Chinese industry body urges US to rectify mistake over chip ban, as global firms face chaos

‘Disruptive, discriminatory’ move put millions of jobs at stake

US 'Chips Alliance' scheme will exacerbate global chip crunch. Illustration: Chen Xia/GT

From laying off workers to expecting hundreds of millions of dollars in losses, global chipmakers, including those in the US, are starting to bear the brunt of the chaos caused by what has been described as the "harshest" US ban on chip technology to China.

As companies, media reports and analysts continue to warn of serious consequences, China's main chip industry association on Thursday called on the US government to rectify the wrong move that puts the global chip industry and other related sectors at risk.

Last week, the US government announced a broad set of technology export controls, including a ban on shipments to China of certain semiconductors made anywhere in the world with US equipment.

Following the move, chip companies around the world have been grappling with the chaotic changes as well as losses.

The Philadelphia Semiconductor Index, a widely tracked gauge of the sector, has lost more than 9 percent since the new measures were introduced last week.

Intel, one of the leading US chip companies, is reportedly planning its biggest round of layoffs since 2016, with thousands of workers set to be let go by the end of the month and some divisions losing up to 20 percent of their staff.

Analysts said that the "disruptive and discriminatory" move could put millions of jobs at stake.

Chipmaking technology supplier Applied Materials Inc said on Wednesday that export restrictions to China would result in a $250-550 million loss in net sales in the quarter ending October 30, with a similar impact expected in the following three months.

China accounted for 29 percent of Applied Materials' total sales in 2021, Reuters reported on Wednesday, citing analyst estimates.

The report also said the impact on sales for KLA Corp, Lam Research Corp and Applied Materials will be in the range of 5-10 percent, not calculating possible retaliatory measures from China.

ASML, Europe's largest supplier of equipment to semiconductor manufacturers, has told its US employees to stop working with customers in China, according to a Bloomberg report, citing a company email.

When reached by the Global Times, the company said that the information was genuine, but it was intended to serve as internal communication only. The company said that it is taking precautionary measures in order to ensure full compliance with the new regulations while assessing them.

The China Semiconductor Industry Association (CSIA) said on Thursday that it opposes the US' arbitrary chip technology ban against China, while urging the US to rectify its wrongdoings in a timely manner in light of the interests of the global semiconductor industry and its downstream customers, as well as the wellbeing of millions of workers in the industry.

Chinese analysts said that if the new measures are strictly implemented, global progress and cooperation will suffer and US companies' research and development (R&D) capacity will be undermined, as some companies could lose up to 30 percent of total revenue. China accounts for one-third of their total revenue.

An industry official surnamed Gao told the Global Times that the US move shows that Washington is adamant about sacrificing US semiconductor companies on the altar of its heated technology crackdown on China.

"With these companies plugged out from the Chinese mainland market, which is one of the world's leading venues in terms of semiconductor capital expenditure, these companies will suffer and their research will be slowed," Gao said. "Employees who serve clients in the Chinese mainland face the prospect of being permanently laid off, and they have little chance to be transferred elsewhere."

Gao predicted serious ripple effects and disruption to the global semiconductor industry chain from the latest US curbs.

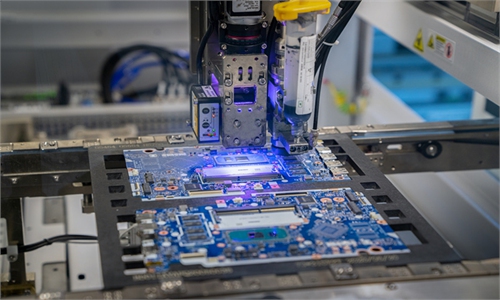

A chip manufacture machine Photo: VCG

Chinese analysts said one of the direct effects of the US ban will be lower investment in the global semiconductor sector, as shown in the recent stock rout.Huang Haifeng, a Beijing-based tech commentator, said the recent US chip share rout is both a result of a perceived supply glut as well as a vote of no confidence in the new US ban.

Losing the Chinese high-end market means less revenue and even less R&D expenditure and slower innovation, Huang said. "Fewer shipments will mean higher product costs to be paid by consumers."

US companies' reputations will be tarnished and from this day on, clients of their products will have second thoughts when making purchases, Huang said, predicting global diversification and segmentation for a costly industry that bases its chance of success on global cooperation.

According to a report by IC Insights, which analyzed semiconductor R&D spending by headquarters locations from 2011 to 2021, the Americas remained the largest origin of this investment, accounting for 55.8 percent of the global total in 2021, slightly up from its 2011 percentage.

The share of the Asia-Pacific (excluding Japan) saw the biggest increase, reaching 29.5 percent in 2021 from 18 percent in 2011, at the expense of shrinking shares by Europe and Japan.

Key players from South Korea, including Samsung Electronics and SK Hynix, reportedly managed to secure a one-year waiver on chip gear in China, reflecting the difficulties faced by the US' ban.