Industrial profit growth slows in May, but recovery remains solid: NBS

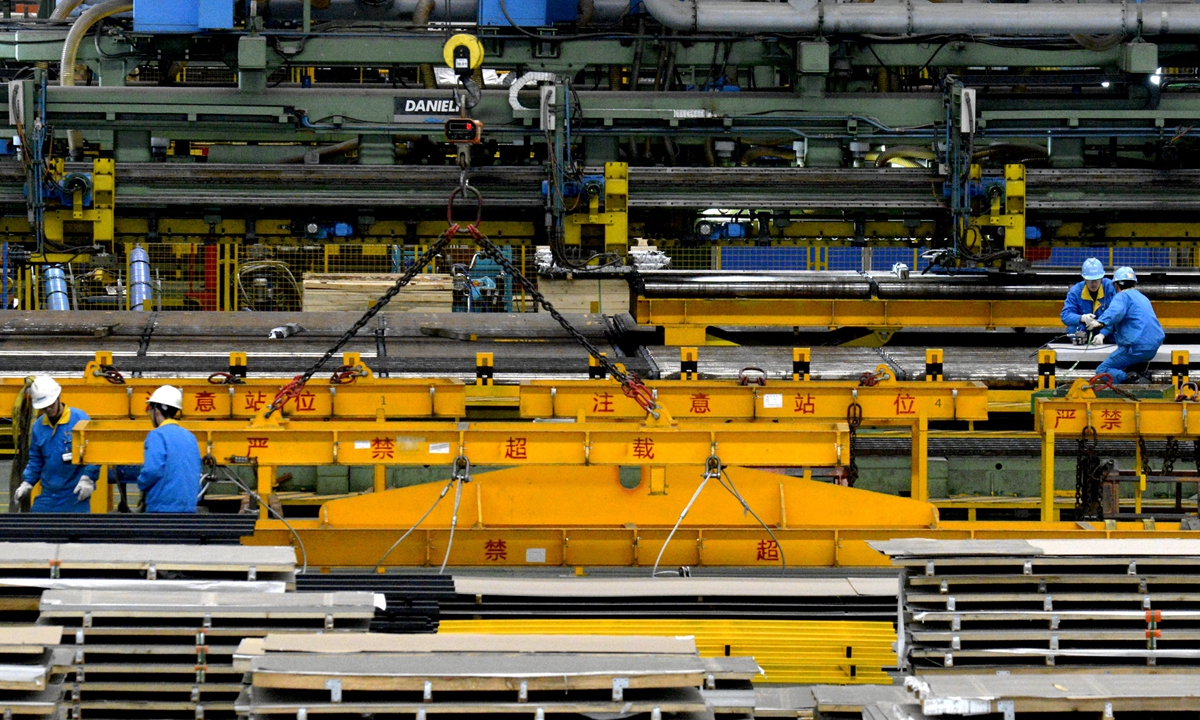

A steel manufacturing firm in Taizhou, East China's Jiangsu Province, is busy making supporting equipment for overseas mining on Thursday. Domestic and international demand continues to pick up, and opportunities brought by carbon neutrality and new infrastructure have led to a rapid rise in industrial investment. Photo: cnsphoto

China's industrial firms reported slower growth of profits in May amid rising raw material prices, but recovery momentum remains solid given industrial sector's strong resilience against rising risk of US inflationary pressure, according to official data and analysts on Sunday.

Profits at major Chinese industrial firms grew 36.4 percent in May year-on-year to reach 829.92 billion yuan, or up 44.6 percent from the pre-virus 2019, the National Bureau of Statistics (NBS) said. The pace is slower than April's 57 percent year-on-year growth, as surging raw material prices squeezed corporate margins.

However, despite the risks caused by the rising US inflationary pressure, Chinese industrial companies are recovering dynamics as expected. In particular, driven by market demand and prices hike, profits at ferrous metal, non-ferrous metals, oil and coal factories increased faster, Zhu Hong, a senior statistician at the NBS said on Sunday.

In addition, profits for consumer goods manufacturing companies jumped 30.6 percent in May. Due to the high demand for COVID-19 testing kits and vaccines, large companies in the pharmaceutical industry saw their profits surging 85.7 percent in May year-on-year, up 23.6 percentage points from April.

But "imbalances in manufacturing companies' profitability became prominent and the recovery basis is uneven," Zhu pointed out.

However, the surging commodity prices have caused rising cost pressure on downstream firms, Zhu said. For instance, Chinese consumer electronics producers had to raise selling prices in order to sustain profits.

As China has largely recovered from disruptions caused by COVID-19, experts see improving bargaining power by Chinese manufacturers at global market and stronger ability to deal with imported inflationary pressure.

The US inflation has jumped to the highest rate since 2008 as its consumer prices index rose at an annual rate of 5 percent in May, up from 4.2 percent in April, according to the US Bureau of Labor Statistics.

"The risks of imported inflation indeed poses pressure on Chinese industrial firms… but this time they performed better compared with 2011 when overseas prices also hiked," Tian Yun, former vice director of the Beijing Economic Operation Association, told the Global Times on Sunday.

Tian said that China's higher level of industrial complexity and resilience, backed by a stable domestic supply chain, has made the country outstanding among major economies.

He referred steel industry as an example, citing that only Baosteel ranked among the world's top 10 steel makers before 2011, but five to six are now from China.

"While the global supply chains were interrupted by the coronavirus, China has the most stable and sophisticated supply chains, which add to its industrial resilience. If you don't purchase them from China, where else can you source?" Tian said.

Predicting China's second quarter GDP growth at more than 10 percent, Tian noted the world now has higher confidence in the health of Chinese economy.

"This also explains why the US wants to coordinate with China on fiscal, financial and monetary policies, as it cannot solve inflation by itself under the current market climate," Tian said.