and illegal mining has also been cutting into the thin margins of China's rare-earth industry. To control the total amount of rare-earth material exports and production, China has imposed a quota on mining, but according to a report by the Xinhua News Agency, in 2019, despite a quota of only 132,000 tons, the actual mining amount exceeded this number by a large margin, most of it mined illegally.

With efforts to crack down on illegal mining, China has been adjusting its domestic mining quota and has opted to import more from other countries, such as Myanmar, according to an industry expert surnamed Chen. This year, China's exports of rare earth plunged to one of its lowest levels, raising widespread concern that China might use the vital material for geopolitical purposes.

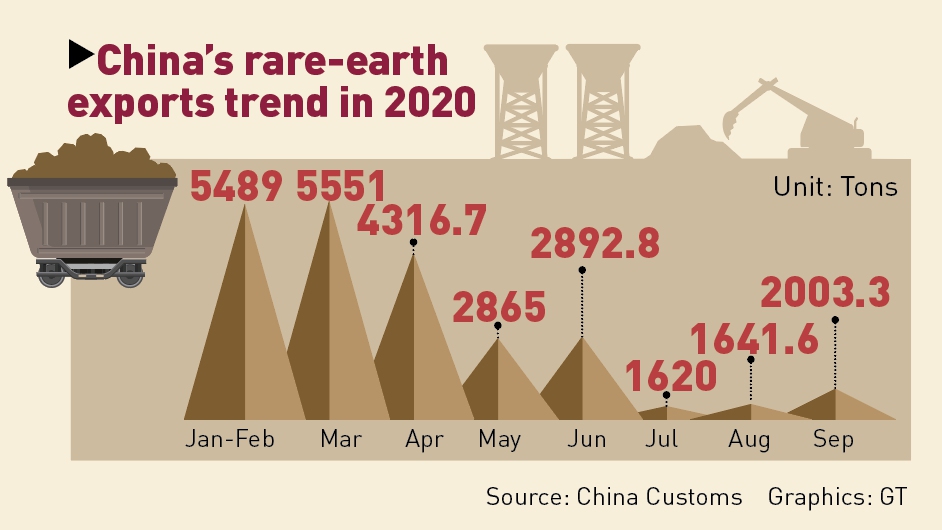

According to government data, China's rare-earth export recorded a year-on-year slump of around 44 percent in September, narrowing from a more than 60 percent drop in the previous two months.

According Liu Enqiao, energy analyst at Beijing-based Anbound Consulting, the fluctuation is a combination of China's shift from large-scale, low-value resource selling to upgrading its technology, and shrinking global demands amid the pandemic and emerging mines in Myanmar and the US.

Liu said that China's rare-earth elements, especially the heavy rare-earth material, have the potential to greatly affect the global supply chain - especially the production of high-end technology products - if China decides to put more limits on its exports. For the US, to establish a supply chain that has been dominated by China for the past decades will take a long time.

"The volatility of China's exports has given rise to concerns that it might be used for geopolitical purposes," Liu said, "although the recent decline in exports was because of the weakened global demand for rare-earth elements as the economic slowdown hit so many countries. The demand for Chinese rare earth will rise again when economy begins to recover."

Graphics: GT

Posted in: INDUSTRIES