The Big Splutter

It was the first time China's economic growth rate dipped below 8 percent since the onset of the global economic crisis in 2009.

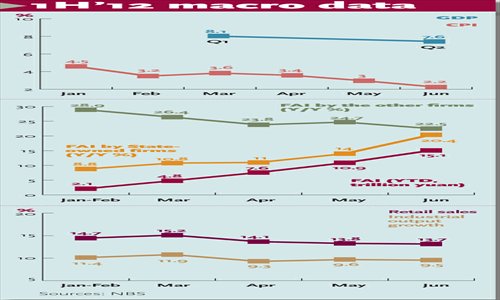

China's GDP growth for the second quarter of 2012 came in at a sluggish 7.6 percent year-on-year, slightly above the 7.5 percent annual growth target and dragging down the first-half growth rate to 7.8 percent, according to the National Bureau of Statistics (NBS) on July 13.

The significant slowdown was due to weak industrial production and fixed-assets investment (FAI), according to the Asian Development Bank (ADB).

The economic data released in May surprised the market on the downside, with industrial output growth in April falling to 9.3 percent year-on-year, well below the market expectation and annual target of 11 percent. The industrial production growth rate continued to underperform in May and June, recording 9.6 and 9.5 percent year-on-year respectively.

Other production indicators, including power generation and daily output of processed crude oil, were also extremely weak in April. Media reports in June saying that coal was overstocked in Qinhuangdao port in North China's Hebei Province evidenced that electricity demand was declining.

From January to June, the country spent 15.1 trillion yuan ($2.4 trillion) in FAI, up 20.4 percent year-on-year. By contrast, the FAI increased 25.6 percent in the first six months of 2011. Foreign direct investment (FDI) has been slowing down as well.

Consequently, the ADB last week revised down a prediction for China's 2012 growth to 8.2 percent from 8.5 percent, and for 2013, to 8.5 percent from 8.7 percent.

The Chinese government has taken measures to prop up the falling economy by approving new railway, highway and other big-ticket projects.

A breakdown of the FAI shows that State-owned enterprises have been leading an increase in investment, particularly in June, boosted by government-led infrastructure construction, according to analysts.

Both Premier Wen Jiabao and Vice Premier Li Keqiang highlighted over the weekend the need to continue stabilizing the economy, facing weakening external and domestic demand.

To ease or not?

China's "growth is slowing as it unwinds the policy stimulus implemented after the global financial crisis," ADB said in a report. "However, authorities have taken measures in an attempt to prevent a further slowdown in economic growth by easing fiscal and monetary policies."

In fact, the second quarter recorded the sixth consecutive quarterly negative growth rate. Some analysts feared that there might be a seventh if no further policy easing was taken, and a surprisingly low inflation rate of 2.2 percent in June also sparked a debate about possible deflation.

The People's Bank of China (PBC) recently lowered the benchmark interest rates twice within a month, after reducing the banks' reserve requirement ratios (RRR) twice in the first half. Analysts foresee three more cuts by the end of the year.

Huang Zhilong, a researcher at Beijing-based think tank China Center for International Economic Exchanges, told China National Radio on Thursday that a RRR cut is imminent this week. He expected the rate to eventually fall below 17 percent in a bid to boost the economy.

However, PBC is cautious about injecting too much liquidity into the market. By the end of June, the broad money supply (M2) in China was 92.5 trillion yuan, up 13.6 percent year-on-year. In contrast, the M2 growth rate was nearly 30 percent in 2009.

China's investment binge in 2009-10 has priced millions of middle-class Chinese out of city center property markets, Reuters reporters wrote in an analytical piece on Sunday.

No hard landing

We believe that there is no need for more rate cuts.

However, the government should do more to stimulate growth via other measures, given that annualized second-quarter growth was 7.4 percent - below the annual 7.5 percent target.

We expect liquidity boost, and see 150 basis points more in RRR cuts, starting in July, plus more lending or fiscal measures. We believe that together with fiscal and monetary stimulus in place, this should be enough to boost growth to 8.2 percent in the second half, and we continue to expect 8 percent growth for the whole year.

This suggests that worries over the excessive slowdown in China have been overblown.

The big picture is that the first half of the year saw the bottom of the cycle and growth is set to rebound in the third quarter, and especially in the fourth quarter, due to government stimulus measures. This is good news for Chinese equities in the medium term, as well as for the yuan, which we expect to appreciate in the second half in offshore and onshore markets.

Dariusz Kowalczyk, senior economist at Crédit Agricole CIB

Investment eyed

The coming recovery will be driven by domestic demand, especially investment. FAI growth in June alone rose to 21.2 percent from 19.9 percent in May.

The policy stance will be pro-growth, but don't expect a huge stimulus. We believe the Chinese government could take more easing measures going forward. We expect annual new loans will be at 8.5 trillion yuan and new loans in the second half will reach 3.6 trillion yuan.

The central government is unlikely to announce any big-bang stimulus package reminiscent of the 4 trillion yuan one in late 2008, but we do expect it to be more aggressive in accelerating startup of new projects and constructing existing projects, and believe that the government will be much more serious about social housing.

Lu Ting et al, analysts at Bank of America-Merrill Lynch