HOME >> BUSINESS

China to change LDR calculation

By Wang Xinyuan and Chu Daye Source:Global Times Published: 2014-6-30 23:43:01

Regulator aims to direct more lending to rural areas

Two passengers walk past an office of Huaxia Bank in Rizhao, East China's Shandong Province on June 26. Photo: CFP

Graphics: GT

China will adjust the way the loan-to-deposit ratio (LDR) is calculated for commercial banks, the country's banking regulator said on Monday, a move analysts say is aimed at extending more credit to rural sectors and micro and small enterprises.Six sub-items of the loans, including lending to the small and medium-sized enterprises and agricultural sectors, will be excluded from the calculation of the LDR.

Meanwhile, the definition of deposits will also be enlarged by including items such as the negotiable certificates of deposits, according to new rules issued by the banking regulator, which go into effect on Tuesday.

The details were released following a remark by Wang Zhaoxing, vice chairman of the China Banking Regulatory Commission (CBRC), at a press conference of the State Council Information Office on June 6, in which he said the banking regulator will make some adjustments to the calculation of the LDR, without altering the 75 percent LDR benchmark required by law.

Chinese commercial banks will need to ensure that the LDR for local currency is below the benchmark of 75 percent, which means a bank's lending is capped at no more than 75 percent of its deposits.

Analysts see the change as a concrete step from the banking regulator to support the real economy.

The new loans extended by the Chinese commercial banks in the next few months will be significantly bigger compared with the same period of 2013, and the total lending this year will likely exceed 10 trillion yuan ($1.6 trillion), ANZ Research said in a research note e-mailed to the Global Times on Monday.

The change in the calculation of the LDR is aimed at strengthening support especially to the cash-starved small enterprises and promoting the newly launched certificates of deposits, Liu Xiao, an analyst with Beijing-based Anbound Consulting, said on Monday.

"Removing loans to small firms from the calculation means banks will be able to grant more credit," he said.

Adding the large negotiable certificates of deposit to the denominator of the ratio will boost the new financial instrument, Liu noted.

The certificates will help bring some opaque off-balance-sheet shadow banking activities such as deposit agreement between banks and clients back to balance sheet so that regulators can better find and manage risks, he said.

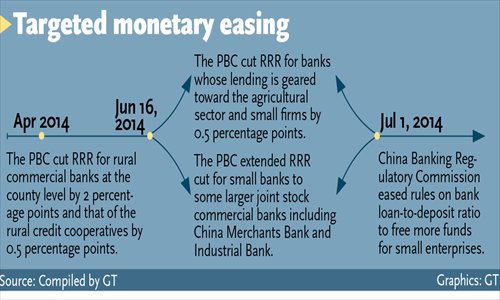

The People's Bank of China (PBC), China's central bank, announced two cuts in the reserve requirement ratio (RRR) for banks engaged in lending to agricultural and small firms in April and June.

Zhao Xijun, deputy director of the Finance and Securities Institute at Renmin University of China, told the Global Times on Monday that the move is a micro-level structural readjustment that will allow banks more room to maneuver and channel more liquidity to rural areas and micro and small enterprises.

"The adjustment in the calculation of LDR is consistent with the two targeted RRR cuts, which are monetary policies of the PBC," Zhao said, "They can be seen as two different policies rolled out by two different institutions aiming at the same target."

Statistics from the CBRC showed the LDR of the vast majority of Chinese commercial banks was below 65 percent at the end of the first quarter.

But banks especially the smaller and local joint-stock commercial banks still feel the pressure in meeting the regulatory requirement of 75 percent LDR, leading to calls for the cancellation of the cap.

Posted in: Industries