SOURCE / INDUSTRIES

Mainland car, headphone industries face chip shortage as some phone firms stockpile products for fear of US sanctions

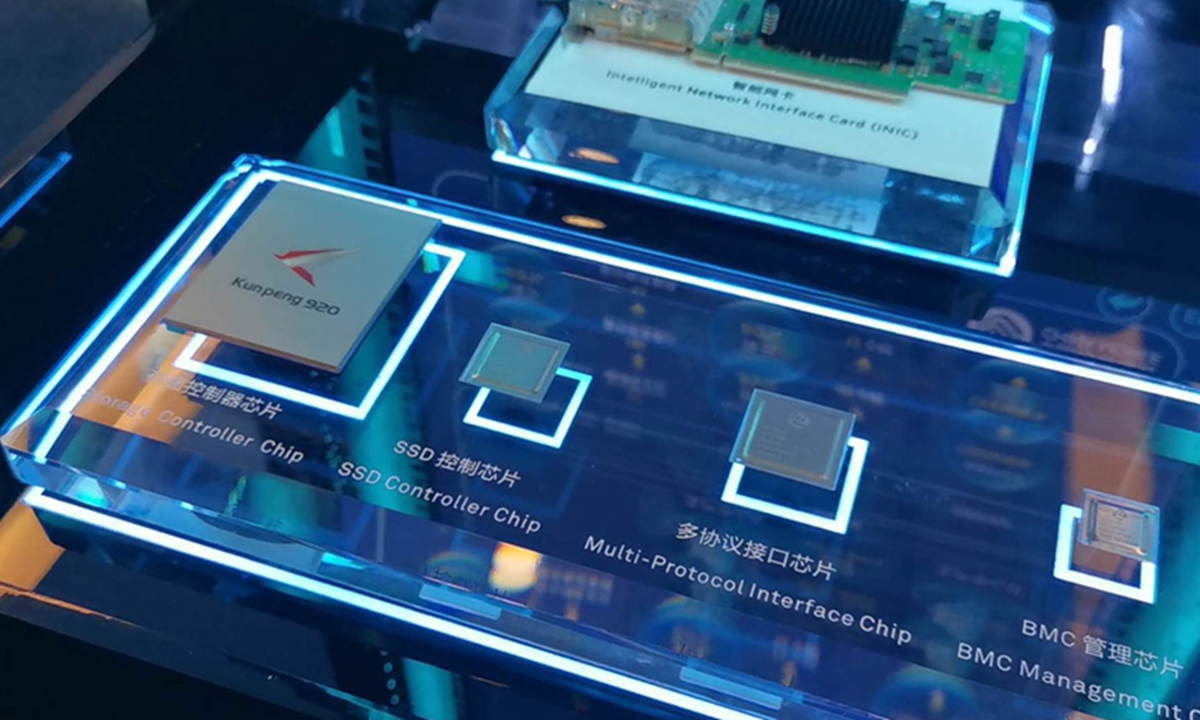

The Kunpeng 920 chip, among other server chips, showcased at Huawei Beijing research center. Photo:CGTN

Sectors in the Chinese mainland from automobiles to headphones face tight chip supplies, although the shortages have not yet seriously affected their operations, analysts and industry sources told the Global Times.

There are many reasons for the problem, from excessive stockpiling as phone companies fear possible US sanctions similar to those imposed on Huawei, to low manufacturing capacity of chipmakers, particularly small and medium-sized ones, they said.

Xu Ying, head of public relations of Volkswagen Group (China), told the Global Times that a broad economic recovery in China has boosted demand, worsening the chip supply situation and "putting some car production at risk."

Xu made the comments after an unidentified source at SAIC Volkswagen was quoted in a study report as saying that the company had to stop production due to chip shortages.

A manager at a Dongguan-based consumer electronics company told the Global Times on condition of anonymity that because of the coronavirus-triggered shutdowns and traffic restrictions, the original equipment manufacturer for his company's products had a shortage of raw materials including chips and diodes in the first half of this year, but everything has returned to normal since mid-year.

Apart from cars and consumer electronics, the headphone industry is also severely affected, as many chipmakers prefer selling to the mobile phone sector where gross profits are higher. As a result, true wireless stereo bluetooth chips are in short supply, Sun Yanbiao, head of Shenzhen-based research firm N1mobile, told the Global Times on Monday.

A report from elecfans.com cited Song Shuo, CEO of Chinese bluetooth firm Trlink, as saying that the bluetooth chips made by Qualcomm had been "in short of supply" for a long time.

The chip shortage has come at a time when demand for chips is surging in China, with the country's push for 5G development and new-energy cars, and when mobile phone companies are increasing their stockpiling of chips amid political uncertainties.

"After Huawei's crisis [as a result of US sanctions], many mobile phone companies stockpiled products on a massive scale to ensure the safety of their supply chains. This has caused chip factories' production to be tight and extended the delivery cycles of those factories," Han Xiaomin, general manager of JiWei Insights, told the Global Times.

According to Han, major chipmakers like Semiconductor Manufacturing International Corp are working at "full capacity".

However, he said that the tight supply situation has not affected terminal companies' business much yet, though the orders should take longer time to fulfill.

"Most terminal industries, including car or mobile phone sectors, are not severely short of chips, as most of them are primarily supplied by large companies whose capacity is stable," Han said.

But there's a gap between manufacturing capacity and market demand, he noted.

"The market is advancing and there is demand for higher chip production capacity, but not enough manufacturing lines are being built. There are not enough large factories to meet demand, while small factories are at a loss as how to increase capacity," he said.

The consumer electronics company manager predicted that the shortage will ease in half a year, when the China-US trade relations might thaw, and the pandemic should be brought under control.