HOME >> BUSINESS

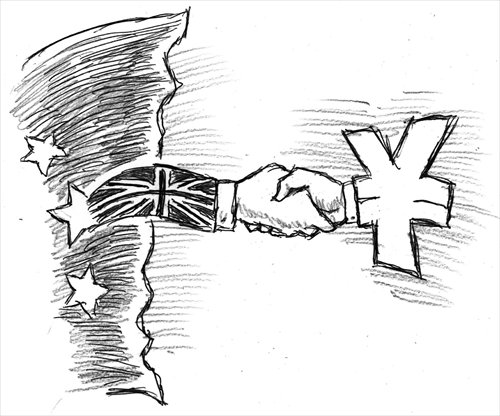

Brexit could prompt more cooperation with China

By Liang Haiming Source:Global Times Published: 2016/6/21 0:08:01

Illustration: Peter C. Espina /GT

As the UK's EU referendum scheduled for Thursday draws closer, recent polls show that those that favor leaving the EU are briefly leading by greater margins. This has prompted global capital allocations to move toward havens, and to a decline in the global stock markets, including the Chinese A-share market. The situation makes market participants worry about the impact Brexit could have on China.It should be noted that swings in the stock markets cannot fully reflect the odds of the UK referendum, as international speculators are known for their specialty in taking advantage of asymmetric information to make a profit.

But will Brexit actually happen? I believe some might have attached too much importance to this. Statistics from major bookmakers show the probability of remaining in the EU has hovered around 70 percent or higher, indicating those who have bet their money on staying in the EU represent the majority of UK citizens. You wouldn't lie to your bookmakers.

We can also refer to tycoon Li Ka-shing's recent movements. He is closely connected to the UK government and UK business and his research team is widely believed to be the strongest in the Greater China region. According to a Financial Times report in October 2015, Li has invested $38.9 billion through companies controlled by him in the UK since 2010. Previously, he had projected China's economic downturn, which prompted him to cut asset holdings in the Chinese mainland and began investing in Europe. When confronted with the UK referendum, he hasn't shown any intention or moves to withdraw from the UK just yet. True, it is still up to market participants to decide whether or not to trust Li's judgment.

Even if the UK withdraws, it is unlikely to significantly affect Asia, China, or the One Belt and One Road initiative.

First, the direct impact of Brexit on the Asian economy might be limited. In a news report by Channel NewsAsia on June 17, Capital Economics' senior Asia economist Daniel Martin said "there are a few economies in Asia for which a decline in UK demand of this magnitude would have a noticeable effect on growth. Cambodia, Vietnam and Hong Kong all have relatively strong trade ties with the UK, however, across the region as a whole, exports to the UK account for just 0.7 per cent of GDP."

The only potential big influence will be on Asian currencies. The withdrawal of the UK's membership in the EU will cause a serious depreciation of the pound and trigger investment in Asia to withdraw from the region toward havens, leading to enormous capital outflows from certain Asian countries and subsequently depreciation of those Asian countries' currencies.

Second, the Brexit impact on China could be positive. Unlike Greece, which is heavily indebted and has the potential to leave the eurozone monetary union, a UK vote to leave the EU aims more to reduce some of its burdens, as the UK economy in recent years has outperformed most of its EU peers. In addition, according to Her Majesty's Treasury (HM Treasury), UK's net contribution to the EU budget in 2014 stood at 8.4 billion pounds ($12.2 billion), while some of the UK's economic and financial policies have been hampered by EU restrictions, despite the large membership fee. The decision to leave the EU might be more beneficial for the UK.

There have been certain restrictions from the EU, especially in the financial sector. If the UK leaves the EU, these restrictions may be loosened. Following the country's strengthened financial cooperation with China, the UK was the first Western country to issue yuan-denominated sovereign debt in 2014, and the People's Bank of China also issued its first offshore yuan-denominated note worth up to 5 billion yuan ($788 million) in London in 2015 during President Xi Jinping's visit to the UK. London, as the world's largest center for foreign exchange trading, is the best platform for the yuan to be more internationalized.

Under such circumstances, if Britain leaves the EU, it could enhance financial cooperation with China instead, which is also beneficial to the communication of the Belt and Road initiative on the policy level, especially in facilitating finance.

More importantly, a UK withdrawal from the EU could prompt the country to be more inclined to cooperate with China in many other fields.

After all, the UK, the nation that once ruled the world but has become less influential today, will resonate with China in elevating each other in the global landscape, which could allow China and the UK to find common ground in many ideas and fields. So is it really bad for China if the UK withdraws from the EU?

The author is chief economist with Guangzhou-based China iValley Research Institute. bizopinion@globaltimes.com.cn

Posted in: Expert assessment