Illustration: Tang Tengfei/Global Times

The US economy shrank for a straight second quarter, with official data showing its GDP contracting at an annualized rate of 0.9 percent from April to June. It has already slumped 1.6 percent in the first three months of this year. Two consecutive quarters of economic contraction is widely regarded as the metric for determining whether an economy has slipped into a recession.

But the Biden administration, obviously concerned about approval ratings as the November midterm elections draw near, has refused to call the US' current economic distress a recession, citing still strong labor employment figures. And, the administration has found a supportive voice in Federal Reserve chairman Jerome Powell, who was also reluctant to call it a recession, saying the first read of a GDP report should be taken with a "grain of salt."

Sounds familiar? About 12 months ago when Biden's outsized fiscal spending splurge, coupled with the US central bank's quantitative easing extraordinarily loose monetary policy, caused a wave of price rises across the US economy, some noted US economists, including former Harvard professor Lawrence Summers, sounded the warning that inflation was raising its ugly head in the US. However, Biden, his Treasury Secretary Janet Yellen and Powell leapt forward, telling Americans and the world that inflation was only "transitory" and it would fade away.

But the facts have proved them very wrong. In June, inflation in the US jumped by a whopping 9.1 percent, a sharp increase unseen in 40 years. On Wednesday, the Federal Open Market Committee (FOMC) decided to hike the federal funds rate by another 75 basis points in its attempt to tamp down runaway price rises.

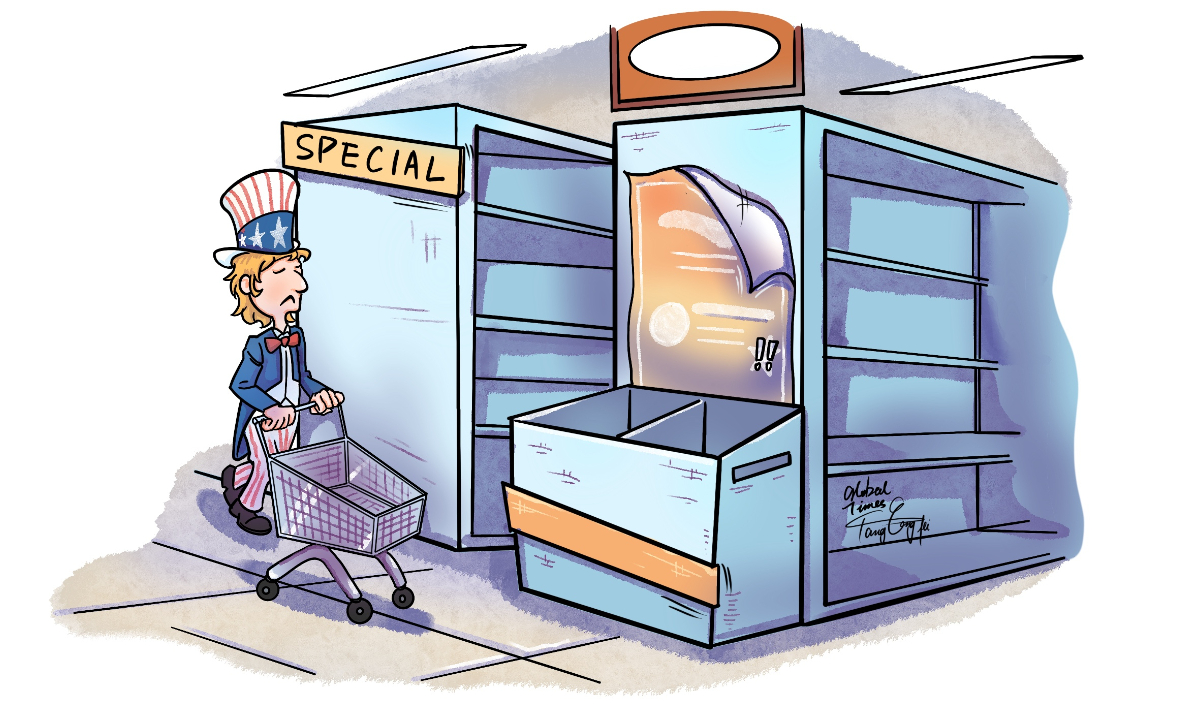

Now, facing the dual headwinds of decades-high inflation and recession, the world's largest economy has actually sleepwalked into stagflation - the nightmarish phase of any economy in which the poor and ordinary working middle class suffer the most. For instance, the persistently high prices have forced many Americans to snap shut their pocketbooks as they spend less on groceries and other consumption items in June.

Some macroeconomic researchers blame the Biden administration's reckless and unbridled fiscal, trade and investment policies for the economic mess in the US today.

By all metrics, Biden's $1.9 trillion fiscal stimulus spending bill that he signed into law in March 2021, sending $350 billion to state and local governments, direct payments of $1,400 and more to each American citizens, plus $300 per week unemployment insurance boost and billions of child tax credit, utility and rental grants touched off the inflation. And, his $1.2 trillion infrastructure bill that passed Congress in November 2021 is viewed as having aggravated price rises. Also, the overly dovish Federal Reserve bungled its policy by prolonging the QE and near-zero interest rate. It should have pushed the pedal much earlier and heavier.

The Biden administration's highly confrontational foreign policy toward Russia and China has also played havoc with the US economy and has in part led to the current economic train-wreck.

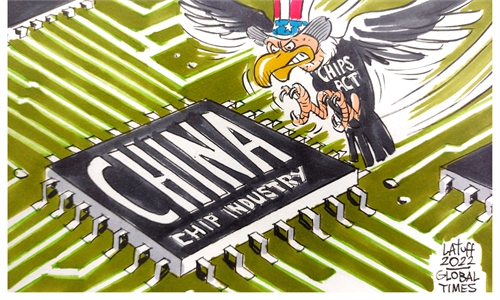

Just take a look at the cascade of global supply shocks and disruptions, as well as persistently high prices of energy, grain, semiconductor chips and many raw materials since Biden came into the White House in January 2021. For example, Biden's hesitation to rescind former US president Donald Trump's unprecedented tariffs war with China has exacerbated the US inflation, making Americans' life harder. And, Washington's harsh economic sanctions on Moscow, including freezing billions of dollars of Russian foreign reserve assets, will drive more governments in the world to dump American treasury bonds and other debts.

In economic practice, tariffs war and economic sanctions are always double-edged, with the initiator hardly escaping unscathed. The US has had such catastrophic economic experiences before, including the 1930-1932 Great Depression, but Washington has failed to learn any lessons.

Following the 0.9 percent annualized quarterly GDP drop announced by the Bureau of Economic Analysis of the US Commerce Department on Thursday, Biden said, quite strangely, that the US is "on the right path and we will come through this transition stronger and more secure." But some opinion polls indicate that as many as 80 percent of Americans don't approve his management of the economy.

Certainly, an economy rapidly losing momentum combined with aggressive interest rate hikes and quantitative tightening is not a recipe for a soft landing. It is estimated to continue to contract in the coming several quarters, as US consumers buy less, housing developers cannot sell their inventory, and factories are stacked with more materials and finished products. The Federal Reserve's rate hikes have already led to higher costs on credit cards, auto loans and a doubling of the average rate on the 30-year fixed mortgages. Home sales in the US have tumbled.

As US consumers continue to pull back on purchases, US economic activity will slow down significantly, and companies will be forced to fire more workers, which will increase the jobless claims. So, those in the US who refuse to admit the US has already entered into a recession will eventually accept the fact and bite their tongues.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn