Sportswear’s dash to digital

Companies would do better in China by working with e-commerce firms: expert

E-commerce has swept the sportswear industry both at home and abroad. According to the latest annual reports of several sportswear companies, online sales have grown into an important source of revenue for the industry. The global sportswear industry is gradually turning to e-commerce to improve its business - a change that is being driven in part by the growing Chinese market, where e-commerce accounts for a significant proportion of sales. Still, some companies have been slow to embrace the change, relying primarily on their own online channels. An expert suggested they should cooperate with major e-commerce retailers to take full advantage of the shift online.

2016 must have been a banner year for adidas AG CEO Kasper Rorsted.

In January 2016, adidas announced it had brought on the former chief executive of Henkel Group as its new CEO.

Adidas' board members hoped the 53-year-old Rorsted could repeat the success he had achieved during the eight years he ran Henkel, the German chemical and consumer goods giant.

Rorsted did not let them down.

By October 2016, adidas had overtaken Under Armour Inc to become the second largest sportswear brand in the US after Nike Inc.

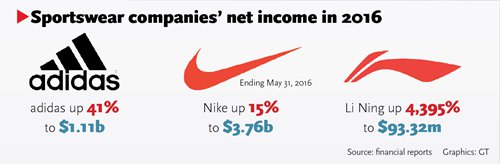

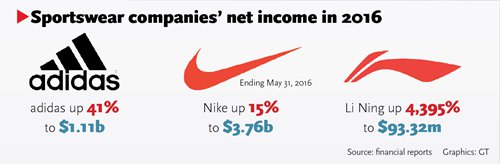

Adidas' global revenue jumped about 20 percent in 2016, according to its 2016 fiscal report, which it released in March. In China, the company's sales surged 28 percent to $3.67 billion, making the country its second largest market.

The company has ambitions to make it even bigger.

"Adidas plans to open 12,000 stores in China by 2020, up from the current 10,000 shops," Rorsted said in a group interview in Shanghai on April 20.

The CEO was optimistic about the company's ability to improve its products and increase its revenue. Specifically, Rorsted sees e-commerce as a way to boost sales.

"We will take every chance to improve our business," he said.

Adidas' focus on digital sales illustrates how the sportswear industry is gradually turning to e-commerce to improve its business - a change that is being driven in part by the Chinese market, where e-commerce accounts for a significant proportion of sales.

The General Administration of Sports of China has forecast that the domestic sportswear market will be worth more than 3 trillion yuan ($435.80 billion) by 2020.

New foundation

In the eyes of adidas' senior executives, e-commerce is an opportunity to pull ahead of the competition. Its competitors agree.

Nike CEO Mark Parker said on an earnings call in March that consumers have decided that digital isn't just part of the shopping experience, it is its foundation.

The company has had some success with its direct-to-consumer channels, such as its website, as online sales grew 18 percent in the last quarter of 2016. The figure far exceeded the company's total sales growth of 7 percent, a sign that the company is managing the shift to e-commerce well, according to a report in March by the financial news website The Motley Fool.

In March, Nike reported that its fiscal 2017 third quarter sales in China rose less than 10 percent year-on-year, with the figure falling short of double digits for the first time in at least nine quarters.

Chinese sportswear manufacturer Li Ning Co, which shut down many of its physical retail stores around 2012 amid large losses, has managed to get back on track thanks in part to online sales.

The company reported that its revenue rose 13.7 percent to 7.93 billion yuan ($1.15 billion) in 2016, with e-commerce sales accounting for nearly 15 percent of the total, according to its annual fiscal report.

Shifting to digital

Sportswear companies might do better in China by working with major e-commerce companies, said Liu Dingding, an independent market watcher.

"It's more desirable [for sportswear companies] to market their products with the help of e-commerce giants such as jd.com and tmall.com, instead of building their own online sales channels," said Liu.

The sportswear industry has been relatively slow to embrace e-commerce, Colin Currie, managing director of adidas Greater China, acknowledged at the group interview.

The company has excelled at brick-and-mortar sales, but developing digital sales will require it to improve its capabilities in e-commerce, social media and e-marketing, said Currie.

The shift could be crucial to perform well in China, where a large proportion of sales are transacted on mobile devices, Currie said. Adidas has made sure that all of its e-commerce sales channels work on mobile devices. The company also plans to communicate and interact more with its customers over social media.

Committed to China

Since adidas closed its factory in East China's Jiangsu Province in 2012, there have been reports that it would shift some of its production back to Germany.

Adidas is set to open its robot-manned Speedfactory in Germany in the middle of 2017, the Economist reported in January. Production will start off slow and gradually build to 500,000 pairs of athletic shoes a year. The company is also building a second Speedfactory in the US for the American market.

Rorsted said the Speedfactory could produce as many as 1 million shoes a year once fully ramped up. Still, it's not much compared with its production across all of Asia, where adidas produces the same number each day.

"In quantity, it is nothing," Rorsted said, referring the Speedfactory's output.

When asked if adidas will shift its production to other countries and regions, Currie responded that the company hopes to diversify its production bases. He added that production in China will not decline, but rather increase as time goes by.

Adidas will retain a large portion of its production capacity in China, its second largest market, Currie said.

