Denis Depoux , Global Managing Director of Roland Berger Photo: Cui Meng/ GT

German-based international management consultancy Roland Berger predicts that China's financial market will attract more overseas capital to come in, the bond market in particular, as more Chinese equities and securities are included in global investment indexes.

The firm also pointed out some challenges faced by mainland financial institutions in the weeks to come, such as bad loans at a number of banks, as well as rising pressure on Chinese securities houses and investment banks to upgrade their services after China pushed registration-based stock listing reforms since 2020.

According to a report published by Roland Berger on China's economic prospects in 2021, China's treasury bonds have already been included in Bloomberg Barclays Indices and J.P. Morgan's GBI-EM index, and will be included in the FTSE Russell WGBI index beginning October 2021, which will increase the level of recognition that overseas investors have for China's equities and securities.

"In the medium to long term, the participation of offshore institutional investors in China's bond market will increase year by year, and will bring overseas investment philosophy and model to Chinese institutions," Roland Berger analysts said in the aforementioned report.

At the end of August 2020, offshore institutions had held 2.8 trillion-yuan ($432 billion) worth of Chinese bonds, accounting for 2.9 percent of China's overall bonds, it pointed out.

Roland Berger analysts said that some risks will face China's financial sector. For example, due to thepandemic as well as the financial services digitalization, many medium and small banks are being "suppressed in their survival space". In 2021, some banks' non-performing loan level will rise, and some smaller regional banks will have to experience mergers and acquisitions as a result.

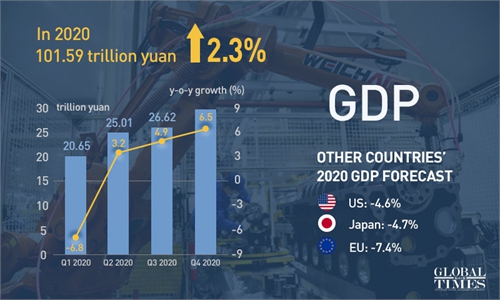

In general, the company predicted that the Chinese economy will face both challenges and opportunities in 2021, as China's capabilities to manufacture products and supply the world would in turn fuel investment in China by global companies. But China still faces obstacles including rising production costs, fiercer competition from neighboring countries, and insufficient technology competence in some sectors.

"China starts a year with a well-functioning economy. There is some uncertainty, but it's uncertainty with Chinese characteristics, which means it's within a certain range of control," said Denis Depoux, a senior partner of global managing director at Roland Berger, on Tuesday.