A view of Beijing Photo: VCG

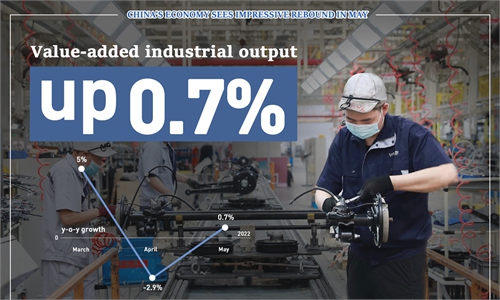

A range of major economic data for May released on Wednesday are sufficient to show the Chinese economy is recovering from the worst COVID flare-ups in two years after measures aimed at curbing coronavirus' spread have eased up as the epidemic have been largely brought under control.But some Western media outlets do not seem to have dispelled their skepticism about the economic resilience of the world's second largest economy. They question whether China will be able to meet its economic growth target of 5.5 percent set for this year after suffering a series of unexpected blows since March, and with the epidemic not fully stifled yet, they suspect the control measures may continue to haunt the Chinese economy, and the sluggish domestic consumption will be a drag on economic rebound.

While some of the concerns seem justified, the overall improvements in major economic indicators disclosed by the National Bureau of Statistics, such as industrial output, fixed-asset investment and surging exports, proves that despite the unexpected shocks, the Chinese economy still has the ability to quickly reverse a downward trend and take the new path to a rapid recovery. The positive numbers are buoying up our confidence in the Chinese economy.

Now, aided with the government's rollout of pro-growth policies, it is almost certain that the economic performance will see further improvement in June, with reasonable growth to be reported for the second quarter.

As long as the economy can shake off the impact of the previous lockdown shocks and accelerate the restoring of normalcy in the second quarter, there is every reason to believe that the Chinese economy will enter a period of even stronger growth in the second half year, ensuring the 5.5 percent growth target set for the whole year.

China's economic fundamentals remain solid. For a long time, investment, domestic consumption and export have been known as the troika supporting China's economic growth, and, even with the heavier-than-expected COVID induced negative impact on the economy in March and April, the momentum to bolster the three drivers of economic growth has retained.

First, China's US dollar-denominated exports grew 16.9 percent on a yearly basis to $308.25 billion in May, customs data showed, beating market expectations. The figure indicates that China's supply chain is recovering faster than expected, which will continue to support the country's exports.

Second, there are growing signs that China has ramped up investment, particularly on infrastructure. Meng Wei, spokeswoman at the National Development and Reform Commission, said on Thursday that in the second half of this year, local governments and enterprises will continue to increase their investment with a good number of new infrastructure projects being planned across the nation.

Third, sluggish consumption in the past months had much to do with the epidemic resurgence. With pro-growth measures and eased COVID control measures, it is hoped that Chinese households' consumption confidence will strengthen.

Of course, there are headwinds facing the economy. For instance, we haven't seen large flow of crowds on the streets of Shanghai and Beijing, but at the factories of Shenzhen and other Chinese cities, robots are moving as swiftly as usual. The pace at which the economy is going back to normalcy will be crucial to the rebound.

Internationally, the US Federal Reserve on Wednesday raised interest rates by 75 basis points, the most aggressive hike since 1994. Fed's massive rate hike is likely to cause some uncertainty about external demand.

If the US cannot avert a hard landing and its economy slips into a serious recession, China's exports will be curtailed, which may cloud its economy's revival.

Nevertheless, Chinese economy has fared fairly well since 2018, weathering the US government' reckless trade and technology war, and other geopolitical tumult. In the coming months and years, China will continue to act as the bedrock of global economic growth.