A World Reshaped

Early morning light illuminates the wreckage of the World Trade Center on September 25, 2001 in New York City. Photo: AFP

Editor's Note:

US' withdrawal from Afghanistan adds to the tally of world powers that have failed in the heart of Eurasia. The war in Afghanistan, which started in 2001, seems to have come to an abrupt end in 2021. What does this mean for the world?

The 9/11 attacks, from non-American forces, on the World Trade Center were a symbol of the beginning of the end of a US-centric global economic and trade system that was shaped in the previous century. Then came the great game to defend and resist the central system of the US, and the transformation and upgrading of all industrial chains through money and science and technology. It's a story that has been and is still shaping our world today. It deserves a closer look.

We need to figure out how the world has changed. Chongyang Institute for Financial Studies, Renmin University and the Global Times (English Edition) jointly released a report, exploring how the world has been reshaped in the two decades after the 9/11 attacks. The following is an excerpt.

Part I: World phenomenology: In 20 years, the world has changed

The COVID-19 pandemic has changed the world, but the world was already undergoing through unprecedented changes even before that. The pandemic has just acted as an accelerant of such changes. The 9/11 attacks were a watershed, dividing the history of the world into different periods. The world pattern is moving toward "the East is rising and the West is declining," the global economy is moving from real to virtual, scientific and technological innovation is shifting to cloud, social structure is breaking up into pieces, and the trend of thought is appearing to be moving forward but in fact it's going backward.

By comparing the GDP of Asia with that of Europe and the US, we can clearly see that "the East is rising and the West is declining." In 2001, Asia's GDP was $8.9 trillion, less than that of Europe and the US. But in the 19 years from 2001 to 2019, Asia's GDP grew by 2.72 times, higher than Europe's 1.19 times and the US' 1.11 times. As a result, Asia's GDP reached $33.08 trillion in 2019, significantly higher than that of Europe and the US.

Why does this phenomenon of "the East is rising and the West is declining" occur? This is mainly because many economies in the world are moving from the real economy.

To start with, there is a growing trend of economic financialization, led by the US. According to the statistics of the World Bank, the ratio of added value of the financial industry in GDP of the traditional financial powerhouses, the US and the UK, has significantly increased compared with 2001.

This reflects the fact that over the past two decades, all economies have been moving from the real economy to the virtual economy. Idle financing affected the development of domestic real economy to varying degrees, and the financial leverage has further risen. Influenced by financial opening-up and international market, China's financial industry has developed rapidly and deepened its financialization in recent years. Over the past two decades, Britain's financial sector has added 26 percent more value to its GDP in 2020 than it did in 2001, and the US added 39 percent compared with the year 2008.

Technological development may be the catalyst for the global economy to transform from real economy to a virtual economy. Over the past more than 20 years, human beings have experienced rapid digitization. According to the Digital 2021: Global Overview Report published in partnership between We Are Social and Hootsuite in January, 5.22 billion people use a mobile phone today, equating to 66.6 percent of the world's total population. Unique mobile users have grown by 1.8 percent (93 million) since January 2020, while the total number of mobile connections has increased by 72 million (0.9 percent) to reach a total of 8.02 billion at the start of 2021.

What accompanies the rapid development of science and technology is the change in the social structure of many countries worldwide, and there may soon be a fundamental change. For example, white people accounted for 68.9 percent of US population in 2001, while the percentage decreased to 57.3 percent in 2020. Ethnic minorities have increased and ethnic conflicts have intensified there.

In the first two decades of the 21st century, the reshaping of countries' social structures has been accompanied by a changing trend in thoughts. Among them, the influence of Western social thinking has had the most extensive and far-reaching effect. Although the wheels of history are rolling forward, this does not mean all social thoughts will move toward progress.

Part II: Dynamics of change: The power to change the world

The first two decades of the 21st century are special, as proven by phenomena of politics, economics, technology, society and thoughts. Looking at the world through the phenomena of change, we need to study how these phenomena have emerged, which parts of the world has witnessed them the most and what stimulated their emergence.

The first two decades of the 18th, 19th and 20th centuries all saw major wars. Before these wars, conflicts weren't uncommon. And the outcomes of these wars defined the entire centuries. The year 2021 saw the withdrawal of US troops from Afghanistan. The war in Afghanistan has ended with relatively small casualties. This may signal the 21st century will be a century when the main focus is on peace and development instead of war.

Unlike the past three centuries, the 21st century is a new era of technological empowerment. For example, the belief that "everything is computable" is speeding up the development of artificial intelligence. Machines are quietly and unnoticeably replacing humans.

A hijacked plane approaches the World Trade Center shortly before crashing into the landmark skyscraper on September 11, 2001 in New York City. Photo: AFP

It is said that the flap of a butterfly's wing in Brazil can cause a tornado in Texas a few weeks later. The change in the world's landscape today may have come from the butterfly on September 11, 2001, when two commercial airliners crashed into the twin towers of the World Trade Center in New York. The shock the 9/11 attacks caused has directly overturned the development track of the world.A terrorist force in the name of defying US military presence has turned the "top global finance center" into a living hell in a devastatingly extreme manner. The disaster resulted in an irreparable loss of international financial talents. Among the nearly 3,000 people who died, 230 of them were executives at major US financial institutions and 130 were stockbrokers. The tragedy was caused by a world system empowered by finance and technology, and by a group of people left behind by modern society.