As for Nike, its latest financial results failed to satisfy its board of directors. The company has been working to win over the domestic market, where it has been losing market share over the last few quarters.

For example, in March, Nike invited popular Chinese singer Wang Junkai from a band TF Boys to help with the design of its Air Max shoe line, going as far as to ask Wang to create his own Air Max design.

China has become a second largest market of many sportswear companies. Along with Nike and adidas, other sportswear brands such as Under Armour and lululemon have shown great interest in expanding further in China, indicating that competition is about to heat up.

A mannequin wears an adidas jacket in Shanghai in September 2016. Photo: CFP

Graphics: GT

2016 must have been a banner year for adidas AG CEO Kasper Rorsted.

In January 2016, adidas announced it had brought on the former chief executive of Henkel Group as its new CEO.

Adidas' board members hoped the 53-year-old Rorsted could repeat the success he had achieved during the eight years he ran Henkel, the German chemical and consumer goods giant.

Rorsted did not let them down.

By October 2016, adidas had overtaken Under Armour Inc to become the second largest sportswear brand in the US after Nike Inc.

Adidas' global revenue jumped about 20 percent in 2016, according to its 2016 fiscal report, which it released in March. In China, the company's sales surged 28 percent to $3.67 billion, making the country its second largest market.

The company has ambitions to make it even bigger.

"Adidas plans to open 12,000 stores in China by 2020, up from the current 10,000 shops," Rorsted said in a group interview in Shanghai on April 20.

The CEO was optimistic about the company's ability to improve its products and increase its revenue. Specifically, Rorsted sees e-commerce as a way to boost sales.

"We will take every chance to improve our business," he said.

Adidas' focus on digital sales illustrates how the sportswear industry is gradually turning to e-commerce to improve its business - a change that is being driven in part by the Chinese market, where e-commerce accounts for a significant proportion of sales.

The General Administration of Sports of China has forecast that the domestic sportswear market will be worth more than 3 trillion yuan ($435.80 billion) by 2020.

New foundation

In the eyes of adidas' senior executives, e-commerce is an opportunity to pull ahead of the competition. Its competitors agree.

Nike CEO Mark Parker said on an earnings call in March that consumers have decided that digital isn't just part of the shopping experience, it is its foundation.

The company has had some success with its direct-to-consumer channels, such as its website, as online sales grew 18 percent in the last quarter of 2016. The figure far exceeded the company's total sales growth of 7 percent, a sign that the company is managing the shift to e-commerce well, according to a report in March by the financial news website The Motley Fool.

In March, Nike reported that its fiscal 2017 third quarter sales in China rose less than 10 percent year-on-year, with the figure falling short of double digits for the first time in at least nine quarters.

Chinese sportswear manufacturer Li Ning Co, which shut down many of its physical retail stores around 2012 amid large losses, has managed to get back on track thanks in part to online sales.

The company reported that its revenue rose 13.7 percent to 7.93 billion yuan ($1.15 billion) in 2016, with e-commerce sales accounting for nearly 15 percent of the total, according to its annual fiscal report.

Shifting to digital

Sportswear companies might do better in China by working with major e-commerce companies, said Liu Dingding, an independent market watcher.

"It's more desirable [for sportswear companies] to market their products with the help of e-commerce giants such as jd.com and tmall.com, instead of building their own online sales channels," said Liu.

The sportswear industry has been relatively slow to embrace e-commerce, Colin Currie, managing director of adidas Greater China, acknowledged at the group interview.

The company has excelled at brick-and-mortar sales, but developing digital sales will require it to improve its capabilities in e-commerce, social media and e-marketing, said Currie.

The shift could be crucial to perform well in China, where a large proportion of sales are transacted on mobile devices, Currie said. Adidas has made sure that all of its e-commerce sales channels work on mobile devices. The company also plans to communicate and interact more with its customers over social media.

Committed to China

Since adidas closed its factory in East China's Jiangsu Province in 2012, there have been reports that it would shift some of its production back to Germany.

Adidas is set to open its robot-manned Speedfactory in Germany in the middle of 2017, the Economist reported in January. Production will start off slow and gradually build to 500,000 pairs of athletic shoes a year. The company is also building a second Speedfactory in the US for the American market.

Rorsted said the Speedfactory could produce as many as 1 million shoes a year once fully ramped up. Still, it's not much compared with its production across all of Asia, where adidas produces the same number each day.

"In quantity, it is nothing," Rorsted said, referring the Speedfactory's output.

When asked if adidas will shift its production to other countries and regions, Currie responded that the company hopes to diversify its production bases. He added that production in China will not decline, but rather increase as time goes by.

Adidas will retain a large portion of its production capacity in China, its second largest market, Currie said.

As for Nike, its latest financial results failed to satisfy its board of directors. The company has been working to win over the domestic market, where it has been losing market share over the last few quarters.

For example, in March, Nike invited popular Chinese singer Wang Junkai from a band TF Boys to help with the design of its Air Max shoe line, going as far as to ask Wang to create his own Air Max design.

China has become a second largest market of many sportswear companies. Along with Nike and adidas, other sportswear brands such as Under Armour and lululemon have shown great interest in expanding further in China, indicating that competition is about to heat up.