SMIC remains years away to compete with TSMC: industry veteran

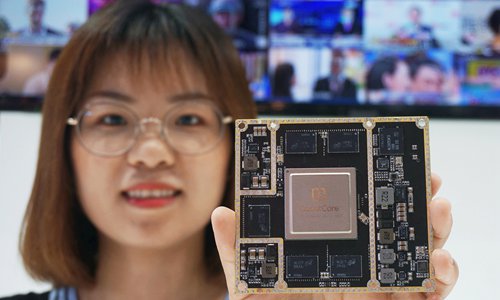

A domestically developed artificial intelligence chip is displayed during the 2019 World Artificial Intelligence Conference held in Shanghai on Thursday. More than 300 Chinese and foreign companies participated in the conference to demonstrate their latest achievements in AI. Photo: VCG

Shanghai-based chipmaker Semiconductor Manufacturing International Corp (SMIC) has lately made quite a splash in both the capital market and the technological field, lifting the nation's confidence in pursuing a key technology breakthrough.

But the Shanghai chipmaker can hardly compete with the Taiwan Semiconductor Manufacturing Co (TSMC), the world's largest semiconductor foundry, an industry veteran said.

In a filing with the Hong Kong Stock Exchange last week, SMIC revealed plans for an IPO on the STAR Market in Shanghai.

The announcement, which paves the path for the company to become the first domestic semiconductor maker with a dual listing in the Chinese mainland and Hong Kong, is a boon for semiconductor companies on both bourses.

The Shanghai chipmaker surprised the markets in May 2019 when it filed for a voluntary delisting of its American depositary shares (ADS) from the New York Stock Exchange, citing multiple considerations including limited trading volumes of its ADS.

Its proposed return to the mainland market came after media reports that HiSilicon, the chip arm of Huawei and a focal point of contention in China-US trade tensions, had shifted its 14-nanometer chipset orders to SMIC from TSMC.

The Global Times learned that SMIC has a partnership with Huawei, but the specifics are yet to be announced.

In its annual report filed with the Hong Kong exchange in late April, SMIC said its 14-nm platform had completed research and development (R&D) and moved into production. The company's next-generation foundry node known as N+1, which boasts a conspicuous improvement in performance and logic density, has made steady progress in R&D terms, and is"now in the customer engagement and product qualification stage,"the annual report said.

SMIC is building its own platform, which is analogous to 7-nm technology, and it makes sense for Huawei to tap SMIC's rising prominence in the foundry arena for its backup plans, Xiang Ligang, director-general of telecom industry association Information Consumption Alliance, told the Global Times on Sunday.

But it is not yet on par with TSMC, which is committing to 5-nm manufacturing technology, Xiang said, noting that instead of envisioning a rivalry, it makes more sense for SMIC to take a down-to-earth approach to playing technological catch-up.

This seems particularly the case amid coronavirus-plagued woes. Global semiconductor revenues are estimated to fall 0.9 percent this year due to a virus-induced hit on both semiconductor supply and demand, Consultancy firm Gartner said in a note sent to the Global Times. This compares with the previous quarter's prediction of 12.5 percent growth.

Global Times