The pattern of the world to a large extent may still be defined by traditional forces. For example, under the US dollar hegemony, once the US' economy encounters any problem, it will resort to printing money, and the whole world will become the victim. Is this approach sustainable? Can an "empire" be sustained through such means?

In response to the 9/11 attacks, the US waged a war in Afghanistan. But in the end, the US military has retreated in a desperate manner and left a pile of mess. Perhaps the war has not really ended yet. It turns out that the technology of the US military has armed terrorists, but inflicted suffering on the Afghan people. This makes you wonder what technology is for.

Part III: Anthropology of civilization: How history tells the future

Since the 9/11 attacks, a new world pattern has gradually taken shape. A large-scale hot war cannot be fought, but it is extremely difficult for any country, including the US, to launch a cold war.

The emergence of "cold peace" also marked the change of the international status of the US. Many believe that the decline of the US began when it became mired in the war on terror in Afghanistan and Iraq. How to define and measure the "decline" of the US is a controversial topic, and hard indicators with different caliber can hardly be regarded as direct evidence of the absolute decline of the US. However, in the general perception of people, the US is indeed no longer as prosperous as before. In fact, the "decline" that the US has experienced over the past two decades is in proportion to the rise of emerging countries represented by China. China today, like the US, can be regarded as the "soft center" of the world.

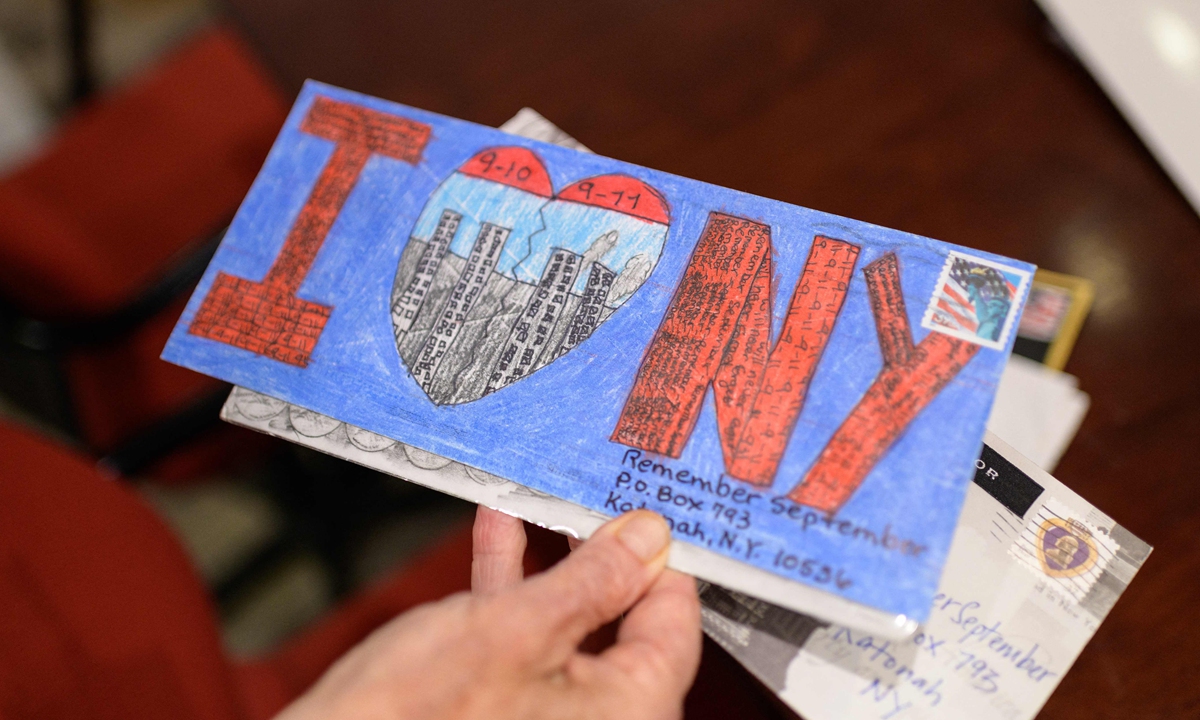

Art pieces donated to the organization "Voices of September 11" are seen in New Canaan, Connecticut, on June 10. Photo: VCG

With the acceleration of global digitization, mankind is ushering in an era of "full data." The US and China are at the forefront of this era. In an era of constant digitization, the leading position of emerging digital technologies in some countries has been hugely profitable, global market share and the ability to set standards. Data elements have become the primary productive force.A fair international environment has gradually begun to be reflected in the financial field. From 2001 to 2020, the US dollar's status as the world's reserve currency was at stake. In 2001, the dollar reached a peak of 72.7 percent, but after the 9/11 terrorist attacks international capital outflow and the accelerated development of emerging economies led to a decline in the dollar's share of foreign exchange reserves.

In the context of technology empowerment and financial development, high costs are not only reflected in military warfare, but also in labor costs, medical and education costs, environmental protection costs and other fields. From 2002 to 2016, the average annual growth rate of hourly labor costs in China's manufacturing industry was 16.8 percent, which was much higher than the average annual growth rate of hourly labor productivity of 9.8 percent. The rise of labor costs will weaken the competitiveness of industries, and have a negative impact on foreign investment and foreign trade, especially for labor-intensive industries. As the improvement of labor productivity is not enough to make up for the decline of enterprise profits caused by higher labor costs, the risk of enterprise exit increases. The US is facing a similar situation.