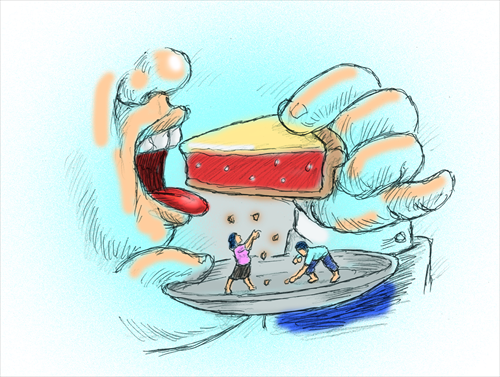

Slicing wealth pie unevenly weakens growth

Illustration: Peter C. Espina/GT

The concept of continuing to make the "pie" of social wealth bigger by developing the economy has been always of great relevance to China. However, under the current circumstances in which China is gradually shifting to a post-industrial society, it is more urgent for China to improve efforts to divide the pie of social wealth fairly.

At a meeting of the Central Leading Group for Financial and Economic Affairs held in May, in addition to emphasizing China's supply-side structural reforms, Chinese President Xi Jinping "stressed efforts to expand the middle-income group [and] improve the income distribution mechanism," according to the Xinhua News Agency. This indicates that China has put the issue that is mostly likely to be neglected during the social and economic transition on the agenda and seeks to resolve it by speeding up reform of the income distribution system.

Fair distribution of the economic development pie is about more than just enhancing social justice or recognizing the legitimacy of China's opening-up; it is also the premise for the sustainable development of the economy.

The Great Depression of the 1930s was superficially triggered by a stock market crash in 1929, but after several generations of analysis, most economists believe the root cause of the depression was the unsolved issue of wealth distribution, which prevented laborers at the time from benefiting from rapid economic development to the extent that workers couldn't afford to pay for the goods that they had produced.

Other countries' fall into the middle-income trap has taught us that it is usually too late to try to narrow the income gap when a society has comparatively large groups of those who are extremely rich and those who are extremely poor. The best solution is to preclude such a situation from developing in the first place while attempting to reduce the size of the extremely poor population to a minimum.

China has already missed its best opportunity to narrow the gap between rich and poor. Starting in 2003, the central government moved to reduce the wealth gap by taking a raft of measures such as scrapping agricultural taxes, establishing a comprehensive social security system, advancing healthcare reform and building large-scale affordable housing projects. The outbreak of the global financial crisis, however, interrupted China's efforts to address the issue of the rich-poor gap. The country's rapid rollout of a 4 trillion yuan ($586 billion) stimulus package helped arrest the economy's slowdown and ensured employment, but it also caused corruption and the accumulation of asset bubbles, owing to a lack of supervision. As a result, wealth has quickly become concentrated among rich families, and the central government's efforts to narrow the gap over the previous several years have largely been in vain. Only once the Lewis Turning Point occurred, leaving the country facing a labor shortage, did the widening of the rich-poor gap begin to moderate.

China's urbanization has theoretically brought a growing middle class into being, but the reality is that scenario might be inflated, as large segments of the rural population who have migrated to cities still have their roots in the countryside. The country has yet to turn these migrants into members of the middle class with relatively strong consumption power. That is also why the majority of manufactured goods suffer from an oversupply issue.

China's overall income distribution was pyramid-like prior to 2008, but as surging investment growth has led to ballooning asset bubbles, the income distribution structure appears to have reverted into an Eiffel Tower. A multitude of young white-collar workers supposedly belonging to the upper part of the pyramid were found to have fallen to the bottom. As the economy enters the new normal, the country's rich-poor gap has stopped widening further due to a lower labor supply, adding to efforts to combat corruption, reduce poverty and improve public services. But the economy's rebalancing will inevitably see many laborers lose their jobs or be forced to take pay cuts. Policymakers will need to choose between two paths that will decide the economy's future: They must either focus on improving efficiency through downsizing the workforce - as China has done in the past, causing workers to bear the brunt of the overhaul - or make workers' rights and benefits a top priority when reshuffling enterprises.

By World Bank standards, China was already ranked among upper-middle-income countries in 2010. But growth in average Chinese people's income has not kept pace with GDP growth, contributing to the prevalence of the sense that the nation is strong while its people are weak, thus eroding happiness. There's also reason to be sanguine, considering that China's current political regime is completely different from those of countries that have fallen into the middle-income trap. China's political stability and its vast domestic market with unbalanced growth among different regions lay the foundation for the country's sustainable growth. According to Liu Shijin, deputy head of the Development Research Center of the State Council, there is a very small possibility that China could fall into the middle-income trap that some Latin American and Eastern European countries have suffered, unless China's growth suffers major setbacks.

My argument is that this conclusion is a bit too optimistic. Although I basically agree that China has many advantages in developing its economy, whether China will escaped this trap still depends on policymakers' awareness of the connection between the widening of the rich-poor gap and the economy's sustainable growth. Attaching excessive importance to expanding the social wealth pie may risk losing the last chance to handle the pie's distribution. And if the income distribution issue cannot be dealt with effectively, it will be impossible for the country to identify its future growth engines.

The author is a financial commentator with China Central Television. bizopinion@ globaltimes.com.cn.