COMMENTS / COLUMNISTS

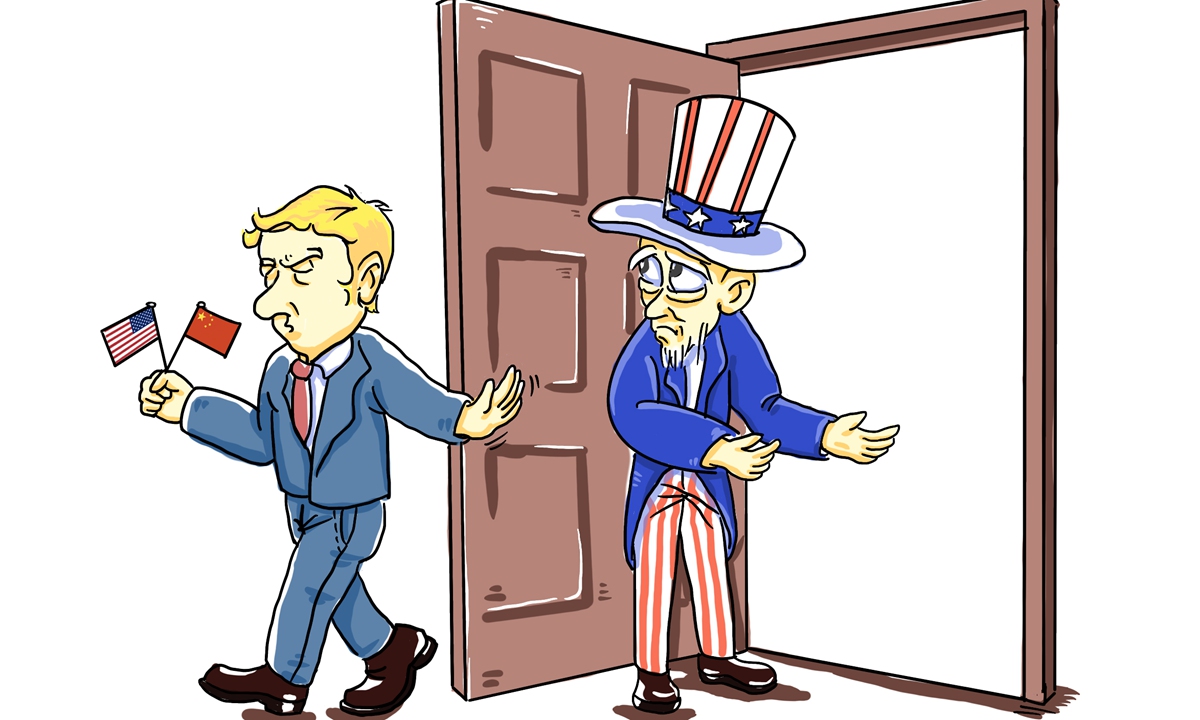

US bid to fan companies out of China bound to hit wall

Illustration: Tang Tengfei/GT

The Trump administration has been pressing forward an initiative to remove global industrial chains from China - the world's manufacturing powerhouse, in Washington's wicked attempt to inflict harm on China by "decoupling" the two economies in trade and technology.But, China's feat to largely tame and control the coronavirus, and Beijing's daring decision to open the still growing colossal market wider to foreign investors, and its giant plan to pump $1.4 trillion into the mainstream new technology infrastructure build-out before 2025, will set the trend that the business-savvy multinational companies will stay and continue to explore China's marketplace.

After all, China's market scale, estimated to hit 45 trillion yuan or $6.4 trillion this year, is alluring for all global business players. Nobody will like to pack up and leave the country.

Correspondingly, as the US-led economic contraction will keep glooming global market consumption, cash-starved companies lack the funds and do not have the temptation to invest in new factories outside of China, but adhere to existing supply chains.

With the world's 28 percent manufacturing capacity and a vast pool of skilled labor, it is not easy to find a substitute like China.

And, the Chinese government's massive stimulus investment into a new economy and new infrastructure, its latest mandate to build the Hainan Island into a full-bloom trade free trade port, and opening the world's second largest economy more broadly, will make the country even more attractive to foreign investors.

Despite Washington's attempt to create a so-called alliance of "trusted partners" or an "economic prosperity network" including Australia, India, South Korea, Japan, New Zealand and Vietnam, which was expounded by US Secretary of State Mike Pompeo on April 29, nearly all the multinational corporations are sticking to their strategy of staying "in China and for China (market)," pundits say.

According to US media reports, the Department of State, Department of Commerce and other agencies were reportedly thinking of using tax incentives and re-shoring subsidies to spur US companies to leave China.

Washington's plan seems to have already hit the wall as China has largely contained the spread of the COVID-19 virus, while the Trump administration has bungled in its response and raised a de-facto white flag to the pandemic.

After total infections exceeded the 2 million mark and the death toll hit 115,000, a "second wave" of infections has now gained pace in the US mainland, as populous states like California, Texas to Florida are seeing rising daily cases.

Based on the sharp difference in coronavirus prevention and control, multinational companies are found "not leaving the China market", and ready to ramp up their investment because China's economic activity has returned to "true normalcy" while the US' clamoring for a complete economic reopening remains a distant vision.

It's normal for people to have trepidations about the killing coronavirus. Though the COVID-19 has been raging on the planet for more than 5 months, there remains many "unknowns" about it, such as whether the virus will evolve and mutate into a more powerful and lethal variant.

The extraordinary precautions being pursued by Chinese authorities will see that this country is able to avoid a resurgence, which will prove to be reassuring for all foreign-invested companies to stick to China's market.

Following a deep sales drop in the first three months, auto sales, a crucial bellwether of a country's economic performance, returned to positive growth territory in May, hitting 2.19 million vehicles and rising 14.5 percent year-on-year. Barring mishaps in the second half of the year, China is expected to achieve 2 to 3 percent GDP growth in 2020, economists say.

Meanwhile, the US Federal Reserve, in its latest monthly report, gauged the biggest uncertainty facing the US economy is how the COVID-19 will trend. The central bank predicted the US economy will contract 6.5 percent in 2020, and it is unlikely to see a genuine improvement before the end of 2022.

With a lingering pandemic, elevating unemployment rate, and dwindling consumption power of the middle class US households, the Trump administration's urge for its companies to leave China is bound to fail. Pompeo may get the answer if he just asks companies like GM, Apple, Qualcomm or Tesla.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn