China to maintain 6% GDP growth benchmark despite pressure: economists

Govt has policy tools to hit 2019 growth target

Visitors at the 2019 China International Industry Fair look over the chassis of a hydrogen fuel cell vehicle in Shanghai on Tuesday. The fair's theme is "Intelligence & Interconnection - Empowering New Industrial Development." Photo: IC

A new array of economic data might have cast a shadow over expectations for the country's economic growth rate this year, but such concerns should not be hyped as the country has the ability to hold the bottom line of economic growth amid ongoing structural adjustments, Chinese economists told the Global Times on Wednesday.

Profits from China's major industrial firms dropped 2.9 percent year-on-year in the first 10 months of the year, registering 5.02 trillion yuan ($713 billion), data from the National Bureau of Statistics (NBS) showed on Wednesday.

In October alone, the profits of major industrial firms fell 9.9 percent on a yearly basis.

High-tech manufacturing saw faster growth in profits, 7.5 percent year-on-year from January to October, Zhu Hong, a senior NBS statistician, said in a statement.

Strategic emerging industries recorded 5.3 percent growth year-on-year during the same period, Zhu noted.

The auto manufacturing sector, however, witnessed a year-on-year profits decline of 14.7 percent, a major factor dragging down overall industrial profits.

The decrease fell within expectations, given that the global economy is under downward pressure and China is in the midst of a tough phase of industrial upgrading, Cong Yi, a professor at the Tianjin University of Finance and Economics, told the Global Times.

"Faster growth in high-tech manufacturing and other industries shows that the new driving forces of China's economy have taken shape," Cong said.

Traditional driving forces have shown a weakening effect, he added.

Growth target

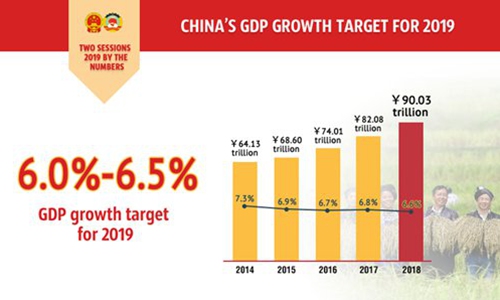

"China will accomplish the GDP target set at the beginning of the year, which is between 6.0 to 6.5 percent," former NBS chief economist Yao Jingyuan said during a seminar in Beijing on Wednesday.

"Considering the GDP performance in the first three quarters, China is able to achieve the goal by the end of the year," said Yao.

According to the NBS, the average GDP growth rate in the first three quarters was 6.2 percent: The first quarter hit 6.4 percent, the second 6.2 and the third 6.0.

The third-quarter figure was a 27-year low amid the impact of a protracted trade war and other factors that exert downward pressures.

For the fourth quarter GDP data, which will be released in January, "it is probably near the third-quarter 6.0 percent while the full year will reach the target range," Cao Heping, a professor with the School of Economics of Peking University, told the Global Times.

Liu Xuezhi, a senior economist at the Bank of Communications, forecast the full year's GDP growth at 6.1 percent.

Some Chinese analysts said it was important China continues optimizing its economic structure, although the process was not that easy when economic growth also remains a priority.

Yu Yongding, a senior research fellow at the Chinese Academy of Social Sciences in Beijing, said Wednesday that 6 percent was the bottom line to stick to for China's growth.

"It is the most significant issue to keep the rate from sliding below the rate," he said.

There is room for policymaker to boost the economy, analysts said.

It was necessary for the Chinese government to adopt some expansionary fiscal policies including investment in infrastructure to shore up the slowing economy, Yu asserted.

The Finance Ministry has issued new bond quotas worth 1 trillion yuan for 2020 to some provincial-level governments ahead of schedule as the country seeks to fund infrastructure construction and pump up the economy.

The ministry said Wednesday that governments must ensure that special-purpose bonds should be issued and used as early as possible, and that the effects will be released early next year, according to a statement on the ministry's website.

Special-purpose bonds are designed for investment in infrastructure and public livelihood projects.

"The issuing of special-purpose bonds can expand to an appropriate degree next year," said Liu. "Maintaining a stable growth rate and enhancing countercyclical regulation should be the key for next year's macroeconomic policy."