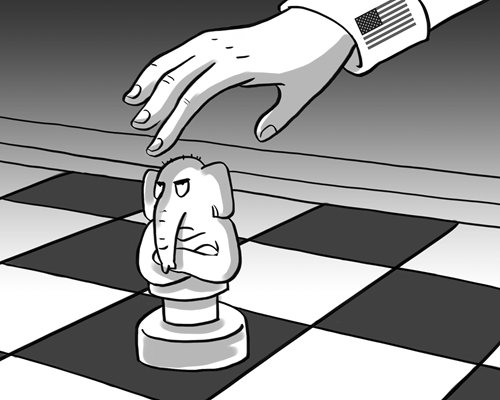

US unrealistic about turning India into a pawn

Illustration: Liu Rui/GT

When Indian Prime Minister Narendra Modi went in for a bear hug with his US counterpart Donald Trump during their first in-person meeting, what did US scholars think?

The Global Times cited their views in its Monday's Observer article, saying India serves as a "key piece in the jigsaw" for the US. The opinions are actually a rehash of Cold War logic: using India to counterbalance China.

In a commentary piece on the Trump-Modi summit carried by Foreign Affairs magazine, C. Christine Fair and Bharath Gopalaswamy said, "The Trump administration would be wise to learn the lessons of the past administrations of George W. Bush and Barack Obama: India - not China - is the best bet for securing US interests in Asia."

These viewpoints are more of Washington's own wishful thinking. What can the US offer New Delhi to serve as a pawn to check Beijing?

Unless India grows into a heavyweight Asian economy, it will unlikely assume the tall task the US intends to impose upon it.

But for India to rapidly develop its economy, its only shortcut is to join China's economic growth and participate in the Belt and Road initiative. This, however, will end up improving its relations with Beijing, with India moving further away from the strategic position the US has planned for it. It is a paradox.

It seems that the mentality of US scholars still lingers in the 1950s and 1960s. They deem it feasible for Asian nations to queue up and follow Washington's steps. They have a meager understanding of today's Asia and China.

Take China's Tibet Autonomous Region, which borders India. The GDP per capita there is relatively low compared to the rest of China, but has exceeded $5,000, three times as much as in India. The infrastructure in Tibet is also far better than in India.

China's economic development has spilled over through Tibet and other border regions. Beijing has played an important role in connecting Nepal, Pakistan, Myanmar, Bangladesh and Sri Lanka to the world. It is conceivable that this region will develop into an important growth source for the Asian economy in the next five to 10 years.

In fact, US entrepreneurs are much smarter than US scholars. The entrepreneurs saw the hope of development in this region, and are now fast muscling into its market amid fierce competition from their Chinese counterparts.

According to Chinese statistics, there is an investment boom from China to India. The amount reached $1 billion in 2016, six times that of the previous year. By the end of 2016, the aggregate of Chinese direct investment in India had surpassed $4.8 billion.

US corporations are scrambling to catch up. Statistics released by KROLL and Mergermarket reveal that the US has put $3.17 billion in India's merger and acquisition market in the first half of 2016, for the first time surpassing the volume it invested in this market in China, which stood at $1.33 billion.

Amazon and US auto companies have become a major force of foreign capital in India on par with China's Alibaba and mobile producers. They have consequently become the primary mover to drive the country's economic development.

The competition between Chinese and US firms in India is an outcome of globalization, creating a space for reshuffling, integration and sharing of interests. The competition also demonstrates that no country can win by containing another.

Pundits addicted to safeguarding US interests by reining in China had better take a drive along the Chengdu-Lhasa highway. When they see the well-protected environment, booming infrastructure and people's living conditions, they may stop thinking about Asian nations as Washington's pawns.

The author is a senior editor with People's Daily, and currently a senior fellow with the Chongyang Institute for Financial Studies at Renmin University of China. dinggang@globaltimes.com.cn Follow him on Twitter at @dinggangchina