COMMENTS / COLUMNISTS

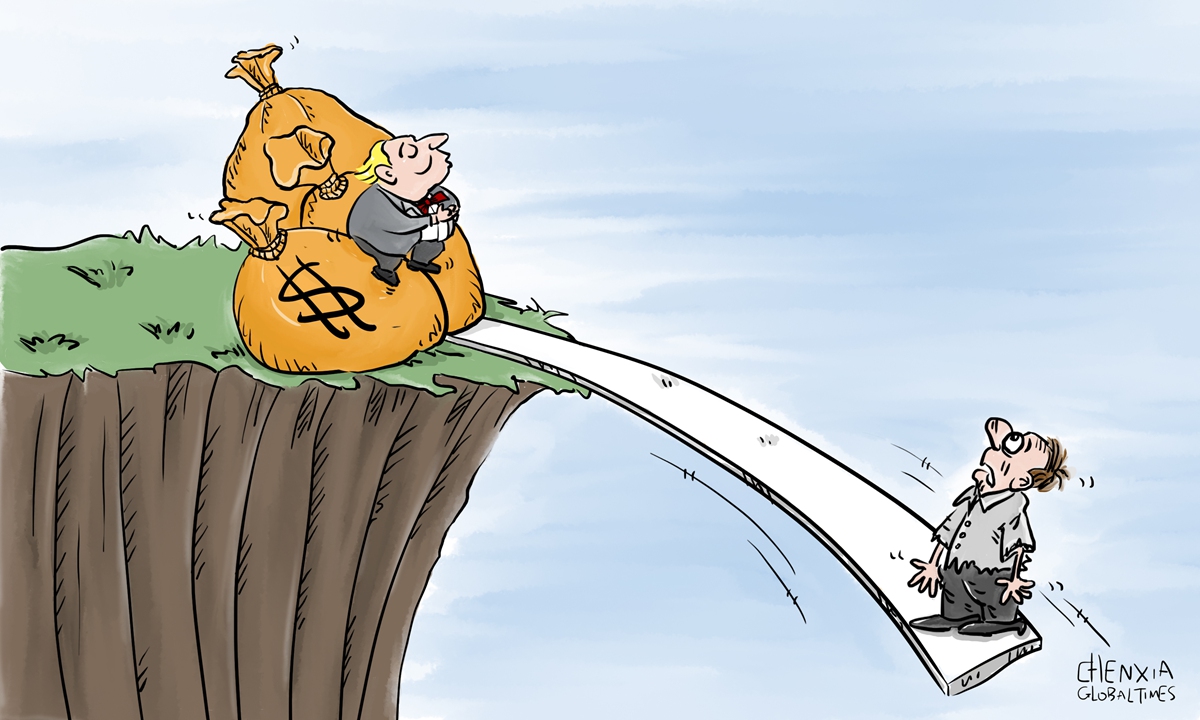

Trump monetary policies feed ‘K-shaped’ recovery, polarizing society

Illustration: Chen Xia/GT

Sky-rocketing US federal debts, rock-bottom interest rates and concerns about an upcoming resurgence of the coronavirus pandemic coupled with the winter influenza are hyping up skepticism that the "K-shaped" economic recovery in the world's largest economy is now an ongoing reality.

The bellwether of the economy's health - the trading price of the US currency - is now near its lowest level in 28 months, down more than 10 percent from its 2020 peak against a number of its global peers.

On Friday, the Chinese currency, the yuan, jumped a massive 1.3 percent in onshore trading and hit a 17-month high against the US dollar, catching up with gains in its offshore counterpart during the week-long National Day holidays. Clearly, the yuan's strength foretells the dollar's decline.

The bearish investors of UBS, Goldman Sachs, Societe Generale and other major investment banks are forecasting more losses for the dollar if the Trump administration cannot take speedy and decisive measures to contain the virus and stop the US economy from plummeting into a deep recession, which seems highly unlikely to the investors.

To add to this, some economists have predicted the dollar will plunge another 20 percent against other global currencies in the coming 12 months. Whether market speculation that the US dollar will crash and lose its prominence as the global reserve currency, will become a reality is yet to be seen.

Feeding the dollar's weakness are the precarious American economic fundamentals, under the watch of the Trump administration. Among them, the rapidly surging federal debts and a faltering recovery of US manufacturing and service sectors, despite the Federal Reserve's near-zero interest rates policy to stimulate the industries, are hard nuts to crack.

It seems US President Trump and his administrative team aren't able to resolve the above problems, despite his chest-thumping and assertion that he was a business genius and real estate tycoon before running for the White House.

The US Congressional Budget Office stated that for fiscal year 2020, which ended September 30, the federal deficit hit $3.13 trillion, thanks to the gap between what the country spent ($6.55 trillion) and what it took in taxes ($3.42 trillion) for the year. The US federal deficits have now already exceeded the size of the US economy, coming in at roughly 103 percent of GDP.

Beginning this spring, the US government spent more than $4 trillion to help stem the economic pain on American workers and companies, which were caused by sudden and widespread business shutdowns.

In the coming years, US federal spending is almost certain to outpace revenue as the heavily indebted country will have to invest in bailouts of failing enterprises and employers struggling in the pandemic fallout, on social welfare and education, and on defense and American troops in order to maintain its position as a military superpower. But interest payments on federal debts alone are expected to consume an ever-growing share of its tax revenues.

Furthermore, the Federal Reserve's extraordinarily loose monetary policy to flood the market with excessive liquidity is a perilous approach.

Federal Reserve chairman Jerome Powell promised that the US central bank would do whatever it took to support the economy from a pandemic-induced meltdown, including near-zero interest rates and launching new rounds of quantitative easing to buy Treasury bonds and mortgage-backed securities. He also appealed to US lawmakers to continue with fiscal stimulus. Between mid-March and mid-July, the Federal Reserve's portfolio of securities grew from $3.9 trillion to $6.8 trillion. And it has continued to rise.

Powell noted that the central bank will have to deploy its lending powers to an unprecedented extent and use the powers forcefully and aggressively so as to "support smooth market functioning".

The results of the Fed's monetary flooding policy are at least making the Trump administration happy, as the US stock market and other equities are now elevated, with a small portion of affluent Americans stock and equity owners also very pleased as their wealth grows.

But the rising tide of liquidity does not raise all boats, as many Americans working in low-skilled manufacturing and service sectors are furloughed or have lost jobs, with some middle-income households using up or depleting their savings.

This "K-shaped" recovery - exacerbated by the Trump administration's 2017 tax cuts policy which disproportionately favors the rich - is driving the US to be an economy of rising inequality and social divide.

In addition to making the US dollar less valuable in the world, the chasm of inequality between wealthy and poor Americans has the potential to lead the US to a path of a so-called "permanent economic slump" as a larger legion of poor Americans are losing their consumption power and more sectors of the economy begin to wither up.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn