Renminbi Photo: VCG

Graphics: GT

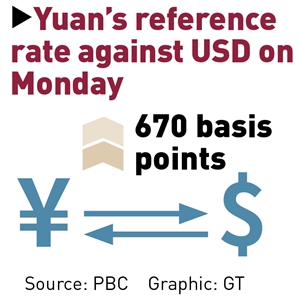

The yuan showed strong fluctuation on Monday, with the reference rate soaring to an almost 18-month high against the US dollar, while the offshore yuan slumped.

The yuan's appreciation in recent weeks would exert pressure on China's exports by decreasing exporters' profit margins, but so far it has not affected orders too much, industry practitioners said.

On Monday, the currency's reference rate against the greenback rose by 670 basis points (bps) to 6.7126 — the highest level since April 23, 2019 — according to the People's Bank of China (PBC), China's central bank. At the beginning of the year, the yuan stood at 6.9681 against the dollar.

As of 6:29 pm Beijing time, the offshore yuan stood at 6.7496 against the US dollar, down 602 bps compared with the previous trading day and also from a rate of 7 three months ago.

Starting on Monday, China's central bank scrapped the risk reserve requirements for financial institutions settling foreign exchange forward yuan positions from a previous level of 20 percent, lowering the cost for selling the Chinese currency.

The yuan has surged against the dollar in recent months along with a better-than-expected economic rebound in China, with sectors like manufacturing and retail bouncing back to growth. In the US, however, the government's propensity to cling to quantitative easing policies has pressured the greenback, experts said.

For exporters, the yuan's move is not good news, as it is eating into their profits. Emily Zhang, sales manager of stamping parts supplier Kinyet in Dongguan, South China's Guangdong Province, told the Global Times that since the yuan started getting stronger in June, Kinyet's margins have narrowed.

A manager from a Yiwu-based mask factory surnamed Ye, an exporter to the US, said that the company's exchange-rate losses this year have been "very great", though he declined to disclose the actual numbers.

Some companies, like Kinyet, have taken steps to cope with the situation. According to Zhang, Kinyet has signed a currency rate float agreements with some clients, who agreed to bear some or all of the extra costs of the exchange-rate fluctuations. But as there are not too many such deals, the company's overall margins have declined.

"We will have to further increase efficiency and improve management to balance the losses caused by the appreciation… But fortunately, we don't see a decrease in the number of orders because of the currency fluctuation, at least so far," Zhang said.

Ye said that very few companies he knew of would spend the money to hedge against exchange-rate losses.

Tu Xinquan, dean of the China Institute for WTO Studies at the University of International Business and Economics in Beijing, said that the yuan's appreciation is a double-edged sword for the economy.

"On the one hand, it's a general hit to exporting companies. But on the other hand, it might also be a good chance for China to enhance the yuan's internationalization," Tu told the Global Times.

Zhou Yu, director of the Research Center of International Finance at the Shanghai Academy of Social Sciences, told the Global Times that the pressure of currency appreciation would become more obvious for exporters when the yuan broke beyond 6.5 against the US dollar.

Chinese customs is scheduled to announce trade data for September and the third quarter on Tuesday. Many experts and institutions estimated that China's exports surged by around 10 percent in the third quarter.